New jail tax rate is 0.17%, will take effect for all Monroe County residents at start of 2025

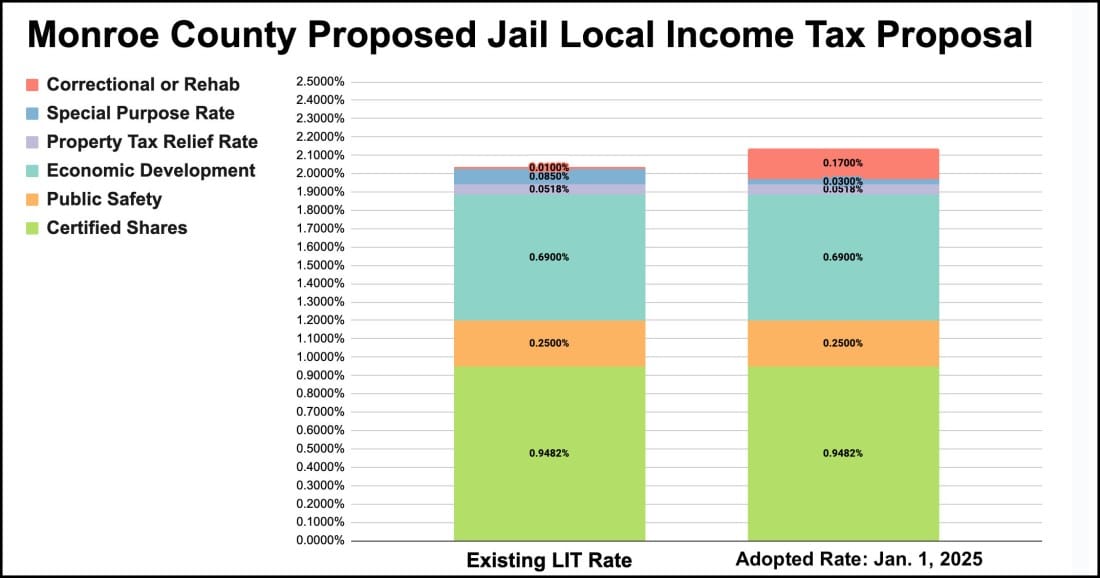

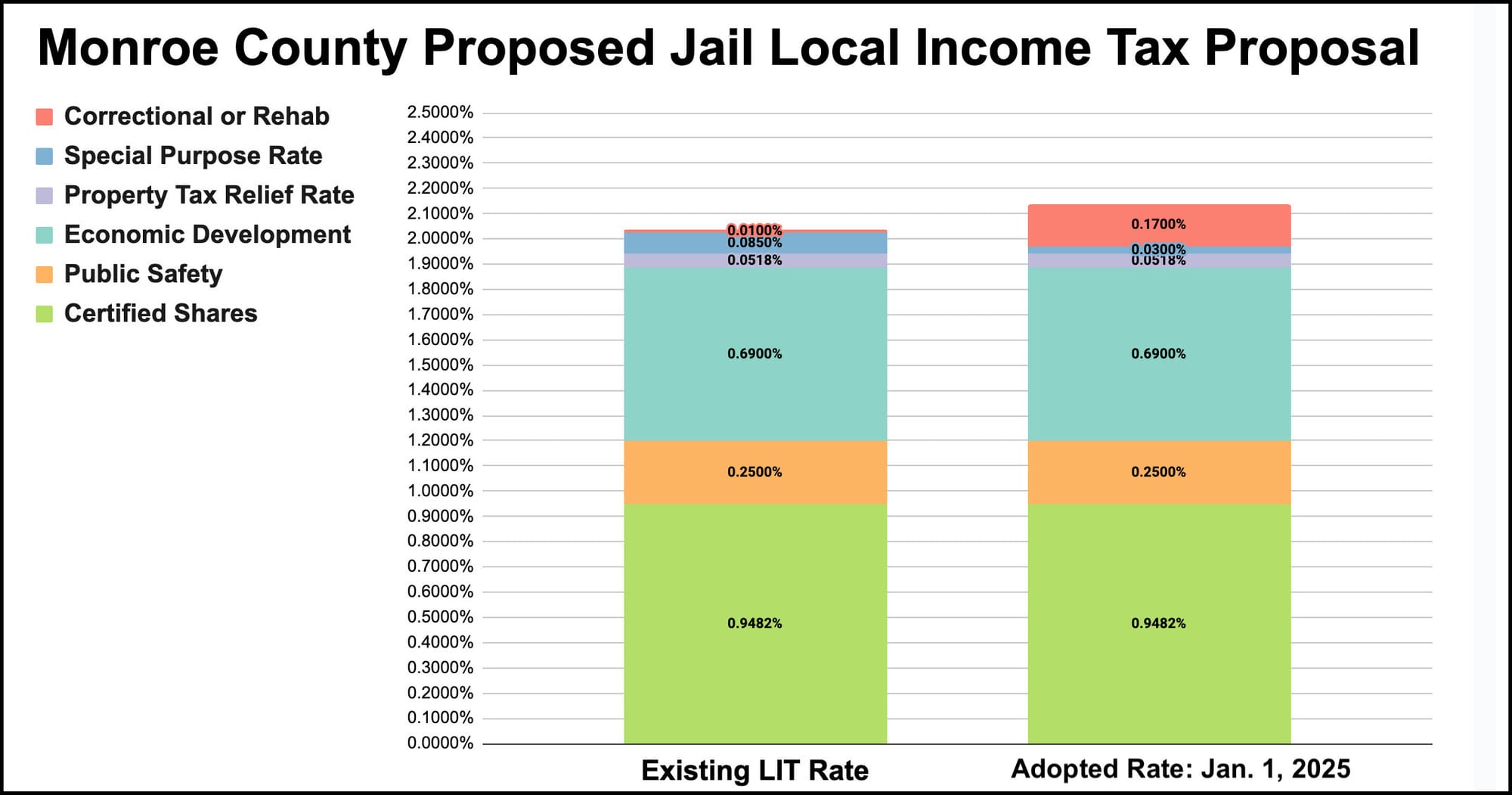

Starting in 2025, Monroe County residents will pay a local income tax rate that is 0.105 points higher than the current rate.

A rate of 0.105, when applied to a taxable income of $20,000 per year, works out to an extra $21 a year.

The county council voted 5–1 to enact the tax, which is supposed to help fund a new county jail and related justice center with a construction budget of up to $200 million or more.

Dissenting was Marty Hawk. Absent due to illness was Cheryl Munson.

A series of formal budget hearings for 2025 was already scheduled for the Monroe County’s Tuesday night meeting. But added to Tuesday’s agenda was an ordinance to increase the jail (LIT) local income tax rate from 0.01 percent to 0.17 percent.

Also enacted in the same ordinance on Tuesday, was a new lower, 0.03-percent rate for the “special purpose” category of local income tax, which currently funds the operation and maintenance of a facility to provide juvenile services. The current rate of the special purpose tax is 0.085 percent.

The combined effect of the increase in the jail LIT to 0.17 percent and a decrease in the special purpose LIT is an increase of 0.105 points in the total amount of local income tax paid by Monroe County residents. The resulting total rate is 2.14 percent.

The day before, on Monday, the county council had held a public hearing on the increase to the jail LIT and the decrease to the juvenile services LIT.

The same two people—Monroe County residents Seth Mutchler and Joe Davis—took the public mic on Monday and Tuesday, both to oppose the enactment of the higher tax.

This week’s hearing and vote were the denouement of a process that began with a mid-September hearing, with more attendees, on a higher jail LIT rate of 0.20 percent. The council later adjusted the jail LIT downward to 0.17 percent.

Councilor Marty Hawk was opposed to enacting the tax, saying that she thinks the ED LIT (economic development local income tax), enacted by Bloomington’s city council in May 2022 should be tapped instead of a jail LIT.

The total amount of ED LIT revenue expected to be collected by Monroe County government for 2025 is around $11.7 million. The revenue that will be generated by a 0.17-percent LIT rate is around $7.5 million.

Hawk also pointed to key as-yet-undecided issues, like the location of the planned new jail.

But on Tuesday night, among other county councilors there was solid support, if not a universal feeling of comfort, in the 0.17-percent rate for the jail LIT.

Councilor Geoff McKim stated on Tuesday that it should not be a surprise that he supports the tax—he had a few weeks ago also supported the higher 0.20-percent rate. McKim took up a point that Davis had made during public comment on Monday about the advisability of waiting on the project until interest rates have gone down, as they’re expected to.

McKim pointed to the fact that the bonds for the jail and justice center construction would likely not be issued until a year and a half from now, which would allow for plenty of time for interest rates to go down.

Councilor Jennifer Crossley said one reason she is comfortable with the 0.17-percent rate is that the wording in the state statute says that the revenue from the jail LIT can also be spent on “rehabilitation facilities” in the county.

Crossley said the council has to “think about how we think about incarceration,” a notion that resonated with Mutchler, who works with a group called Care Not Cages, which advocates generally against incarceration.

Councilor Kate Wiltz said she is glad the council worked to lower the rate from 0.20 percent to 0.17 percent, but she added, “I can’t say that I’m comfortable with it or feel in favor.”

Still, Wiltz said “I recognize that it’s our duty to finance the jail project and hopefully related justice projects.” Wiltz said she doesn’t see viable alternatives that will “provide an outcome of quality,” adding, “I don’t want to jeopardize the project.”

The backdrop to current efforts to plan a new jail facility includes a lawsuit filed by the ACLU in 2008 against Monroe County on behalf of jail prisoners, about overcrowded conditions at the jail. The Monroe County jail operates under a settlement agreement that has been extended several times.

The current effort towards constructing a new jail, stems from two reports from consultants hired to study the local criminal justice system. The reports were delivered three years ago, in July 2021.

The reports from the two consultants—RJS Justice Services and Inclusivity Strategic Consulting—highlighted a number of challenges in Monroe County’s criminal justice system.

The key conclusion from the RJS study, which prompted the start to the recent effort was: “The jail facility is failing and cannot ensure consistent and sustainable provision of constitutional rights of incarcerated persons.

On Tuesday night, county council president Trent Deckard alluded to the possible threat that federal authorities would intervene, if Monroe County government does not act to resolve the problems with the jail. “I’d rather vote for this today, than to have a judge come in later and tell me how I will vote on this, where that will go,” Deckard said.

Deckard said, “We cannot go back to those conditions. We must go forward. And I see this vote as a small step towards that.” Deckard added, “I am always reluctant to ask taxpayers for anything.”

But Deckard said about those who are incarcerated in the county jail: “I do recognize—that is our neighbors, that is our friends, that are human beings in that constitutional care facility.”

Why is the council lowering the juvenile services rate?

County councilors are not looking to maintain the special purpose tax at just 0.03 for the longer term, because that would not be enough to fund juvenile services over the long haul.

But it will allow for the current high fund balance for the special purpose LIT to be drawn down. And the lower special purpose rate would provide a relatively lower overall rate for taxpayers, at least for a while, compared to an increase in the jail LIT rate, with no adjustment to the special purpose LIT.

It’s the same logic the council council used last year, when it established a jail LIT rate for the first time, at 0.01 percent, while reducing the special purpose LIT rate to 0.085 percent. The net effect of that move was no change to the overall income tax paid by Monroe County residents.

The rate for the special purpose LIT won’t increase in the future, unless a future council acts to increase it.

A 0.17-percent rate applied to a taxable income of $20,000 per year works out to $34 a year.

| Allocation Rate Category | Existing LIT Rate | Proposed Rate |

| Certified Shares (IC § 6-3.6-6) | 0.9482% | 0.9482% |

| Public Safety (IC § 6-3.6-6) | 0.25% | 0.25% |

| Economic Development (IC § 6-3.6-6) | 0.69% | 0.69% |

| Property Tax Relief Rate (IC § 6-3.6-5) | 0.0518% | 0.0518% |

| Special Purpose Rate (IC § 6-3.6-7) | 0.085% | 0.03% |

| Correctional or Rehabilitation Facilities (IC § 6-3.6-6-2.7) | 0.01% | 0.17% |

| Emergency Medical Service3 (IC § 6-3.6-6-2.8) | 0.00% | 0.00% |

| Staff Expenses for State Judicial System (IC § 6-3.6-6-2.9) | 0.00% | 0.00% |

| Total Tax Rate | 2.035% | 2.14% |

Comments ()