Proposed local income tax increase for Monroe County residents, tax bump for Bloomington property owners: Some details emerge

In a memo released Thursday afternoon, Bloomington mayor John Hamilton announced some details about an anticipated local income tax (LIT) increase for Monroe County.

Bloomington’s city council will be asked to enact a tax increase as soon as one month from now.

Also getting some additional detail was the issuance of $10 million in general obligation (GO) bonds that the council will be asked to approve. Issuing GO bonds will bump Bloomington’s property tax rate.

Several documents released on Thursday, and posted on a separate page on the city’s website, include a breakdown for potentially $17 million in additional annual spending by the city of Bloomington, based on additional local income tax revenues.

The broad categories of possible increased LIT spending are: climate change ($6.35 million); essential services ($2.5 million); public safety ($4.5 million); and quality of life ($3.65 million).

Under the climate change category, the biggest part ($4.85 million) could go towards public transit.

[Google Sheet compiled by The B Square]

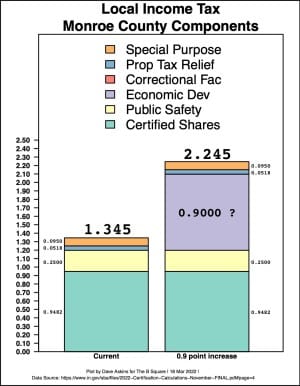

Not part of the documentation was the income tax rate increase that would be required in order to generate the $17 million of revenue. The B Square’s calculation of the rate increase that would be required to generate $17 million is around 0.90 points.

That would increase the current LIT rate for Monroe County from 1.345 percent to 2.235 percent.

The B Square calculates that increasing the LIT rate by 0.90 points would also generate more money for Monroe County and Ellettsville government, totaling about $16.25 million a year.

After some back-and-forth with The B Square, on Friday afternoon Bloomington’s communication director Andrew Krebbs confirmed the basic arithmetic: To generate an extra $17 million for Bloomington, the LIT rate would need to increase by about 0.90 points.

Depending on how community discussion goes about the proposed projects in the next couple of weeks, not everything on the current project list will necessarily wind up as a part of the final proposal, according to Krebbs. Whatever is requested from the council in April could be less than the 0.90 points it would take to pay for everything on the list.

When Hamilton proposed a half point increase in the LIT in 2020 (which was ultimately not enacted), he took criticism for first pitching the rate increase, with a promised process later for sorting out how to spend the money. This time around, the administration is downplaying the amount of the tax increase, in favor of the project list.

Krebbs described the projects in the documents released on Thursday as “a menu of options.” “[S]ome of these projects may end up being funded and others may not,” Krebbs wrote.

Krebbs added, “But because the projects are the primary focus and the consequent LIT rate is in many ways a secondary consideration, we have not approached this as a proposal for a LIT increase.”

The proposal for issuance of $10 million in general obligation (GO) bonds was first floated in connection with budget deliberations in the fall of 2021.

The idea is to issue $5 million worth of parks bonds and $5 million worth of public works bonds this year and to issue another $10 million of GO bonds every five years.

Over the next couple of weeks, some of the projects on the GO bond list look like they will need to be winnowed out, at least for the first year’s issuance. That’s because the upper end of the total estimated cost is about $24.5 million, more than twice the amount of the planned bond issuance.

Whereas the LIT projects are heavy on operational expenses, like salaries for police officers, the GO bond project list is weighted towards capital and infrastructure projects.

For additional background on how Bloomington’s city council can enact a LIT increase for all Monroe County residents, and how to calculate the rate that is required to generate $X in LIT revenue, see past coverage: Analysis: Refresher for possible local income tax increase in Bloomington, rest of Monroe County

The anticipated schedule of next steps is laid out by the Hamilton administration for three successive Wednesdays in April:

- April 6, 2022: Hamilton’s presentation to the city council

- April 13, 2022: City council discussion of LIT and GO bond legislation (first reading)

- April 20, 2022: Final vote by the city council (second reading)

The administration’s schedule does not include the possibility that Bloomington’s city council would approve the LIT increase by just a 7–2 vote or less. On that scenario, the the proposal would need some additional support on the Monroe County council or the Ellettsville town council.

Below are the potential project lists for LIT and GO bonds. The same information is included in The B Square’s [Shared Google Sheet]

| Bond Type | Item | Min Estimate | Max Estimate |

| Parks GO Bond | Cascades Phase 6 -path/connection to Miller Showers Park | $3,200,000 | $3,200,000 |

| Covenanter Drive Protected Bicycle Lanes (College Mall to Clarizz Blvd) | $2,400,000 | $2,880,000 | |

| W. 2nd Street Modernization, Protected Bike Lanes (Walker St to B-Line) | $1,500,000 | $1,500,000 | |

| N Dunn St Multiuse Path (45/46 Bypass to Old SR 37) | $800,000 | $960,000 | |

| Griffy Loop Trail dam crossing and community access | $375,000 | $375,000 | |

| Replace missing sidewalk on Rogers St. by Switchyard Park | $200,000 | $200,000 | |

| Replace gas powered equipment with electric equipment | $25,000 | $25,000 | |

| Parks GO Bond Total | $8,500,000 | $9,140,000 | |

| Public Works GO Bond | High Street Multiuse Path, Intersection Modernize (Arden Dr to 3rd St) | $2,500,000 | $5,000,000 |

| Energy efficiency retrofits for all City buildings | $1,000,000 | $3,000,000 | |

| City fleet vehicle hybrid/ electrification fund | $1,200,000 | $2,200,000 | |

| Citywide LED conversion of street lights | $1,500,000 | $2,000,000 | |

| Sidewalk projects (TBD) | $300,000 | $1,000,000 | |

| Downtown ADA Curb Ramps (e.g., W Kirkwood and Indiana Ave) | $500,000 | $1,000,000 | |

| Create green waste yard at Lower Cascades Park | $400,000 | $500,000 | |

| Citywide traffic signal retiming | $42,500 | $425,000 | |

| GPS for city fleet | $250,000 | $250,000 | |

|

Public Works GO Bond Total

|

$7,692,500 | $15,375,000 | |

| TOTAL | $16,192,500 | $24,515,000 | |

| Category | Description | Annual Cost |

| Climate Change | Major new service providing 15 minute frequency across a priority East/West corridor. This route addition would boost attractiveness and convenience for riders and reduce automobile use | $2,100,000 |

| Multiple efforts toward climate change prevention and preparedness. See Proposed Climate Action Plan Investments in “New Revenue FAQs” for more detail | $1,500,000 | |

| Increase access/improve equity for people who can’t ride fixed-route BT, qualify for paratransit, require special accommodations while enhancing convenience, and expand those services. City-wide service expansion. | $1,400,000 | |

| Improve convenience for all riders, boost ridership, reduce automobile use | $820,000 | |

| Achieve 7-day service for greater consistency and reliability in an effort to boost ridership and reduce single occupancy vehicle use | $300,000 | |

| Focus on workforce partners to develop pilot program in collaboration with the Transportation Demand Management program; explore a potential “Park and Ride” program for special event traffic management | $125,000 | |

| Improve access to public transportation with a focus on workforce and low-income riders | $100,000 | |

| Climate Change Total | $6,345,000 | |

| Essential Services | Offer incentives to attract and retain talented City employees, such as pay adjustments, hiring bonuses, creation of new positions, tuition reimbursement, relocation allowance, longevity bonuses, and/or housing assistance. | $1,000,000 |

| Replace shortfall resulting from decreased Cable Franchise Fees (cable fees lost to streaming) to fund essential IT infrastructure replacements, cybersecurity, and CATS | $500,000 | |

| Meet obligations for city property & liability Insurance, materials & supplies, repair & maintenance. | $500,000 | |

| Maintain aging facilities and other physical assets and replace when required | $500,000 | |

| Essential Services Total | $2,500,000 | |

| Public Safety | Replace or repair damaged and aging facilities with new or upgraded facilites, in order to attract and retain employees and meet safety standards | $1,500,000 |

| Fund the costs associated with the contingent Fraternal Order of Police (FOP) contract | $1,500,000 | |

| Consolidate public safety headquarter operations to replace current damaged and inadequate facilities and to benefit from efficiencies of scale. | $1,000,000 | |

| Tailor response options for 911 calls, health and wellness checks, etc. to divert more 911 calls to non-sworn personnel. Explore combining police/fire non-sworn. | $250,000 | |

| Expand the roles and increase the number of Police Social Workers and Community Service Specialists to respond to some non emergency calls for service and those calls that do not require a law enforcement response. Provide ongoing support for the STRIDE center. | $250,000 | |

| Public Safety Total | $4,500,000 | |

| Quality of Life | Improved access to housing equity through funding assistance for the Housing Security Group/homeless; low/mod income renters; low/mod homeowners; support missing housing types | $2,000,000 |

| Direct support of low income working residents / families – possible Individual Development Accounts to match savings; focused on direct impact, possibly thru SSCAP, MCUM, Trustees, others | $750,000 | |

| Funding for workforce development initiatives, including workforce reentry, re-skilling and up-skilling, and entrepreneurship training, as well as operations and infrastructure funding for the Trades District Technology Center. | $500,000 | |

| Funding to improve food access and nutrition insecurity. Funding support will focus on partnerships with food service providers to address gaps in local food access for low income and food insecure residents. | $200,000 | |

| Funding for maintenance of existing arts spaces, execution of the recommendations of the City’s Arts Feasibility Study and Public Arts Master Plan, and support for arts organizations. | $200,000 | |

| Quality of Life Total | $3,650,000 | |

| Grand Total | $16,995,000 | |

Comments ()