Monroe County, Bloomington review applications from private sector for COVID-19 relief money, as emergency is continued

On Wednesday morning at their regular weekly meeting, Monroe County commissioners voted to extend the order of emergency for the county another two weeks through May 1. It was an expected move that squares up the county’s emergency order with executive orders from Indiana governor Eric Holcomb .

As confirmed COVID-19 cases and deaths from the virus continue to rise across the state and the country, local city and county elected officials this week are getting closer to putting about $2.7 million in local economic relief at the disposal of local businesses and nonprofits that have been impacted by the pandemic.

The city is hoping to have some checks out the door by late this week or next week. The county is looking to make announcements of the first relief recipients by the middle of next week.

The idea is to provide local businesses some loans to bridge them across the gap between now and the more robust federal relief they might eventually be able to get through the CARES Act.

The governor’s stay-at-home order and ban on dine-in service at restaurants has meant a significant shutdown of most businesses that collect the 1-percent food and beverage tax across Monroe County. That’s led the city and the county governments, which have control over their respective 90–10 shares of the tax proceeds, to tap $2.2 million, of about $5.7 million in unexpended funds, for the local economic relief effort.

Neither the city nor the county governments are restricting the funds to support business or nonprofits that collect the food and beverage tax. The key question is whether the business is tourism-related, a requirement that can be traced to the statute under which the tax is collected. The relationship to tourism is a secondary statutory purpose—the primary one is to support the expansion of the Monroe County convention center.

Guidance from the Indiana State Board of Accounts (SBOA) has been analyzed by both city and county legal staff as giving the green light to expenditures of the food and beverage tax for local economic relief, provided certain conditions are met. Among the conditions is that a clear local policy be in place that finds the proposed use of dedicated food and beverage tax funds be the closer to the purpose than general fund money.

As a nod to the SBOA guidance, Bloomington’s city council built into their appropriation ordinance, approved last week, a finding that food and beverage tax proceeds are closer than general fund money to the purpose of giving economic relief to tourism-related businesses .

The county commissioners recognized the SBOA guidance by adopting a policy at their Wednesday meeting this week, stating their finding about the use of the funds, and outlining the process for making awards of the funds. The county’s award process includes a review of applications by one of the three commissioners, the forwarding of a recommendation to the county’s legal staff, a review by legal staff and then consideration for approval by the full three-member board of commissioners.

The city and county governments are providing relief funds to entities located inside the Bloomington city limits and outside the city, respectively.

At the seven-member county council’s meeting on Tuesday, councilor Marty Hawk said she was “rather astonished” that the number of applicants for COVID-19 relief from the area outside the city limits did not include more restaurants. She wondered if the message was getting out.

The county is making up to $200,000 of food and beverage proceeds available for COVID-19 relief.

President of the board of commissioners, Julie Thomas, was on hand at the county council’s Tuesday meeting to respond to Hawk. Thomas reviewed how any business that is related to tourism was invited to apply—that means it’s more than just restaurants. At least three restaurants have applied, Thomas said, and she hopes a fourth one will apply—she’s made several attempts to contact its owners, Thomas said.

On Wednesday, Thomas said she hoped to be able to announce the first awards of support from the county next Wednesday (April 22).

The city’s approach to awarding its more than $2 million worth of relief funding is different from the county’s. Director of economic and sustainable development for Bloomington, Alex Crowley, updated the city council at its regular meeting on Wednesday on how that process is going.

Applicants submit their information through an online form. That much is the same as the county’s approach.

In Bloomington’s process, the application is reviewed first by a representative of a lending institution. That review is pretty objective, Crowley told the city council, and involves a scoring metric. After that review, the application is passed along to a five-member committee of the Rapid Response Fund advisory commission, consisting of lenders and financial professionals. The five-member committee does a more subjective impact review.

The committee’s summary sheet is passed along to the city in summary form and then either approved or denied by the city, Crowley said.

If the application is approved, it’s the city that decides the source of the funds—either $2 million of food and beverage proceeds or $350,000 money that’s been approved by the Bloomington Urban Enterprise Association (BUEA). The idea is to use BUEA money to support businesses and nonprofits that aren’t necessarily tourism-related, which would make them ineligible to get support from the food and beverage tax.

For Bloomington’s relief program, an eligible business has to have a physical address inside the city limits or be a nonprofit that resides in or serves Bloomington. The business has to have at least one employee, but no more than 250 employees.

To qualify for a loan, a business has to show there’s been a negative impact in revenue due to the COVID-19 pandemic, and has to have been open before Feb. 29. Applicants also have to be making good faith efforts to pursue other funding sources.

The money will be lent at a rate of 2 percent with a 3-year repayment period. Payments could be deferred for the initial six months. If the loan is repaid within a year, then no interest would be owed. A small subset of the loans, for certain nonprofits, might be forgivable.

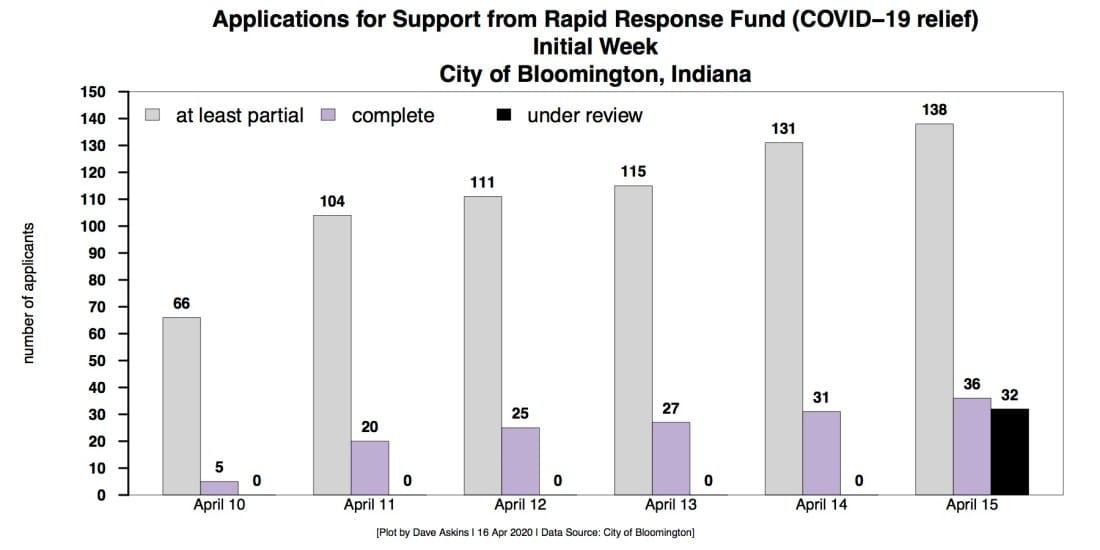

So far, Crowley reported on Wednesday, 138 applications had been at least partially filled out, in the week since the launch of the program last Thursday.

Of those 138, 36 applicants have completed an application. The first 32 of those made up the first batch that’s now under review, Crowley told the city council.

Crowley laid out some challenges that his economic stabilization and recovery (ESR) working group is trying to address, which have become apparent as applications have come in. One is the the completion rate.

Why have only 36 of 138 applicants finished the application? One possibility, Crowley said, is that people have clicked through to the application out of curiosity, leaving what counts as an unfinished application. The ESR group is looking at ways of improving the application, Crowley said.

Another challenge is the lack of much non-White representation among the applicants. Just one Black applicant is among the 36 who have completed an application. The male-to-non-male split for gender is 17–15 among the 36 completed applications.

During last Thursday’s press briefing, when Bloomington’s application process was launched, ESR working group member Erin Predmore, who’s CEO of the Greater Bloomington Chamber of Commerce, responded to a question about the effort to include minority-owned businesses in the relief effort.

Predmore said the chamber had established a Black business owners “affinity group” made up of about 45 to 50 people. And the city has a women- and minority-owned business enterprise list that can be targeted, Predmore said.

Crowley told the city council on Wednesday that the ESR working group would be looking at ways to improve communication to underserved businesses.

Comments ()