Push towards 2026 budget: Monroe County OKs hiring freeze, eyes local income tax revenue, cuts longevity pay, keeps 3% COLA

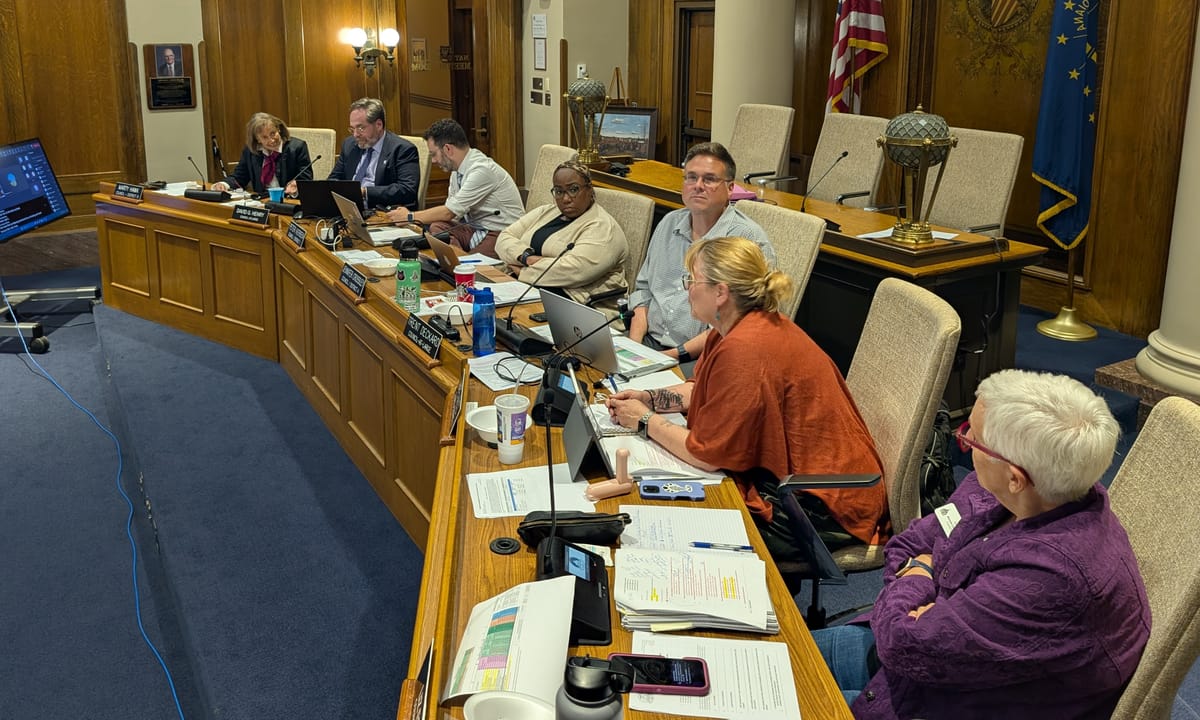

Monroe County councilors worked until around 11 p.m., on Tuesday trying to get their 2026 budget into shape for adoption on Oct. 14. The council started the night with a draft budget that calls for $127.65 million in revenue, and $132.06 million in expenses, for a deficit of $4.41 million.

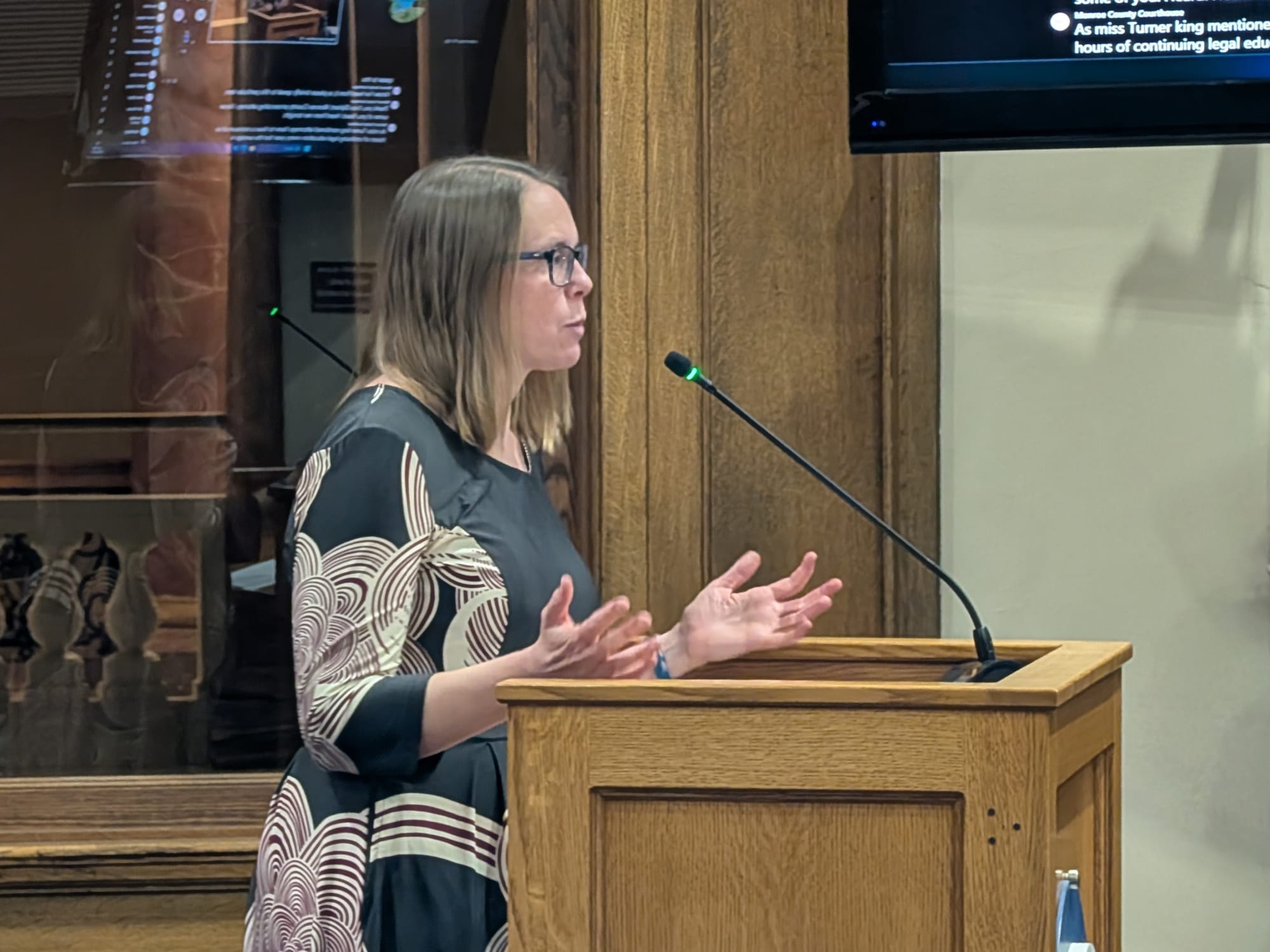

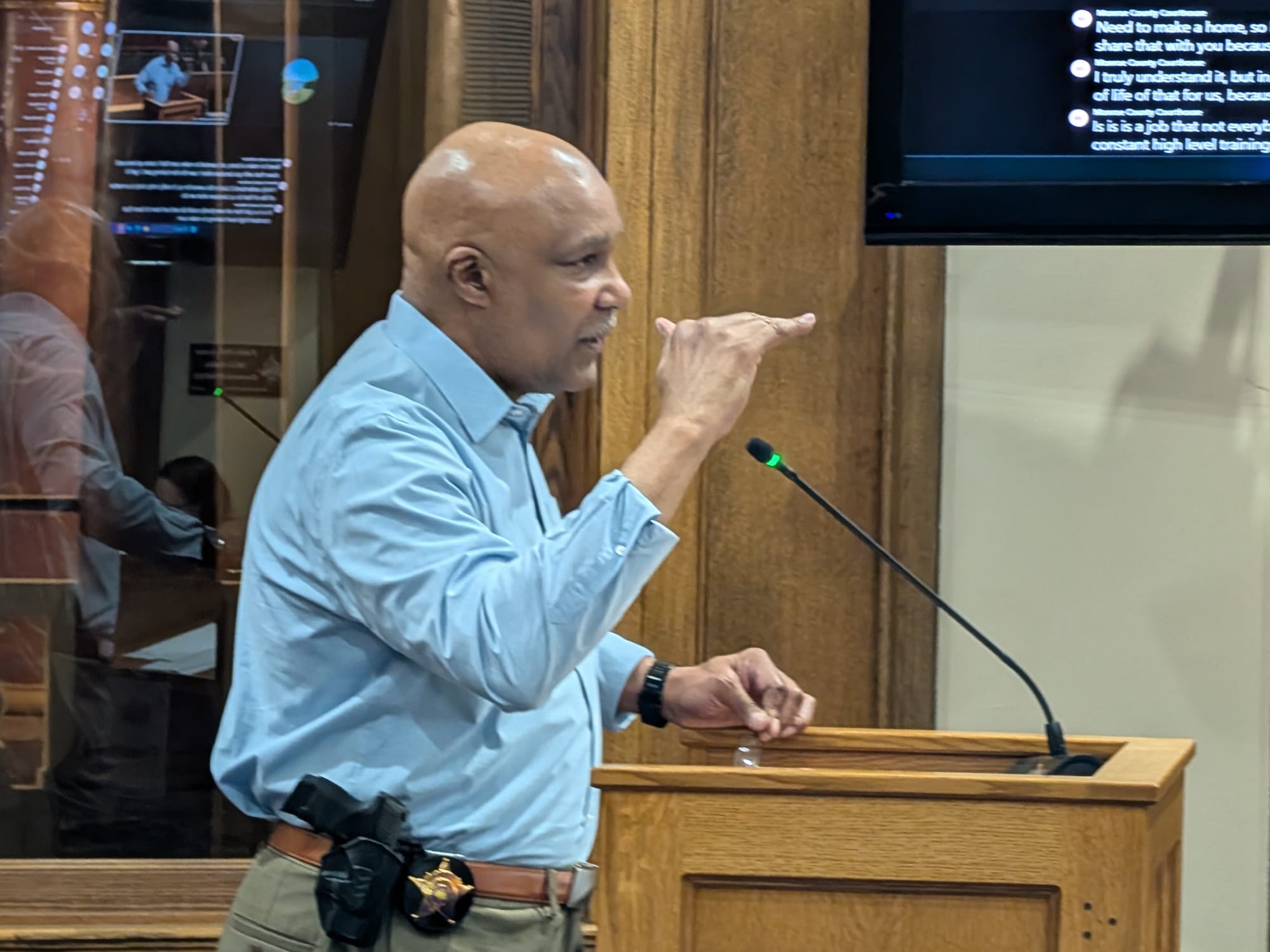

Addressing the county council about training budgets were three elected officials. From left: Erika Oliphant, Monroe County’s prosecutor; Mary Ellen Diekhoff, presiding judge of the Monroe Circuit Court; Ruben Marté, Monroe County’s sheriff. (Dave Askins, Sept. 30, 2025)

Monroe County councilors worked six hours, until around 11 p.m., on Tuesday (Sept. 30) trying to get their 2026 budget into shape for a final adoption vote on Oct. 14.

Asked after the meeting what’s left to do, council president Jennifer Crossley summed it up by saying, “A lot.”

There’s so much work left that the council has scheduled a special meeting next Wednesday, Oct. 8.

The council started the night with a draft budget that calls for $127.65 million in revenue, that has to pay for $132.06 million in expenses, for a deficit of about $4.41 million. The council voted to make several cuts, across several different categories, but the impact of those cuts won’t nearly make up for the current shortfall.

The council also passed a hiring freeze, which applies to all full- and part-time staff positions in county government, with a process in place for department heads to request exemptions. Positions that were already in the hiring process at the time of the meeting were exempted from the freeze.

On Tuesday night, the approach the council took to making cuts was to focus not on individual line items in any departmental budget, but rather to focus on types of line items across departments, like postage, supplies, services, and travel and training. Cutting postage by 5%, for example, is expected to save $8,640.

To measure the impact of Tuesday’s cuts on the deficit, the auditor’s office was waiting to do the math until the following day, instead of trying to undertake on-the-fly modifications of spreadsheets in all the places where updates would need to be made.

Among the specific items Crossley named for work in the next two weeks was defining a budget for the economic development local income tax (ED LIT), which is a revenue source that the council has up to now left untouched for the regular budget. That’s because the money has been earmarked for the planned new jail and justice center.

With a year-end balance of about $10.9 million in 2024, which has now increased to around $20 million, projected revenues through the end of 2026 would put the ED LIT fund balance at around $35.8 million.Even though “economic development” is literally part of the name of the tax, the legal constraints on the use of revenues is not tight. The final item on the list of ways the money can be spent is “any lawful purpose.”

The idea is that the impact of SEA 1 has made totally unreachable the planned $225-million funding target for the justice facility—even if all the revenue from the jail tax and the maximum allowable ED LIT amount under SEA 1 were used for bonding. If that target is unreachable, then the idea is that it makes sense to consider using ED LIT revenue to patch some holes in this year’s budget. In any event, under SEA 1, the entire LIT system changes in 2027.

Councilors are supposed to submit their suggestions to the council office for budgeting the ED LIT money by Oct. 3.

In some cases, a closer consideration of the practical realities of cuts in certain categories across all departments, led to much smaller cuts than proposed at the start of the night.

For example, the council approved a 5% reduction in training and travel lines, which is expected to save $10,088. But the original proposal was to lower every training line item in each departmental budget to $1,000 for a potential savings of around $90,000. During the discussion on reducing training and travel budgets, three elected officials addressed the council to emphasize the critical nature of training for their departments.

Mary Ellen Diekhoff, presiding judge of the Monroe Circuit Court, said, “Probation, community corrections—they have to do certified training for so many hours to be able to stay certified. … Also, judges are required to get 15 hours a year CLE [continuing legal education], and if we don’t get it, then we will be suspended from doing our jobs.”

Monroe County’s prosecutor, Erika Oliphant, specifically addressed the proposal of lowering every training line item in county government to $1,000: “The $1,000 would fund one attorney to go to one Indiana Prosecuting Attorneys Council conference and get their CLEs for the year. I have 18 deputy prosecutors. So $1,000 gets me one trained person for their minimum amount for one year.”

Ruben Marté, Monroe County’s sheriff also spoke to the council about the impact of training on recruitment, saying, “I assure you, a lot of the agencies want to come to us because of the training level and the professionalism that we have at the present time.” He added, “In this arena for us, it really, truly, truly, is a matter of life or death for us, because what we do is—it’s a job that not everybody could do.”

In another move, the council voted to eliminate longevity pay for all county employees not covered by negotiated collective bargaining contracts. The savings was estimated at $341,102 across all funds.

Weighing in remotely from the public mic was former county councilor Geoff McKim, who pointed out that cutting longevity pay was literally cutting salaries. McKim said, “I really feel like you’re doing this in the wrong order. Why are you talking about cutting people’s salaries … before you even discuss cutting the growth of salaries, i.e. the COLA.”

McKim’s recommendation was: “At this point, you could really cut the COLA, pass the hiring freeze, establish an ED LIT budget, and call it a day.” McKim says it’s conceivable that cutting the longevity pay of an employee, would mean, even with the COLA, that the employee will make less in 2026 than they’re making in 2025.

The council did not heed the advice of their former colleague, voting 4–3 to maintain the planned 3% cost-of-living adjustment (COLA) for county employees. The cost of the COLA was reported as $2,477,169 across all funds. The city of Bloomington’s COLA this year is 2.7%, and some councilors felt that dialing the Monroe County COLA down to 2.7% from 3% would be appropriate.

Councilors in favor of maintaining the 3% COLA pointed to a letter that was sent to department heads earlier in the year, which indicated that a 3% COLA was included in the proposed salary grids. That left the impression that the council would be working to make that happen and councilors wanted to meet the expectation of the 3% COLA set by the letter.

Voting for maintaining the 3% COLA were Peter Iversen, Jennifer Crossley, Liz Feitl, and Trent Deckard. Voting to consider reducing the COLA from 3% COLA were: Kate Wiltz, Marty Hawk, and David Henry.

The special county council meeting is for next Wednesday (Oct. 8) at 5 p.m. in the Nat U. Hill Room of the historic county courthouse. The final budget adoption meeting is scheduled for Tuesday, Oct. 14.

Comments ()