Monroe County council looks at boosting employee pay in 2024: “We have our work cut out for us.”

On Tuesday night, Monroe County councilors opened a discussion about next year’s salary increase for county employees.

A starting point for that discussion is 6 percent. No decisions were made on Tuesday. The county’s budget process will unfold over the course of a couple of weeks starting Sept. 6.

The 6-percent number is based on the December 2021 to December 2022 consumer price index increase (CPI) for the Midwest region, as calculated by the US Bureau of Labor Statistics. That figure has long been used by the county council as a reference point for pay increases.

As the fiscal body for county government, it’s the county council that makes the final decision on the budget.

But pushing for more than 6 percent are the Monroe County commissioners, who weighed in this year with a recommended increase of 8.5 percent. The commissioners are required under state law to make a recommendation on salaries.

The 8.5-percent increase recommended by the commissioners is also a number supported by Monroe County auditor Cathy Smith, according to the auditor’s financial director Brianna Gregory at Tuesday’s meeting.

Not enough on their own to support an increase as high as 6 percent are the projected increases to the two main revenue streams used by the county government to pay for employee salaries.

Property tax revenue will increase just 4 percent in 2024 compared to 2023. That’s based on this year’s calculation, under state law, of the maximum levy growth quotient (MLGQ), which is 4 percent.

The MLGQ would have been higher, by more than a full percentage point, except for some legislation enacted by the General Assembly this spring. The legislation, in the form of HB 1499, amended the state statute on the MLGQ calculation for the next two years, putting a limit of 4 percent on the MLGQ.

If IC 6-1.1-18.5-2 had not been amended, the outcome of the MLGQ calculation would have been 5.1 percent.

The other revenue stream that will not see growth as high as 6 percent is the certified shares portion of the local income tax (LIT). The growth in the certified shares category from 2023 to 2024 is about 3.75 percent.

Starting this year, Monroe County government has received an additional $11 million in LIT revenue each year—in the economic development category. That’s the result of the tax increase that the Bloomington city council enacted last year.

But the county council has, at least up to now, appeared to consider economic development LIT revenue off limits for regular budgeting. That’s because the economic development LIT is seen as the likely main source of funds for the land acquisition and construction costs of a new jail.

The county council could, on its own, enact a LIT increase in a category that is designed just to pay for corrections, including jail construction—which would free up economic development LIT funds for other budget needs.

So far this year, the only discussion of imposing a corrections LIT has come in the context of shifting a LIT rate that is restricted to funding youth services to a rate that can pay for corrections.

The proposal is to reduce the special purposes youth services rate from 0.0950 percent to 0.0850 percent, but to impose a rate of 0.0100 in the corrections category. That proposal got a first reading in front of the county council on Tuesday night.

The impact of the rate shift on tax payers is zero, but the impact for county budgeting means roughly $400,000 more revenue that could be spent on general budgeting, including employee salaries.

But it’s bigger than a $400,000 hill that county councilors have to climb, in order to fund pay raises in 2024 that would approach 8.5 percent.

Councilor Geoff McKim led off Tuesday’s discussion by making a grim point—that based on the 4B forms that the auditor had provided to the council—which include the 2024 departmental budget submissions—there would be a general fund deficit of about $2.6 million. That’s without any cost of living increases.

Still, McKim pegged the 6-percent CPI as the figure that “we have to defend doing anything lower than.” McKim sized up the task facing the county council, if it wants to approve even a 6-percent increase: “We have our work cut out for us.”

The tables prepared by the council’s administrator Kim Shell for the work session laid out in each line the impact of a pay increase in increments of 0.5 percent. Highlighted were the rows corresponding to 4 percent (maximum levy growth quotient), 6 percent (CPI increase), and 8.5 percent (recommendation from commissioners).

One takeaway from the table: The additional revenue needed to support each percentage point of a pay increase for county employees is about $380,000. So the shift in the LIT rate, from youth services to corrections, which frees up about $400,000, would amount to a pay increase of about 1 percentage point.

But given the deficit that the budget would show, without any pay increases, that $400,000 can be analyzed as just reducing the deficit, not as allowing for a pay increase.

Included in the table reviewed by the county council at Tuesday’s meeting is a column that lays out the hourly flat-rate increase equivalent of an across-the-board percentage increase.

Councilor Marty Hawk said she thinks it’s important to include the flat rate hourly adjustment as an option, because “it really helps the ones on the lower end.” She added, “It does really help the people who make the least amount of money.”

To illustrate Hawk’s point, a $1/hr increase for an employee making $15/hr is a bigger percentage raise than a $1/hr increase for an employee making $30/hr.

Several councilors expressed support for considering a flat hourly rate increase, instead of an across-the-board percentage increase.

Councilor Cheryl Munson noted that it had been the practice of the county council historically to alternate between a percentage increase and a flat hourly increase.

Weighing in from the public mic for consideration of those on the lower end of the salary scale were Beth Hamlin, who is executive director of the prosecutor’s office, and Jackie Nestor Jelen, who is the county planning director.

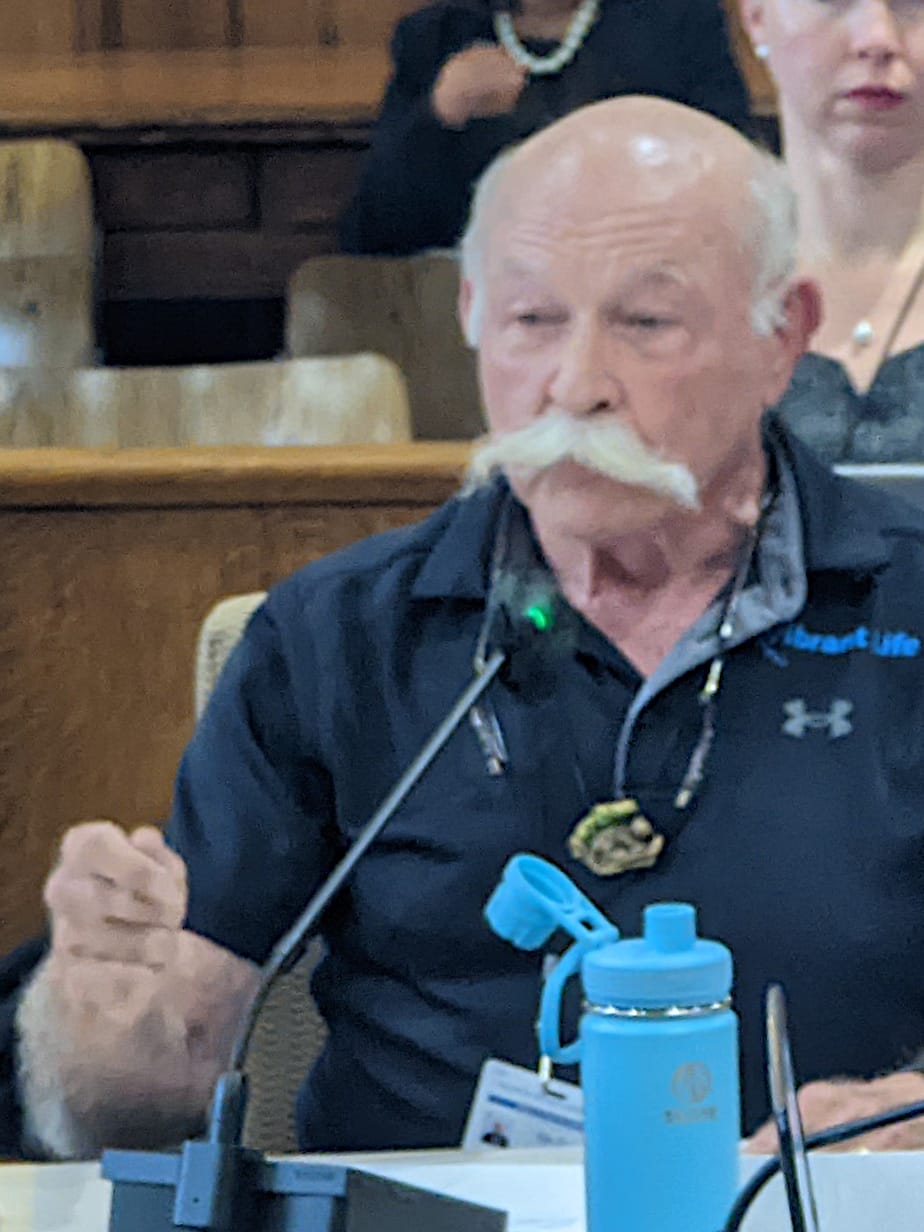

Also from the public mic, health officer Clark Brittain stressed the importance of salary for employee morale and retention. Even if work environment, job satisfaction, and self worth, exceed salary, that still leaves salary in the top four factors for retention, based on various studies, Brittain said.

“Salary is a reflection of how much we value our employees,” Brittain said.

County treasurer Jessica McClellan delivered remarks from the public mic in support of more pay for county employees. She received a big round of applause from the crowd of county workers that had gathered in the Nat U. Hill room at the county courthouse on Tuesday, to watch councilors discuss possible pay increases.

McClellan said, “Our employees are feeling dissatisfaction, lack of motivation, while at the same time county government is becoming very complex.” She continued, “The funding is complex, and the compliance with the funding is complex. Our services that the county provides become more complex as we set higher goals.”

McClellan added, “Adequate compensation can attract employees who are willing to face the various risks of managing public funds. Low pay encourages incompetence and negligence.”

County councilors did not seem to need persuading that they should look for ways to give employees better pay. It’s not clear, though, what ways they might find.

Councilor Jennifer Crossley asked what the impact on the budget would be if all elected officials had their salaries frozen for three years. She was not making a suggestion to freeze the salaries of elected officials, Crossley said, but she wanted to know what the fiscal impact would be.

County council president Kate Wiltz looked to the upcoming schedule of departmental budget hearings, which start on Sept. 6. Wiltz asked that department heads reexamine their proposed budgets and review them for possible reductions that would allow for more money to be put towards increased compensation for county employees.

Wiltz said, “It would be immensely helpful if everyone could look at their budgets between now and the hearings, and be thinking about that, because…we’re in a bit of a bind, and we want to do right by our people.”

Comments ()