Monroe County sets special meeting to vote on Simtra Biopharma tax break for former GE site redevelopment

A special meeting of the Monroe County council has been called for 4 p.m. on Aug. 26 to discuss the possible approval of a tax abatement for Simtra Biopharma, which announced in late July that it had purchased the former GE site on Bloomington’s west side from Cook Group.

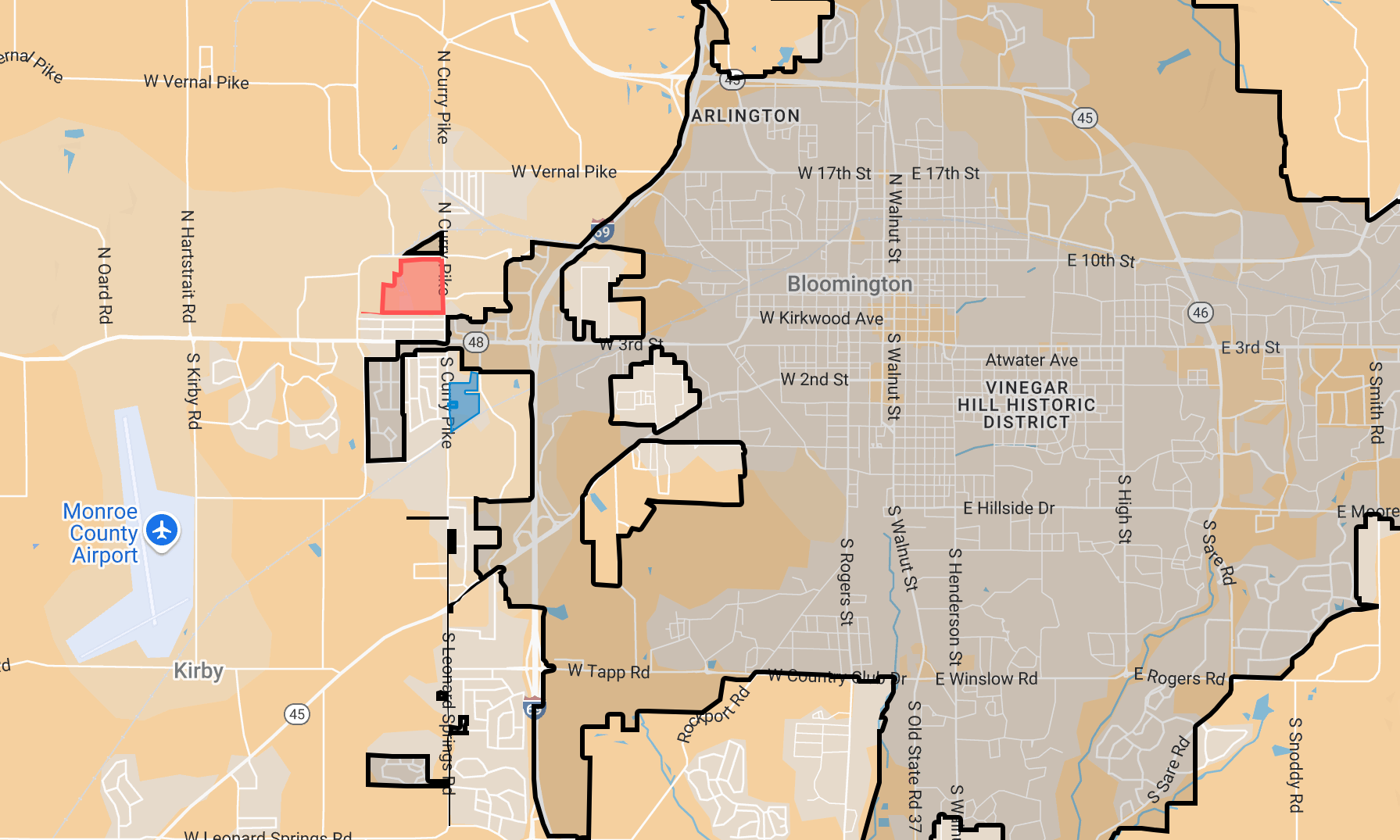

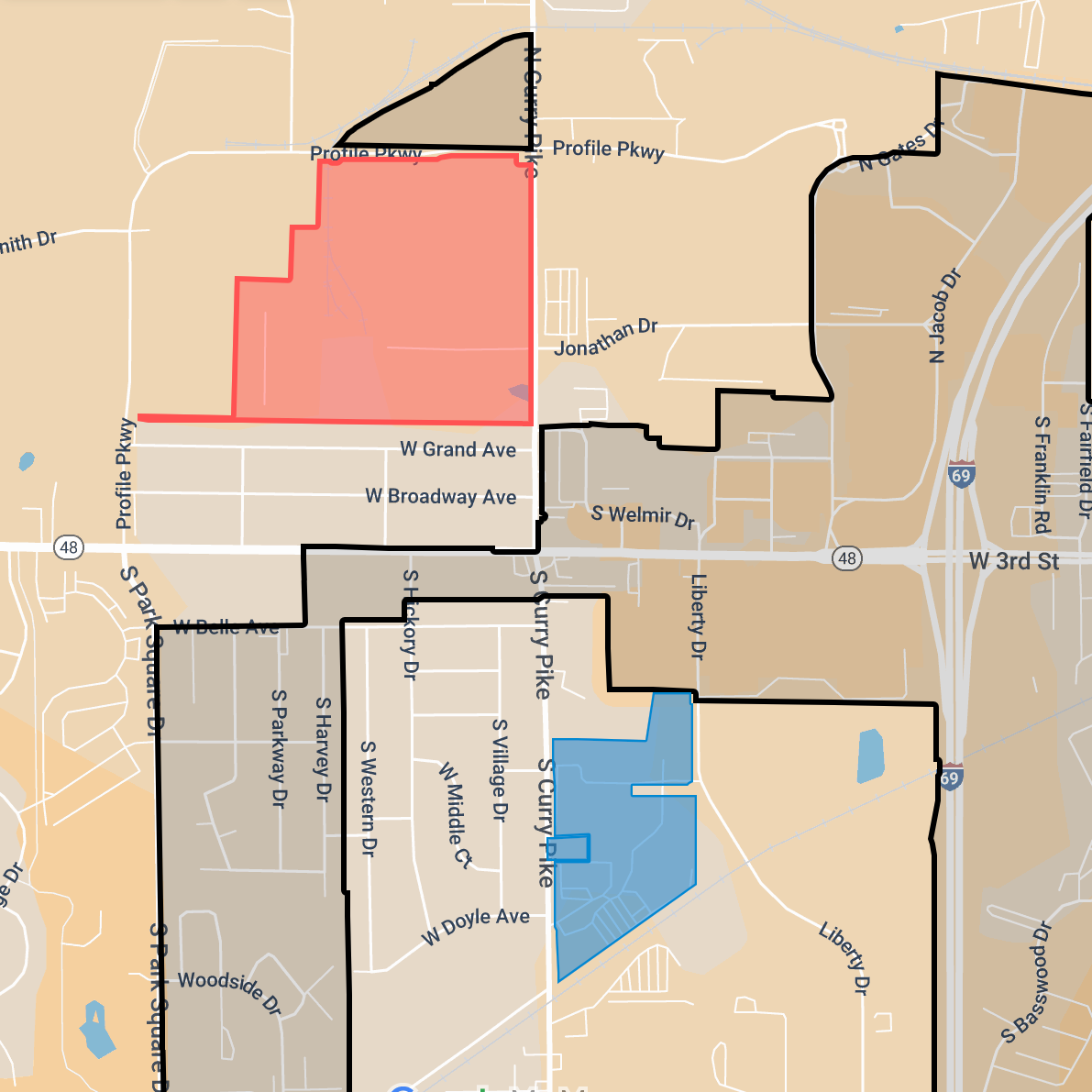

Maps by The B Square with parcel information from Monroe County. Shaded red is the parcel that was purchased from Cook by Simtra BioPharma Solutions. Shaded blue is Simtra's existing facility.

A special meeting of the Monroe County council has been called for 4 p.m. on Aug. 26 to discuss the possible approval of a tax abatement for Simtra Biopharma, which announced in late July that it had purchased the former GE site on Bloomington’s west side from Cook Group. Details of the requested tax abatement are still being negotiated between county officials and Simtra.

The scheduling of a special meeting was the outcome of a discussion by the Monroe County council at its regular meeting on Tuesday. The fiscal body of the county will have just an hour for the special meeting on the Simtra tax abatement, because the first work session for 2026 budget planning is set to start at 5 p.m. the same day.

The possibility that Simtra would be asking for a tax abatement did not come as a surprise. In February 2024, the company asked for and received an abatement in connection a $250-million investment in its other westside facility. The news release issued by Simtra in late July about the real estate deal with Cook Group stated, “Simtra will be working closely with Monroe County, Indiana officials on a phased development plan, and the Company will share additional details in the coming weeks.”

Simtra wants to use the site that it purchased from Cook Group to manufacture oncology focused injectable drug products. The facility would run isolator-based vial and prefilled syringe filling lines, according to Simtra. Monroe County property transfer records now show that Cook Group sold the former GE property to Simtra for $45 million. In 2017, Cook Group bought the real estate for $6.5 million.

Based on Tuesday’s discussion by county councilors, some of them were given a tour of the planned new facility.

Tuesday’s deliberations among councilors started with an introduction of the topic by county attorney Jeff Cockerill. “The goal of the company is to clearly utilize that building in manufacturing and those kind of ways. The goal of the county is to have them utilize the facility and manufacturing in those ways, as well as employ people, get wages at a good level,” Cockerill said.

In late July, a Simtra spokesperson said at that point it was too early to give specific numbers about how many new employees the expansion will add. The company currently employs about 1,300 people at its site just outside the Bloomington city limits. The newly purchased facility is also outside the city—which is why Simtra is in talks with Monroe County government, not the city of Bloomington about a potential tax abatement.

In connection with tax abatements, companies are commonly required to hit some minimum figures for new jobs as a condition for receiving a break on their taxes.

On Tuesday, Cockerill described to the council how a typical abatement works: In the first year, an abatement is given for 100% of the taxes, with a decreased abatement by 10 points each year until there is no tax break in place after 10 years.

But Cockerill described Simtra’s request as an “augmented abatement,” indicating that Simtra had asked for a structure that differs from the standard 10-year model. Cockerill also described the possibility of “revamping” the abatement that was approved for Simtra in February 2024.

Council members generally expressed support for the potential of Simtra’s project to revitalize a long-vacant property and bring high-quality jobs to the area.

Councilor Kate Wiltz said it’s important to tie the abatement to specific performance metrics and suggested that the company might be asked to make a contribution to the Bloomington Economic Development Corporation. “I think we’d all talked about performance metrics being tied in the ways that they normally are, but maybe to be very specific about timing of those performance metrics and the impact on the percentages,” Wiltz said.

The council’s conversation also touched on the mechanics of enforcing the terms of the abatement. Councilor David Henry asked about “clawbacks”—provisions that would allow the county to recoup benefits, if the company were to fail to meet its commitments. Cockerill told Henry that while the county has not historically needed to enforce such provisions, the current negotiations would likely include them. “In this one, I think we would have some language for clawbacks… When it’s in the MOU [memorandum of understanding] … that is a much easier, much more enforceable mechanism,” he said.

Council president Jennifer Crossley raised the question of housing and the limited benefit of adding new jobs, if they are filled by workers to commute into the county—because local income tax is paid based on residency. Crossley said, “I really want to see how they can work with us here in the county, because, you know, the jobs are great … However, if we have all of that money that’s being made here … with the workforce here, and it goes elsewhere, we’re not really helping ourselves in the long run, when it comes to a lot of challenges that we see here in the county.”

Following up on Crossley’s point, Wiltz suggested the possibility that Simtra could offer compensation-related benefits to employees who are Monroe County residents. Wiltz also floated the idea of asking that the company install a wildflower meadow in place of an expansive lawn. Councilor Peter Iversen asked about the possibility that the company could help make connections to the county’s trail network.

The Monroe County History Center uses the former GE site that Simtra purchased from Cook Group for its annual garage sale, which is the center’s biggest fundraiser. Councilor Liz Feitl indicated at Tuesday’s meeting her understanding that the history center would not immediately have to move the location of the sale.

Cockerill told county councilors he is aiming to have a draft agreement ready for their review by next Monday.

On July 22, county councilors held an executive session, closed to the public, for negotiations on the tax abatement deal. That’s allowed under Indiana’s Open Door Law, which includes as lawful reason for an executive session “interviews and negotiations with industrial or commercial prospects or agents of industrial or commercial prospects by … a governing body of a political subdivision.”

Comments ()