Public bus notebook: ‘Dumb’ fare boxes could be in Bloomington Transit’s future

When passengers pay cash for the $1 fare in order to board one of Bloomington Transit’s 42 fixed-route buses, they put the money into a CENTSaBILL farebox.

The farebox counts the coins or validates the dollar bill, which makes it in some sense “smart.”

But the current fareboxes are obsolete and no longer supported. One of the basic approaches to fare collection now being considered by BT is to use “dumb fareboxes”—which would serve as a receptacle for the money, but wouldn’t validate the amount.

The new “mobile ticketing” approach would focus technology on validating passes and providing passengers with some additional options for buying tickets and passes.

BT’s five-member board voted unanimously at its Tuesday meeting last week, to ask Left Turn Right Turn, which is BT’s fare collection consultant, to forge ahead with development of a request for proposals from vendors in the mobile ticketing market.

If the BT board eventually awards a contract to a mobile ticketing vendor, that would mean passengers dropping cash fares into a “dumb” farebox.

The board’s vote came after a presentation from Left Turn Right Turn’s Yuval Grinspun, and Philippe Gervaise with Niti Systems Consultants, who joined the BT board meeting on a Zoom video conferencing interface.

Instead of validating the relatively small number of cash fares that are collected, a new fare collection system would focus on automatic electronic validation for the relatively large number of boardings by BT passengers who have some kind of pass.

Around 70 percent of BT fixed-route rides are taken by Indiana University affiliates, who present their university ID card as a pass. Those IDs are currently validated visually by drivers, who press a button connected to the farebox to record the boarding.

The idea for the new approach is that IU affiliates and other pass holders would have their boarding validated electronically—say with a scanner that reads QR codes.

The approach BT is now considering would include some additional options for passengers who use monthly passes. The new approach would use monthly “fare capping,” instead of charging a set amount that has to be paid upfront for the pass.

Currently, a monthly BT pass requires the $30 to be paid upfront, in order to obtain the pass. That’s true even for passes that are bought through Token Transit—which gives passengers a way to buy a pass that is displayed on their smartphone screen. BT drivers validate Token Transit passes visually.

The benefit of buying a pass, instead of paying for each individual ride, is that the cost per ride will be less—at least for frequent bus riders.

The “fare capping” approach would simply charge passengers the standard fare for each trip, but would cap the total amount paid in a given month at $30. No upfront payment of $30 would be required.

In a system that uses account-based architecture—with user data centralized on their account, hosted in the back office system—the amount that a user has paid so far in a given month can be monitored.

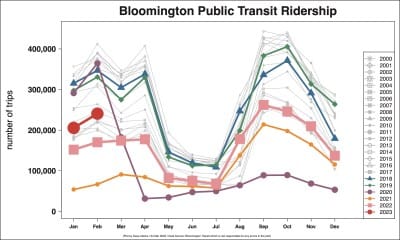

BT’s consideration of a new fare collection system comes in the context of ridership that continues to incrementally increase after plummeting during the COVID-19 pandemic. The roughly 240,000 rides taken in February 2023 is 41 percent more than the 170,000 rides taken in February 2022.

But February 2023’s number is still just 65 percent of the 365,000 rides taken in February 2020, which was the last month before the effects of the pandemic were seen.

From the March 21, 2023 Left Turn Right Turn slide deck on fare collection options:

| Core BackOffice | Equipment | Cash Users | Pass Users | Other Users | Add. Options | |

| 1 – Mobile Ticketing | Mobile Ticketing System | • Make existing fareboxes dumb • On-board Validators • Printers at sales location |

Dumb fareboxes – No Transfer | QR Code on Smart Phone | Purchase QR-coded paper passes (monthly) at sales locations | • Smart Cards and Smart Card Validators • Ticket Vending Machines • SaaS |

| 2 – New Farebox System | Farebox BO | • Validating fareboxes with Integrated QR Code/Smart Card validators • Printers at sales location |

Validating fareboxes -Transfer | QR Code on Smart Phone | Purchase at a sales location or On-board | • Smart Cards • Ticket Vending Machines |

| Popularity | Competition | Procurement | Users | Implement | Other | |

| 1 – Mobile Ticketing | High among agencies with large pass usage | • Many suppliers | Design/Built or SaaS | Less attractive for Cash users (paper and transfer eliminated) | Less disruptive, can be phased-in Need change in fare policy | • Future-proof • Limited upfront investment makes switching supplier possible |

| 2 – New Farebox System | Conservative approach for agencies concerned with cash users | • Limited Competition | Design/Built with larger investment upfront | Cash, transfer, QR Code on Smart Phone | • Tied to one supplier • Higher maintenance cost |

Comments ()