Public meetings on future of Bean Blossom fire protection show uncertainty about cost, procedure

Three public meetings this week at Bean Blossom’s community center have wrapped up with some uncertainty about the costs and the procedures that are related to a change in fire protection for the township.

Bean Blossom’s fire department is the only one remaining in Monroe County that is staffed by volunteer firefighters.

But it looks pretty certain that Bean Blossom, in the northwest corner of the county, will be adopting the same approach as other parts of the county—opting for paid professional firefighters to staff a station, instead of volunteers who respond from wherever they are.

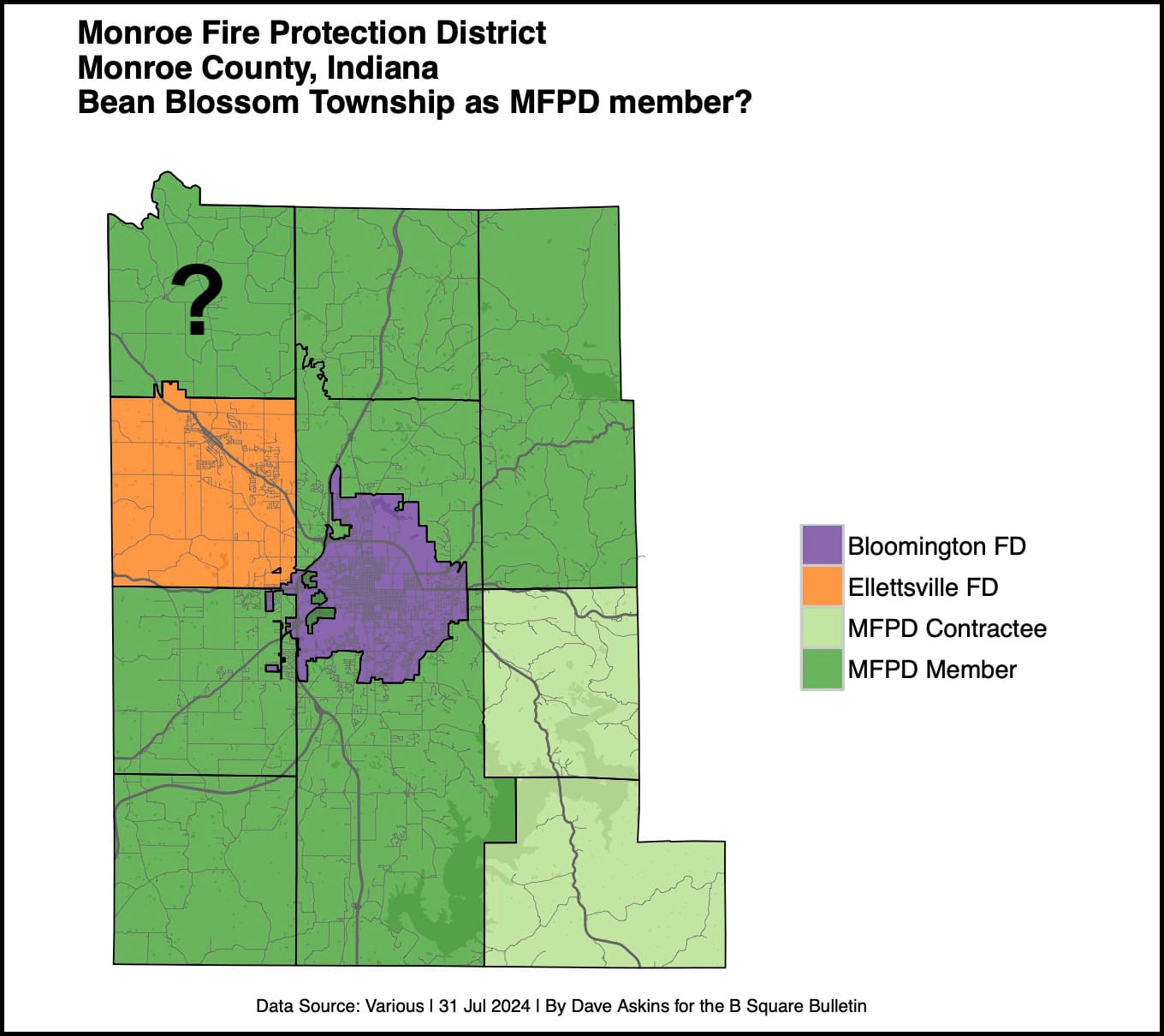

This week’s meetings were meant to provide Monroe Fire Protection District (MFPD) a chance to provide information and answer questions from Bean Blossom Township residents about what it would mean for them to join the MFPD.

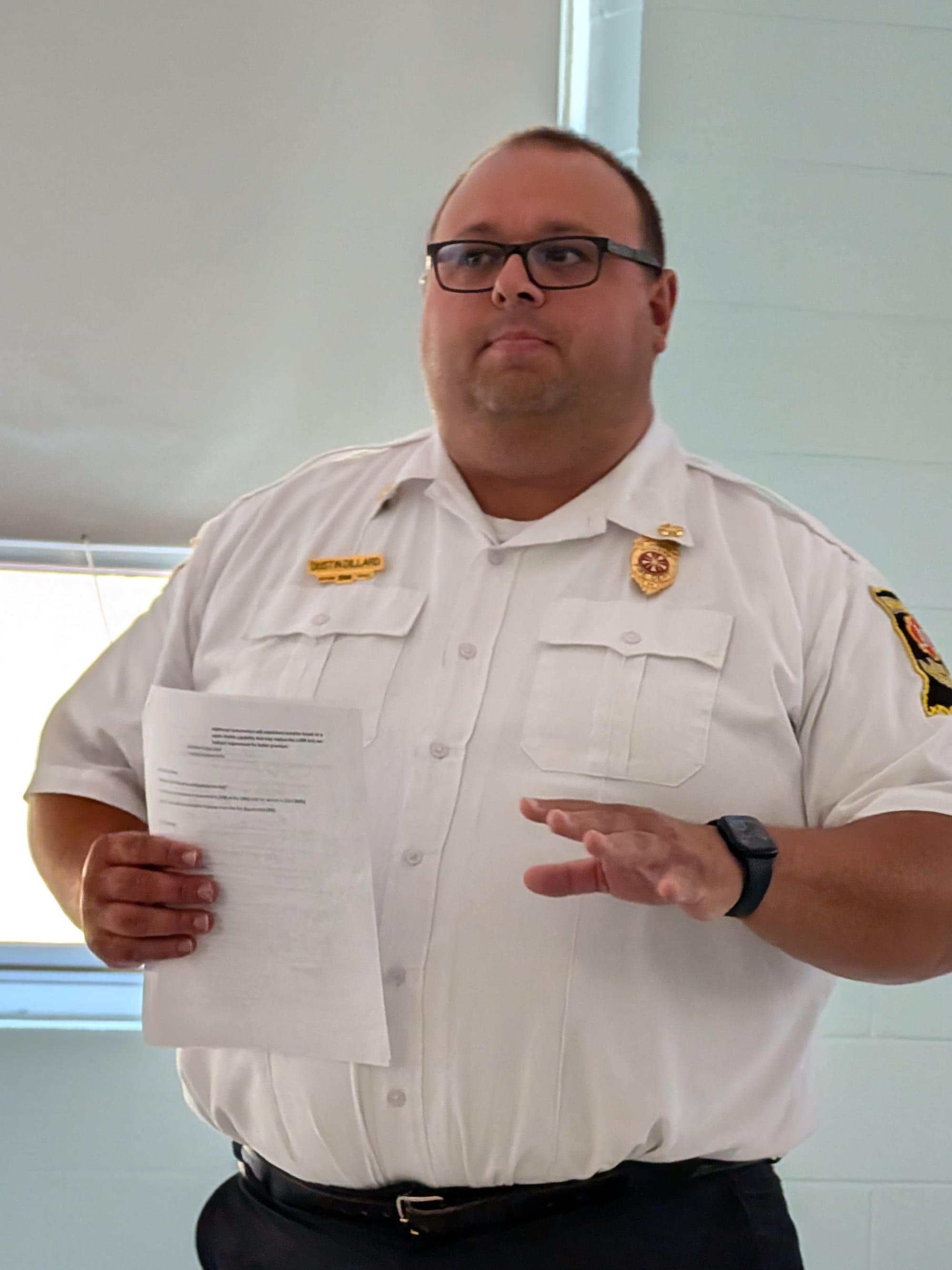

MFPD chief Dustin Dillard told attendees of Wednesday’s meeting that joining the MFPD would mean the township’s fire station, just around the corner from the community center, would be staffed 24/7 with two firefighters.

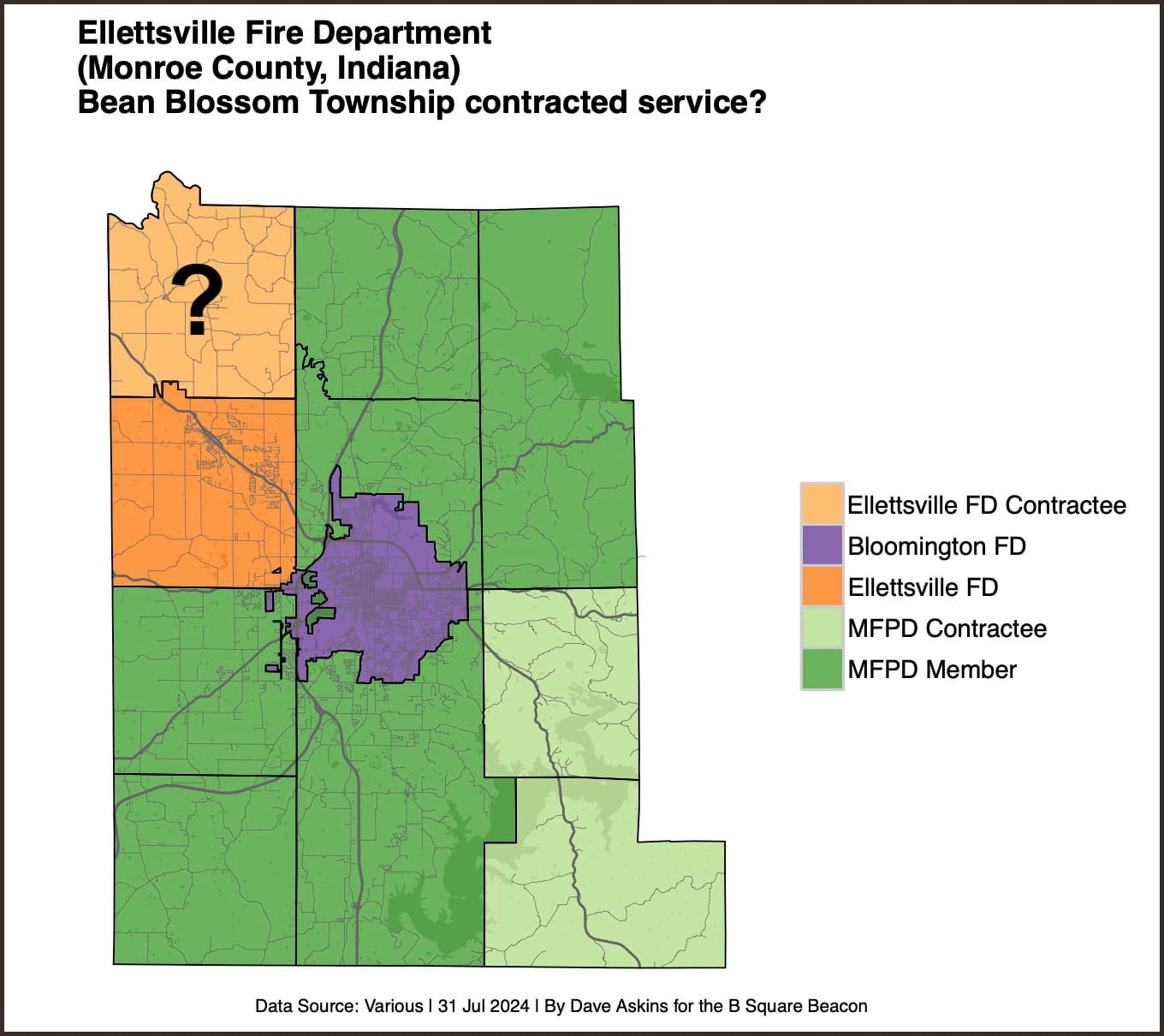

But one possibility in the mix, which seems to have at least some support among township residents, is for the township to contract for service with Ellettsville’s fire department.

It’s certain that for Bean Blossom landowners joining the MFPD will mean higher property taxes than they pay now—exactly how much more is not quite clear.

It’s certain that it’s the Monroe County commissioners who make the decision about whether Bean Blossom Township becomes a part of the MCPD, but it’s not clear exactly what path the commissioners will follow to take a vote on the question.

Joining the MFPD

MFPD already serves most of Monroe County’s geographic area outside of the city of Bloomington, including all or parts seven member townships: Bloomington, Perry, Van Buren, Indian Creek, Clear Creek, Benton, and Washington. MFPD also serves Polk and Salt Creek townships on a contractual basis.

As attendees of Wednesday’s meeting, county commissioners Julie Thomas and Penny Githens heard questions from property owners about paying higher taxes, but also questions about the procedure they will follow for making a decision.

According to Bean Blossom Township trustee Ron Hutson, around 1,600 postcards were sent out to Bean Blossom property owners. The postcards can be mailed back to the trustee’s office. Those postcards are then forwarded to the Monroe County auditor’s office for validation.

The postcard gives landowners the option of checking a No or a Yes box for joining the MCFD.

The postcard is not a “referendum.” They’re are serving the role of a “petition” in the process that the county commissioners adopted with a resolution approved in late July.

The July resolution says that if inside of 30 days after the required public engagement meetings, 50 residents file a petition against the township joining the MCFD, then the commissioners will conduct a hearing to hear objections.

Four years ago, when Benton Township joined the MFPD, a similar resolution mentioned a threshold of 20 percent of “freeholders” who needed to send back a postcard indicating support, in order for commissioners to move forward with adding Benton Township to the MFPD.

No such 20-percent threshold is mentioned in this year’s resolution about Bean Blossom.

It was not arbitrary that the commissioners chose a 20-percent threshold for the Benton Township process. The state law on the establishment and expansion of a fire district says the process can be initiated by a petition signed by 20 percent of landowners. But state law does not appear to require commissioners to add a township to a district, just based on those petitions.

The state law also says that if a petition against adding area to a district contains the signatures of 51 percent of property owners within the proposed district, then the commissioners have to “dismiss the petition” to add area to the district.

Based on the wording of the state law, commissioners also have to dismiss a petition to add a township to fire district if it is signed by property owners who own at least two-thirds of the property in the area, as measured by assessed value.

At Wednesday’s meeting in Stinesville, there was enough uncertainty about the process that county commissioners said a clarification on the exact procedure would be posted on the Monroe County website.

[Updated Sept. 3, 2024. The details of the procedure for Bean Blossom to join MFPD have now been posted on the county government’s website. It looks like at least 500 property owners will need to support joining the MFPD.]

Some basic alternatives: MCFD or Ellettsville Fire Department

MCFD is a taxing authority, which can and does collect a property tax.

One basic question that Wednesday meeting attendees wanted answered: What will we get for the increased taxes we pay to MCFD?

MFPD chief Dustin Dillard told meeting attendees it would mean the township’s fire station would be staffed with two firefighters 24/7.

The cost of staffing that station would come to around $980,000 a year.

Dillard told them: “This fire station next to you [the Bean Blossom volunteer fire department station] operates on an $85,000 a year budget.” None of that money goes to pay firefighters. Dillard said: “Most of that money goes into insurance policies—on the building, on the trucks, on the workers comp in case a firefighter gets hurt.”

Dillard added, “Some of these folks are literally putting money out of their own pockets into the fuel and the fire trucks, because there is simply not enough money to fund that volunteer group.”

Dillard said there’s just 10 firefighters who are active volunteers with the Bean Blossom department. Around half of the active volunteer firefighters work full time for another fire department, Dillard said—which means one third of the time those volunteers are just not available. (Full-time firefighters typically work 24 hours straight and then have 48 hours off.)

To get an idea of how much additional tax Bean Blossom landowners would have to pay, based on the Monroe County 2024 budget order, the line for Bean Blossom shows a property tax rate for fire protection of $0.0715 on an assessed value of $178,013,979—for a total fire levy of $127,280. That includes the cumulative capital fund.

The total Monroe Fire Protection District rate in the 2024 budget order, including the cumulative capital fund, stands at $0.2802, about four times the rate for Bean Blossom Township. When applied to the Bean Blossom Township total assessed value of $178,013,979, the current MCFD rate would generate $498,795. That would still fall short of covering the additional cost for MFPD to staff the Stinesville firehouse.

But because Monroe Fire Protection District’s property tax rate has to be applied uniformly across all property in the district, increasing the rate for the entire district would have the effect of distributing the cost of Bean Blossom’s fire protection across other member townships in the MFPD.

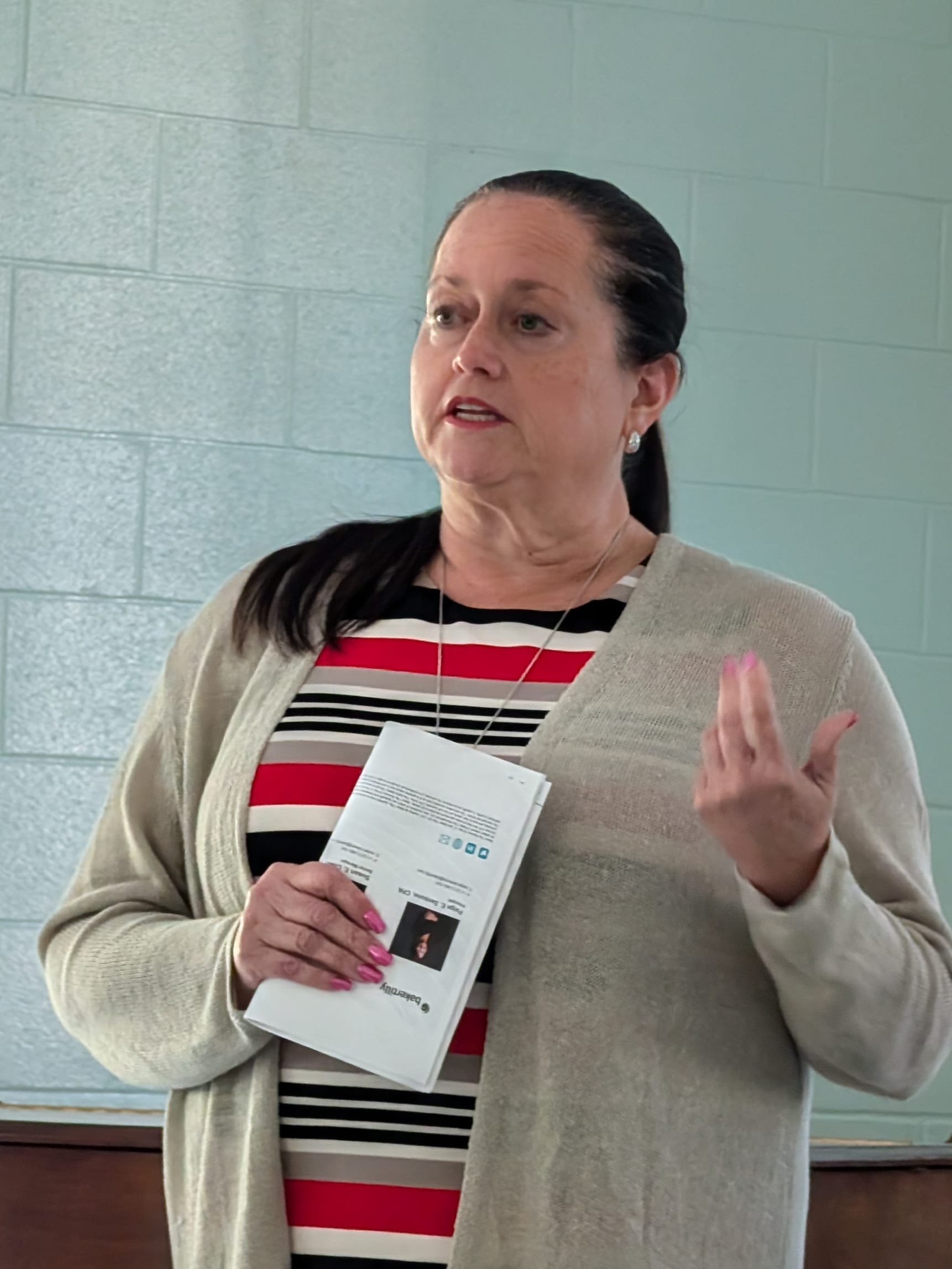

The numbers presented on Wednesday by Susan Cowen, a Baker Tilly accountant, showed that adding Bean Blossom Township to MFPD starting in 2026 would mean a uniform MFPD rate of $0.3712. That would work out to $91 more per year in taxes for the owner of a Bean Blossom house, worth $100,000, according to the Baker Tilly analysis.

But Dillard told the group that the $0.3712 figure is too high—because Baker Tilly’s analysis assumes 2026 expenditures, based on 2024 assessed value and revenues.

Dillard said at Wednesday’s meeting that $0.2833 would be the highest tax rate that Bean Blossom landowners would see, as long as he’s chief.

The proposal from Ellettsville Fire Department (EFD), which was presented to the Bean Blossom Township board at a May 11 meeting, was to contract with EFD for fire protection. EFD chief Kevin Patton attended Wednesday’s meeting to answer questions.

EFD is proposing to cover calls in Bean Blossom under a five-year contract. But that would not entail staffing the Stinesville station.

For the first three years, EFD would simply cover the calls from inside Bean Blossom at no cost to the township, according to Patton. For the fourth and fifth years of the contract, Bean Blossom would pay Ellettsville just what the township is currently paying for fire protection, from its existing fire protection levy.

For the period of the contract, Ellettsville is proposing that Bean Blossom Township would sign over all the fire trucks and equipment to EFD. That means Ellettsville would cover all maintenance, testing, and insurance for the trucks and equipment.

This is supposed to be an “in kind” payment by Bean Blossom, in lieu of additional cash payment, for the first three years of the contract. But if the contract is canceled, then according to Patton, “The apparatus and equipment would revert back to Bean Blossom…”

Just the step of contracting with EFD, even without staffing the Stinesville station, could improve response time by 6 minutes for some calls. Currently, Ellettsville responds to many calls in Bean Blossom Township.

If EFD were the primary department for Bean Blossom calls, that would eliminate what is currently a 6-minute delay. After the first alarm, if there’s no response by Bean Blossom after 3 minutes, then the alarm is sent again. Only after another 3 minutes is the alarm sent to EFD.

At Wednesday’s meeting, Bean Blossom Township’s volunteer fire chief Thomas Goodwin was pressed by the audience for his position on the issue. He told the gathering that in terms of fire protection, he wants to see the Bean Blossom station in Stinesville staffed 24/7 with two firefighters.

Goodwin explained his answer by saying, “I want to know if my family needs somebody, there’s going to be somebody.” At the same time, he said, the additional cost would not affect him in the same way it would affect all the other people in the room.

Some of the others in the room included landowners of agricultural land. As one attendee pointed out, construction of buildings needing fire protection could not even be considered in the floodplain on his agricultural land—yet that real estate is getting taxed for fire protection. One attendee estimated that the impact on his tax bill from joining the MFPD would be $4,500.

Comments ()