Proposed jail tax rate trimmed by Monroe County to comply with maximum decimal places

At a Thursday meeting, the Monroe County council voted to adjust its proposed rate for the new jail local income tax (LIT) from 0.175 percent down to 0.17 percent.

That means the public hearing set for Oct. 7 will be on the revised 0.17-percent rate.

On Monday, the county council held a public hearing on a higher rate of 0.2 percent. But on Tuesday, the council voted to reduce the rate. The competing proposal was 0.15 percent, and by compromising exactly in the middle, the council arrived at the 0.175-percent rate.

Why did the county council revisit the question again on Thursday? The council made the slight reduction from 0.175 to 0.17 percent, based purely on the allowable number of decimal places in the correctional and rehabilitation facilities LIT.

County attorney Molly Turner-King told the council on Thursday that as she prepared the ordinance for the Oct. 7 public hearing, after conferring with Indiana’s Department of Local Government Finance (DLGF), she learned that the corrections LIT rate has to be set in increments of 1/100 of a percent.

That meant 0.17 or 0.18 percent would be possible, but 0.175 percent would not be a possible LIT rate. The council easily settled on the 0.17-percent rate.

The vote on setting the advertised rate at 0.17 percent for the Oct. 7 public hearing was 6–1—the same as it was on Tuesday to set it for 0.175. But the one dissenting vote was different.

On Tuesday, councilor Peter Iversen dissented because he had wanted to see the 0.2-percent rate enacted that night, instead of holding another public hearing on the lower rate. Iversen had wanted to send “a clear message to the community that we are dedicated to fixing this problem and fixing it tonight.”

On Thursday, Iversen was on board with the 0.17-percent rate, because the question of timing was already moot. Iversen put it like this: “It’s revenue sufficient for us to meet our programming goals, and it moves us forward within the timeline that we had advertised.”

But Marty Hawk, who had voted for the 0.175-percent rate on Tuesday, because it was lower than the 0.2-percent rate, dissented on Thursday. Hawk said she doesn’t want to support the use of the jail LIT to build a new jail, because she thinks the county could use the economic development LIT to pay for it.

Hawk also said on Thursday she objects to the North Park location as the site of a new jail. A purchase agreement for the North Park location, west of SR 46 of Hunter Valley Road, is expected to appear on next Wednesday’s meeting agenda for the county commissioners.

Under state law, the county council also has to approve the purchase of any new significant property, regardless of how it is funded.

On discovery of the decimal-place issue with the 0.175 percent rate, the council did not have to set a special meeting to revise it, because a Thursday meeting on the 2025 budget was already on the calendar.

Not affected by Thursday’s vote was the council’s plan to advertise a new, lower rate of 0.03 percent for the “special purpose” category of local income tax, which currently funds the operation and maintenance of a facility to provide juvenile services.

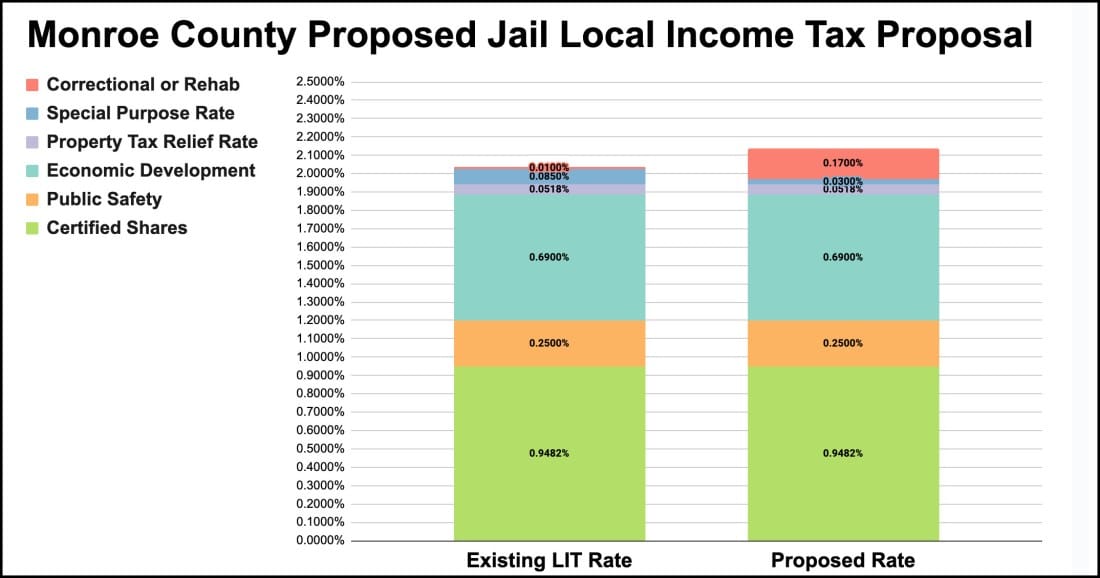

The combined effect of the increase in the jail LIT to 0.17 percent and a decrease in the special purpose LIT would be an increase of 0.105 points in the total amount of local income tax paid by Monroe County residents. The resulting total would be 2.14 percent.

County councilors are not looking to maintain the special purpose tax at just 0.03 for the longer term, because that would not be enough to fund juvenile services over the long haul.

But it would allow for the current high fund balance for the special purpose LIT to be drawn down. And the lower special purpose rate would provide a relatively lower overall rate for taxpayers, at least for a while, compared to an increase in the jail LIT rate, with no adjustment to the special purpose LIT.

It’s the same logic the council council used last year, when it established a jail LIT rate for the first time, at 0.01 percent, while reducing the special purpose LIT rate to 0.085 percent. The net effect of that move was no change to the overall income tax paid by Monroe County residents.

The rate for the special purpose LIT won’t increase in the future, unless a future council acts to increase it.

A 0.2-percent rate applied to a taxable income of $20,000 per year works out to $40 a year.

| Allocation Rate Category | Existing LIT Rate | Proposed Rate |

| Certified Shares (IC § 6-3.6-6) | 0.9482% | 0.9482% |

| Public Safety (IC § 6-3.6-6) | 0.25% | 0.25% |

| Economic Development (IC § 6-3.6-6) | 0.69% | 0.69% |

| Property Tax Relief Rate (IC § 6-3.6-5) | 0.0518% | 0.0518% |

| Special Purpose Rate (IC § 6-3.6-7) | 0.085% | 0.03% |

| Correctional or Rehabilitation Facilities (IC § 6-3.6-6-2.7) | 0.01% | 0.17% |

| Emergency Medical Service3 (IC § 6-3.6-6-2.8) | 0.00% | 0.00% |

| Staff Expenses for State Judicial System (IC § 6-3.6-6-2.9) | 0.00% | 0.00% |

| Total Tax Rate | 2.035% | 2.14% |

Comments ()