Monroe Convention Center expansion: Bloomington city council work session set for April 5

Bloomington’s city council has set a work session for this Friday (April 5) at noon, to discuss a project that has been in the works for a few years—the renovation and expansion of the Monroe Convention Center.

The current convention center stands on the southwest corner of 3rd Street and College Avenue.

The work session will likely be closely watched by other elected and appointed officials, because the city council is not necessarily unanimous in its support of every aspect of the planned expansion.

At the end of February, councilmember Kate Rosenbarger voted against the interlocal agreement that lays out the working relationship between city government, county government, and the Monroe County capital improvement board (CIB).

The CIB was established in July of 2023, through a county ordinance, and has been working since October of 2023 to move the project forward.

The interlocal agreement was approved over Rosenbarger’s sole dissent, but some doubts were also expressed by councilmember Matt Flaherty. Flaherty’s skepticism was not strong enough to prevent his support of the interlocal.

Still, at a subsequent council meeting on March 27, Flaherty laid out some elements of the expansion project on which he has clear opinions: “I don’t think we should be connecting buildings to fossil fuels. Full stop.”

Flaherty continued, “I’m also not a supporter of public subsidy for a hotel, or for public subsidy for parking garages beyond what we already do—which is extensive.”

Flaherty’s comment came in the context of a meeting agenda item, asking the food and beverage tax advisory commission (FABTAC) to make a recommendation on a $250,000 expenditure of food and beverage tax revenue to support the CIB’s 2024 budget. The money was already appropriated in 2024, as a part of the city council’s 2024 budget approval.

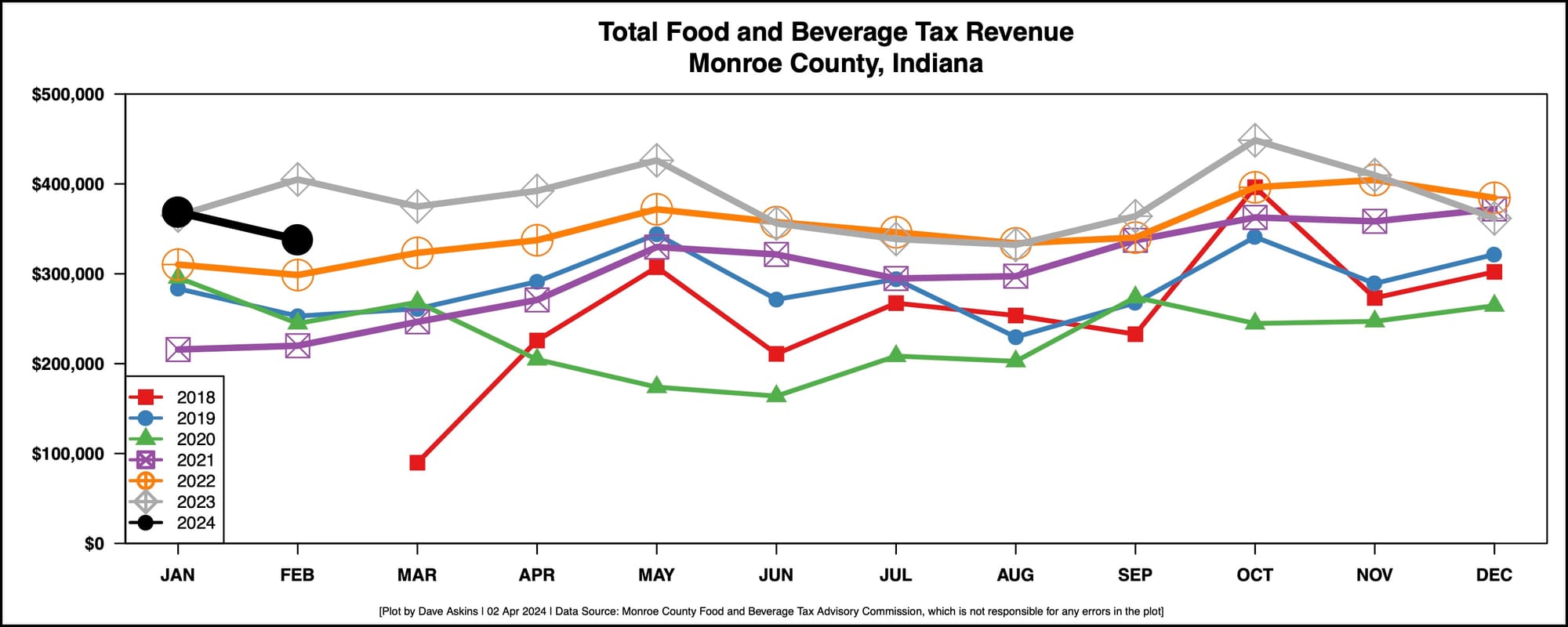

It is Bloomington’s share of the 1-percent food and beverage tax, enacted in 2017 by the Monroe County council, that is intended to provide the funding for the convention center project.

Here’s the breakdown of the CIB’s proposed budget for 2024.

| Category | Subcategory | Amount | Totals |

| Category 1 – Personnel | $0 | ||

| Category 2 – Supplies | $1,000 | ||

| Category 3 – Services | $249,000 | ||

| Professional Fees – Internal | $130,000 | ||

| Professional Fees – External | $50,000 | ||

| Architectural & Design Fees | $50,000 | ||

| Insurance | $15,000 | ||

| Other | $4,000 | ||

| Category 4 – Capital | $0 | ||

| $250,000 |

All but $1,000 falls into the category of “services.” The “internal” amounts are meant to cover fees billed by CIB’s legal counsel and controller. The “external”amounts include owner’s rep, construction manager, and architectural services.

In the “other” subcategory are included services like the design and maintenance of a website.

Some of the city council’s leverage on the convention center project comes in the form of appropriations from the 1-percent food and beverage tax that was enacted in 2017 by the Monroe County council. But the required statutory procedure includes the FABTAC.

The FABTAC met on Thursday, the day after the city council’s March 27 meeting, to give its recommendation on the $250,000 budget.

Cheryl Munson (county council), Lennie Busch (Lennie’s), Julie Thomas (county commissioner), and Gretchen Knapp (Bloomington deputy mayor) made up the four needed for a quorum on the seven-member group. Not attending were Bloomington city councilmember Andy Ruff, and two local restaurateurs, Susan Bright (Nick’s) and Mark Bell (Trailhead Pizzeria).

Last Thursday, the FABTAC voted unanimously to recommend the $250,000 expenditure. The FABTAC’s influence on the process was diminished by 2023 legislation, which left in place a requirement that the FABTAC give a recommendation, but removed the requirement that the recommendation have majority support on the FABTAC, in order for the expenditure to be made.

Here’s how IC 6-9-41-16 read in 2022 (emphasis added in bold):

(b) The county and city legislative bodies must request the advisory commission’s recommendations concerning the expenditure of any food and beverage tax funds collected under this chapter. The county or city legislative body may not adopt any ordinance or resolution requiring the expenditure of food and beverage tax collected under this chapter without the approval, in writing, of a majority of the members of the advisory commission.

Here’s how IC 6-9-41-16 reads now, without the bolded wording:

(b) The county and city legislative bodies must request the advisory commission’s recommendations concerning the expenditure of any food and beverage tax funds collected under this chapter.

Another way the city council has leverage on the convention center project is though the interlocal agreement, which says ”[D]uring the Project design and construction period and before implementation of the contract described in Article III Section 2C above, the CIB shall have authority to determine its budget solely with the City Council…”

When the city council voted on the interlocal agreement, over Rosenbarger’s dissent, she described other kinds of projects, besides the convention center expansion, that she thinks should be considered for funding from food and beverage tax revenues.

Rosenbarger pointed to the wording of the state statute on the county’s food and beverage tax, which was enacted in 2017 by the Monroe County council, to support the expansion of the convention center. The state law says the city’s share of the tax has to be spent on “a convention center, a conference center, or related tourism or economic development projects.”

Rosenbarger said about that clause, “That line starts out pretty specific about what you can do with a convention center, but then kind of blows up to anything tourism related or economic development projects.”

Some identical wording in the statute, about the county’s use of the food and beverage funds, is being used by Monroe County government to pursue projects that are not directly the convention center.

Indiana’s state legislature has taken notice of the lack of progress on the convention center expansion, for which the food and beverage tax has been collected since 2017. The city of Bloomington’s food and beverage tax fund balance at the end of 2023 was $17,457,361.36

The 2023 law [HB 1454] uses the local food and beverage tax as a prod, to require Bloomington and Monroe County to show some progress on the convention center project. One requirement is the development of a plan to spend food and beverage tax revenue by Dec. 1 each year. That plan has to be filed with the state by year’s end.

A second requirement of HB 1454 is that by July 1, 2025, the city and the county have to actually spend some food and beverage tax money, as described in the required plan. If those requirements are not met, the legislation ends Monroe County’s ability to impose the tax.

Locally, the Monroe County council has demonstrated a willingness to consider abolishing the tax that it enacted in 2017—if adequate progress is not made on the convention center project.

In late 2019, when negotiations between the Bloomington’s then-mayor John Hamilton and the county commissioners hit an especially rocky patch, the council put two different ordinances on a meeting agenda, both of which would have ended the food and beverage tax.

On that occasion, county councilors did not vote on either ordinance. Shortly after that, there appeared to be a consensus that a CIB would be the governance structure for the convention center expansion. But just a couple of months later, in early March 2020, before the COVID-19 pandemic hit, progress again stalled.

Another piece of leverage that Bloomington has for influencing the convention center project is through its ownership of a piece of land that is a potential spot for the expansion—the former Bunger & Robertson lot at 4tth Street and College Avenue. That’s just north of the existing facility.

Bloomington’s 2024 plan for expenditures of food and beverage tax revenue—which the city had to file with the state under the new 2023 legislation—gives some insight into the potential real estate dynamics.

Here’s how the plan reads:

In 2024, the City anticipates using these F&B funds for the following purposes, in coordination with the FABTAC and Common Council (emphasis added in bold):

1. To pay the expenses associated with creating a nonprofit building corporation to issue debt in support of design and construction of the Convention Center expansion.

2. Under an appropriate agreement with the CIB, to pay the CIB’s personnel and administrative expenses during the design and construction phase of the expansion

project, including the hiring of counsel and a controller.Additionally, if the CIB wishes to acquire certain real property owned by the City’s Redevelopment Commission for the convention center expansion, then depending on negotiations between the CIB and the RDC, some portion of City F&B funds may be used to help the CIB acquire that property.

It is possible that if the CIB wants to use the land for the expansion project, the city of Bloomington could be looking to get reimbursed, from food and beverage tax revenue. Bloomington’s RDC spent about $7 million in TIF (tax increment finance) to purchase the former Bunger & Robertson property.

The biggest part of the property was purchased in summer 2019 for about $5 million. The northeast corner of the parking lot of that property was purchased for $1.9 million in March of 2023.

The Bloomington city council’s Friday noon work session is scheduled to take place in the McCloskey Room of city hall. A Zoom link has been distributed in the work session’s calendar listing.

Comments ()