Looming shift in local income tax: Bloomington public buses will need county government help, service outside city expected

The BT board’s regular monthly meeting included an initial look at the 2026 budget and a financial advisor’s briefing on a new state tax law—both important items in their own right. More significantly, board commentary indicated a strong interest in countywide service, because of the new law.

The Bloomington Transit board’s regular monthly meeting on Tuesday included an initial look at the 2026 budget and a financial advisor’s briefing on a new state tax law—both important agenda items in their own right.

But the combination of those two points prompted some board and staff commentary that was probably even more significant. That’s because it signaled an increased interest in pushing the public transit agency’s existing effort, working with Monroe County officials, to expand transportation services beyond the city boundaries to include the rest of the county.

Based on board commentary, BT could sometime soon adopt a new name to reflect a geographic area that’s bigger than Bloomington.

Impact of SEA 1 on Bloomington Transit's countywide plans

The continued momentum towards countrywide service comes from two features of SEA 1, which was enacted by state lawmakers earlier this year, and revises the way property taxes and local income taxes are structured.

Under SEA 1, as of 2028, the city of Bloomington will no longer be in control of the amount of local income tax (LIT) revenue that BT receives. Instead, it will be the Monroe County council that will decide what, if any, LIT rate will be imposed for the benefit of BT. The fact that the county government, not the city council, will decide whatever LIT rate that benefits BT is one big difference compared to the current system.

But possibly a bigger difference is the fact that any LIT rate for BT will now be paid directly by every resident of Monroe County. Until SEA 1 was enacted, local income taxes were paid countywide, but the revenue was distributed based on population or property tax footprint of the jurisdiction.

Under SEA 1, any Monroe County resident with an income could be paying a percentage of it to support BT—if the county council decides to impose a rate. But if an income tax rate paid by all county residents is directly supporting BT, those residents will expect some transit service.

After Bloomington’s city council enacted an ordinance in 2023 to allow BT to provide service outside the city boundaries, in January 2025, BT started a running service just outside the western boundary of the city—Route 13 (Park 48/Ivy Tech). The new Route 13, meant to serve a big educational and employment center, has seen limited ridership so far—it’s the lowest performing route in the system. But at the board’s next meeting in August, some revisions are expected to be presented that are meant to improve ridership.

Asked after Tuesday’s meeting, if BT is prepared to meet the expectation of transit service countywide, more than just a bit beyond the city’s borders, BT board chair James McLary pointed to the agency’s strategic plan. The plan calls for “operational integration” and a “funding partnership” with Rural Transit, which is a program of Area 10 on Aging. McLary told The B Square that he thinks a “holistic approach” is needed: “If you get Rural Transit, they can take care of the outlying areas. We can take care of the urbanized areas.”

Any funding partnership on BT’s end—paying Rural Transit to provide some kind of service in non-urbanized areas—would likely have to come from BT’s local income tax revenue.

Preserving local income tax revenue for BT?

Currently, BT receives local income tax revenue in two chunks. One is BT’s own share, which is budgeted in 2026 at about $650,000. The other chunk, budgeted in 2026 at around $3.8 million, comes from a share that is distributed to the city of Bloomington and given to BT by the city under the terms of a five-year interlocal agreement. The 2026 budget year is the fourth year of that agreement.

So starting in 2028, roughly $4.5 million in BT revenue could completely disappear—if the Monroe County council were to decide not to impose any LIT rate to benefit BT. The $4.5 million amounts to about 30% of the $14.1 million that is budgeted for operating expenses in BT’s 2026 preliminary spending plan.

Leading off Tuesday’s meeting was Reedy Financial Group’s Tim Stricker, who gave the board a primer on SEA 1. From a practical point of view, Stricker said, it is BT’s revenue from local income taxes (LIT), as opposed to the property tax levy, that is in the most jeopardy.

In 2026, the impact of SEA 1 on BT property tax revenue will be just around $30,000, according to Stricker. If SEA 1 did not exist in 2026, BT would receive an estimated $1,743,793 compared to an estimated $1,713,353 under SEA 1. And even when SEA 1 is fully implemented in 2032, Stricker said, BT’s annual shortfall in property taxes is estimated to be about $42,000, compared to the rules before SEA 1.

A key constraint on the LIT rate that county government could impose for BT comes from the sum of three different limits: 1.2% for the county government’s own expenses; 0.4% for fire protection and EMS; and 0.2% for other entities, like townships, libraries and transportation agencies. Even though those limits add up to 1.8%, SEA 1 puts a 1.7% overall limit on the sum of those individual limits.

That means if the county government were to impose the maximum LIT rate for its own expenses (1.2%) and the maximum rate for fire protection and EMS (0.4%), that would leave just 0.1% for all the other entities. Of those other entities, BT is the only “special district” listed in Monroe County’s budget order, and special districts have an SEA 1 LIT rate limit of 0.05%.

Under SEA 1, the city of Bloomington would be able to impose up to a 1.2% LIT rate on just city residents. Monroe County's current local income tax rate is 2.14%.

Based on Stricker’s calculations, there is a scenario where the county government imposes the maximum rate of 0.05% and BT would receive around $2.2 million in LIT revenue. That’s still around just half the amount of LIT that BT is currently receiving. It’s a slim prospect after SEA 1 that the city of Bloomington would continue to provide any of its own share of LIT revenue to BT. After SEA 1, the city government will be hard-pressed to make its own ends meet .

At Tuesday’s meeting, board members noted that their conversation about LIT funding has up to now been with the city of Bloomington, but will now shift to a negotiation with Monroe County government. As board member Doug Horn put it, “It’s a political game.”

At Tuesday’s meeting, when it came time for the BT board to review the draft 2026 budget, the line for advertising got some attention in the context of BT’s possible repositioning to provide more service outside the city of Bloomington.

In the draft budget, advertising is set to triple, from $50,000 to $150,000. But it’s not clear that even the increased amount is meant to cover the cost of a rebranding effort. Board member Don Griffin said, in the context of adding the county government as a working partner and the advertising budget, “We really need to think about branding.”

BT’s general manager John Connell pointed out that one of the goals of BT’s strategic plan is to provide services throughout the urbanized area. The urbanized area includes most of Bloomington, much of its immediate surroundings as well as Ellettsville.

In that context, Connell said, “Maybe a name change would be appropriate.” Connell added that the governance of BT could change to include Monroe County government: “Maybe at some point this becomes … a seven member board with county representation.”

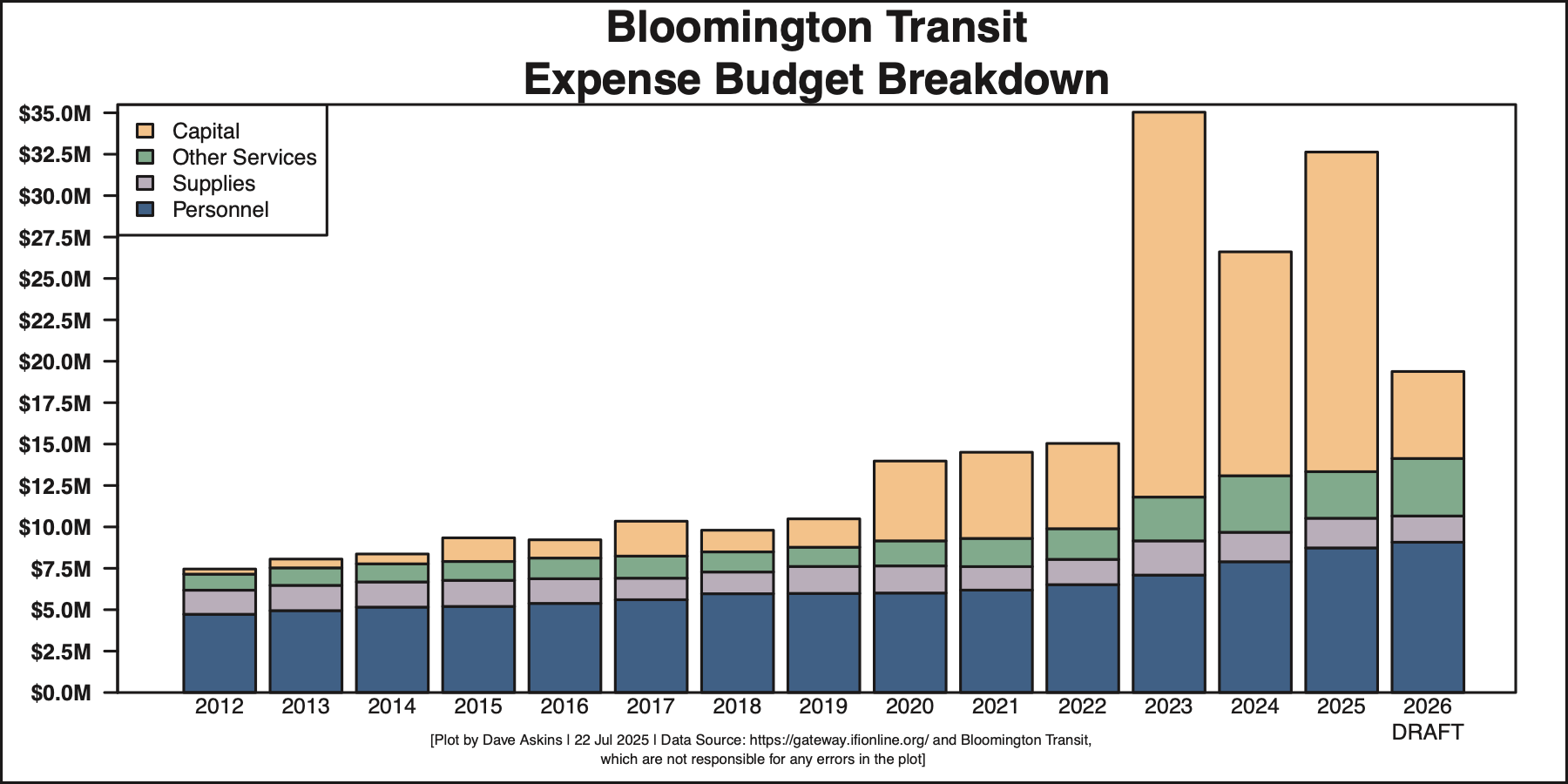

Review of 2026 draft budget

At its Tuesday meeting, the Bloomington Transit board also got an initial systematic look at its 2026 draft budget. The total 2026 spending plan is currently proposed at around $19.4 million, which is about a 41% drop from the 2025 budget, which was approved for $32.6 million.

The overall decrease is mainly due to a reduction in capital expenditures. The 2025 budget included $12.5 million for land acquisition, a line item that is not included for 2026. The purchase of land for a new operations center, with a location that has not yet been publicly disclosed, is still pending environmental review.

There’s also about $1.8 million less for new buses—$4.2 million for 2026 compared to $5.9 million this year. BT is planning to buy two new articulated buses in 2026.

The proposed 2026 non-capital operating budget, which includes compensation, services, and materials, stands at $14.1 million, which is a 6% increase over 2025.

Total compensation is budgeted at $9,074,955, which reflects a 4% increase for bus drivers.

Areas where Bloomington’s public bus agency plans to spend more in 2026 than in 2025 include advertising, electricity, and building maintenance.

BT plans to spend three times as much on advertising its services—$150,000 in 2026 compared to $50,000 in 2025. At recent meetings, board members have expressed disappointment about the lack of awareness in the community of its new microtransit service, branded as BLink.

Spending on electricity is budgeted at $250,000, compared to $79,310, an increase of about $170,000. That increase is attributed to the 16 additional electric buses in BT’s fleet. Board members noted that there is a corresponding drop of roughly $205,000 in the fuel budget, from $1,075,000 to $870,250.

Building maintenance is budgeted at $100,000, which is double the previous year’s amount. That’s due to the aging facility at Grimes Lane, according to McLary.

The budget also includes a $174,050 contingency fund for possible new services in 2026.

On the revenue side, property tax receipts are projected at $1.74 million, an increase of 4%. Combined fares from passengers and agreements with big multifamily housing complexes are budgeted at about $1.32 million, up from $1.1 million in 2025. The amount that Indiana University will be paying, so that its affiliates can board without paying a fare, is budgeted at $1.25 million.

Advertising revenue is expected to drop from $175,000 to $80,000. That’s because the board has adopted a new policy reducing the amount of advertising that can appear on BT buses.

BT is budgeting the same amount as last year for operating support from the state of Indiana’s Public Mass Transportation Fund (PMTF)—about $2.6 million.

Federal assistance for operations and capital is projected at $6.4 million, down from $17.5 million—most of that due to the elimination of a line for land purchase in the expenditure budget.

BT is planning to use $824,870 in reserves to balance the 2026 budget, which is less than the $3.17 million in reserves it used to balance this year’s budget.

A final version of the proposed 2026 BT budget is expected to be presented at the board’s August 20 meeting, before being presented to the city council later in the month.

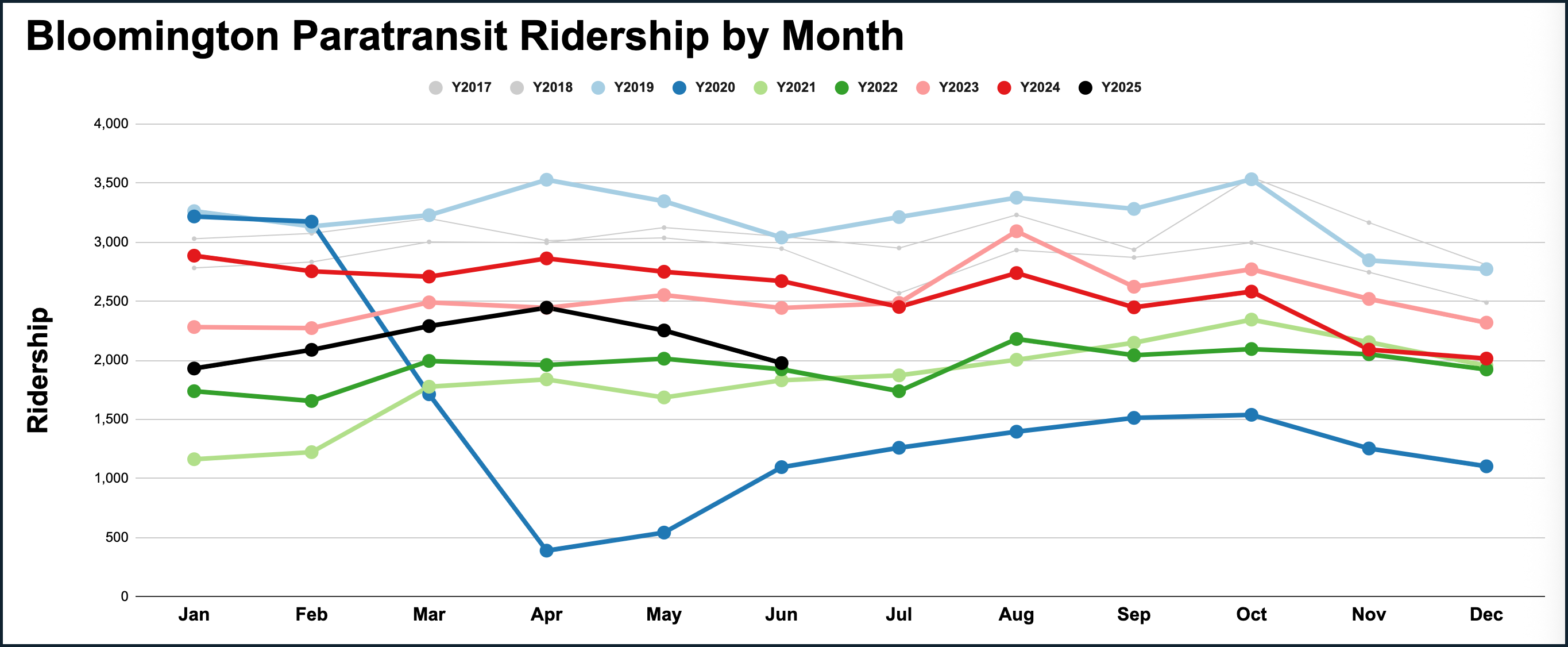

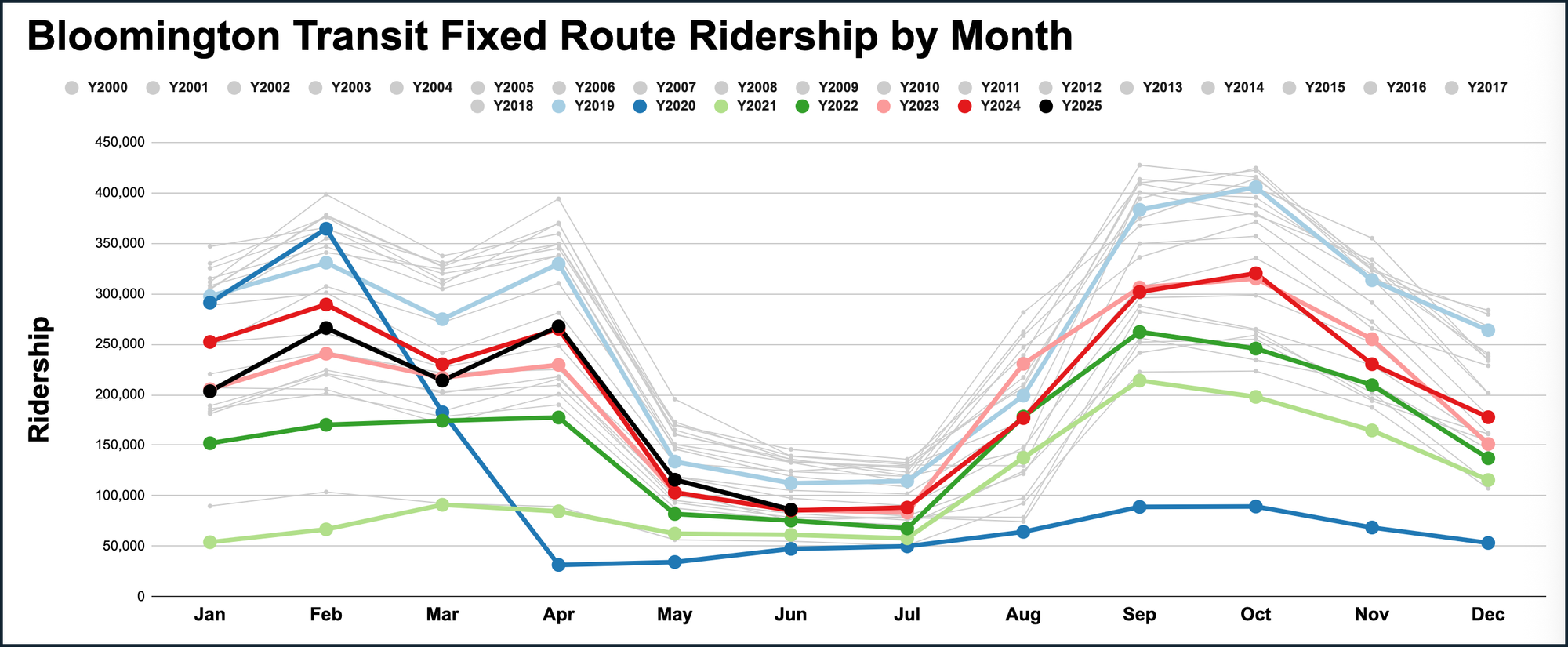

Charts by The B Square with data from Bloomington Transit.

Comments ()