SB 1 allows higher rates for local income tax, gives cities power to tax only their own residents

At a panel discussion hosted by the city of Bloomington on Wednesday, local leaders gave an initial response to SB 1, a local tax bill that has now been signed into law by Indiana governor Mike Braun. The event was recorded by CATS.

The bill covers property taxes as well as local income tax (LIT). SB 1 reduces property taxes, but gives local units a little bit more flexibility on local income taxes—starting in 2028. It sets up the possibility that local governments will try to make up for the lost revenue from property taxes by imposing income taxes at a higher rate.

According to the fiscal analysis from the Legislative Services Agency, over the next three years, the total impact in property tax revenue for all local government units in Monroe County, compared to the baseline of no change to the law, will be: -$9,851,000 (2026); -$11,814,000 (2027); and -$15,471,000 (2028).

Panelists on Wednesday included: Jen Pearl (Bloomington Economic Development Corporation); Hopi Stosberg (Bloomington city councilmember); Peter Iversen (Monroe County councilor); Kerry Thomson (Bloomington mayor); Eric Reedy (Reedy Financial Group); Jody Madeira (Monroe County commissioner); Alexis Harmon (MCCSC assistant superintendent); and Talisha Coppock (Downtown Bloomington, Inc.)

On the topic of raising local income taxes, Bloomington mayor Kerry Thomson signaled that it could be a possibility: "Does it mean that we absolutely are asking for a new LIT? The answer is: We really need to carefully look at this, but we cannot do more with less." Thomson continued: "I can tell you that my administration has been laser focused on making sure that we are running a really efficient government, and so if we have less, we won't be able to do as much, and that is very clear to me."

Spoonmore and Pearl cautioned against increasing the LIT rate. Pearl said that local income taxes make it harder to compete for talented workers. Spoonmore said, "I think the knee jerk reaction sometimes that communities may have is to just say: Look, we've got the ability to raise taxes—Let's do it." Spoonmore added, "But I would challenge our leaders to think much more strategically…and much more collaboratively—city, county, school, corporations, libraries, etc."

Both Spoonmore and Pearl pointed out that in the state of Indiana, local income tax revenue goes to the place where the worker lives, not where the job is. Spoonmore put the idea of imposing additional local income taxes in the context of population shifts.

The results of the 2020 census for Bloomington showed a drop from 2010, when 80,405 Bloomington residents were counted, to 79,168. But the numbers were impacted by the COVID-19 pandemic, which resulted in clear undercounting of college students in Bloomington.

So, immediately after the 2020 census numbers were released, the expectation from many observers was that the ACS (American Community Survey) estimates starting in 2021 would show an increasing trend from the baseline of about 79,000. But that's not what the ACS numbers show. The most recent ACS estimates indicate that Bloomington is losing population. Here's the ACS trend: 78,988 (2021), 77,358 (2022) and 74,028 (2023).

Spoonmore expressed concern about the population decrease that the area is experiencing. "For the first time in our history, we're losing population, particularly population of working-age people that will pay local income taxes."

Spoonmore continued: "In the latest Indiana Business Research Center's analysis, which was just released a couple of months ago, Monroe County ranked dead last in population growth. We were negative. We lost more population than any other place in Indiana." Spoonmore added, "So that's not something to really be proud of, and if we raise income taxes, it's not really going to help us out a lot."

SB 1 increases the total LIT rate that can be imposed in a county—from 2.5% to 2.9%. SB 1 also for the first time allows the LIT revenue to be divided among government units, based directly on where the taxpayers live inside a county. Currently, the income tax is collected for the geographic area of a county and distributed to the government units based on either property tax footprint, or population.

For example, the 0.69% economic development local income tax (ED LIT), which was enacted countywide by Bloomington's city council in 2022, is distributed to Bloomington, Ellettsville, and Stinesville, and Monroe County government based on population. That assumes that the per capita income in each of the three municipalities, and the unincorporated areas of the county, is the same. That's almost certainly not the case, but up to now it has been one of the best objective approximations of the actual income tax paid by residents of those jurisdictions.

It's now possible for Indiana's Department of Revenue to tease apart LIT revenue by jurisdiction, which means it's technically possible for a city council to impose an income tax just on residents of a city. From SB 1: "the fiscal body of a municipality may… impose a local income tax rate on the adjusted gross income of local taxpayers in the municipality that does not exceed…1.2%."

It has historically been a sore point for non-city residents that for the Bloomington city council to increase the LIT for Bloomington residents, that increase extended to all Monroe County residents.

One measure of the complexity and freshness of the provisions in SB 1 was an apparent misstatement by Bloomington mayor Kerry Thomson on Wednesday, about who is in control of the city's LIT rate. Thomson said, "[Under SB 1] the city's LIT in this bill is now approved by the county. The city no longer has control over that." In fact, Bloomington will have complete control over the basic 1.2% that the city is allowed to impose on just its residents.

Here's how the new LIT categorical scheme breaks down, based on a table from Financial Services Group, presented to the Monroe County council's long term finance committee on Thursday.

Thomson's statement on Wednesday was correct in the context of fire protection. Under the new scheme for LIT that is set forth by SB 1, there is no longer a category for public safety, out of which the Monroe County government and Bloomington have been funding their joint 911 dispatch center. Instead, there is a category for fire protection and EMS. Under SB 1, it's the county council that will have authority to set the LIT rate for fire protection. The maximum rate that can be set for fire protection and EMS is 0.4%.

The new fire protection LIT category relies on a distribution formula that includes Bloomington's fire department. Once the rate for fire protection LIT is set by the county council, the revenue will get distributed to each fire protection service in the county, not based on where the taxpayer lives, but rather through a formula that includes geographic area and population of the fire protection service area.

Monroe Fire Protection District (MFPD) chief Dustin Dillard has been working through some tentative numbers to estimate what rate would be needed in the new scheme, to match the current level of LIT funding that the MFPD receives. The numbers are tentative and rely on various assumptions, like the idea that the geographic area served by MFPD for formula purposes should also include the townships that MFPD serves under a contract.

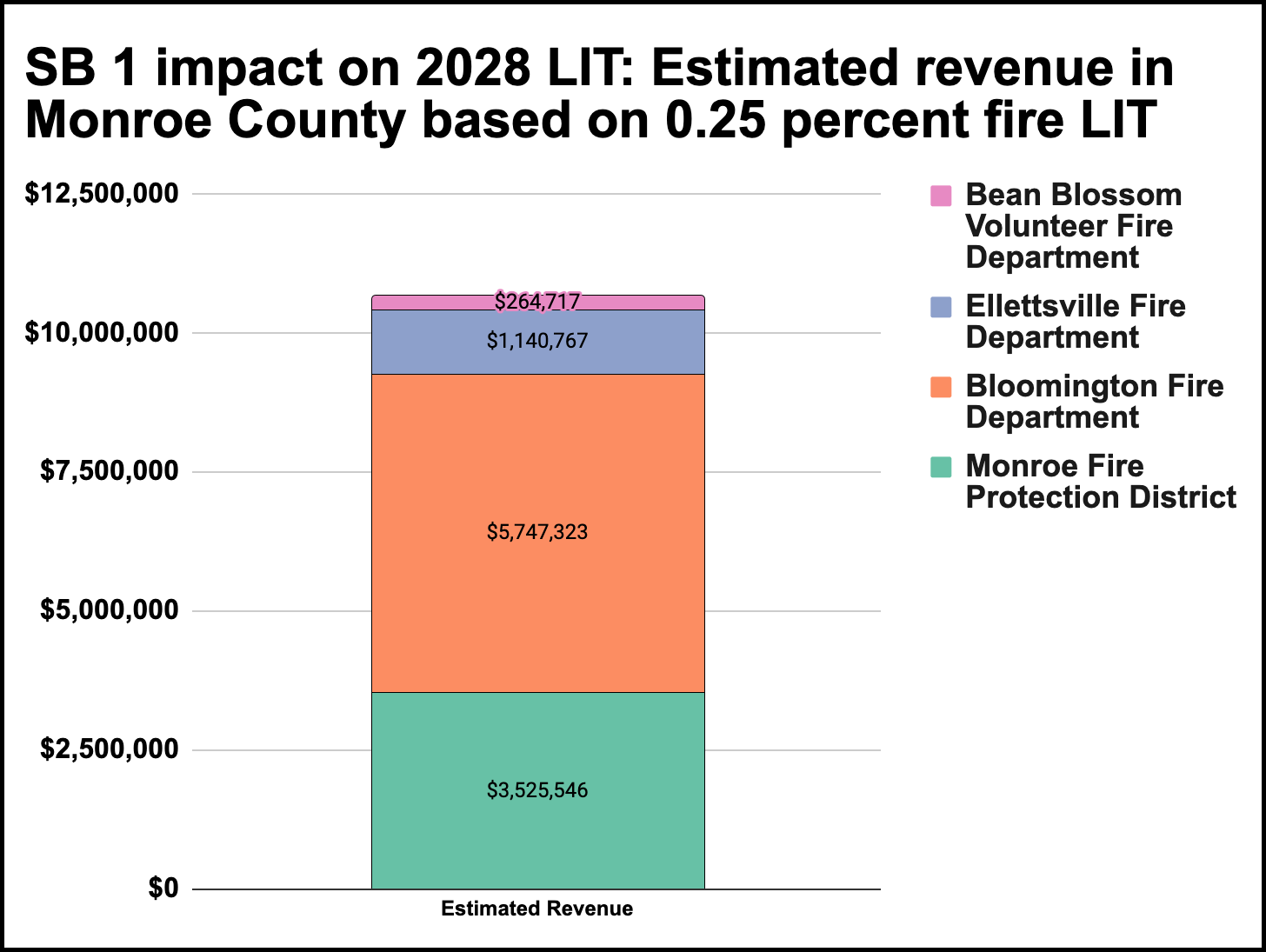

Based on the population-area formula in SB 1, the relative share of the total fire protection LIT revenue would break down like this, based on Dillard's calculations:

- Monroe Fire Protection District: 33.02%

- Bloomington Fire Department: 53.82%

- Ellettsville Fire Department: 10.68%

- Bean Blossom Volunteer Fire Department: 2.48%

Based on 2024 figures, a 0.25 fire protection LIT rate would generate an estimated $10.67 million. Based on the relative numbers, the distribution would break down like this:

- Bean Blossom Volunteer Fire Department: $264,717.24

- Monroe Fire Protection District: $3,525,545.75

- Bloomington Fire Department: $5,747,323.01

- Ellettsville Fire Department: $1,140,766.75

The $3.5 million for MFPD would be in the ballpark of the $3.8 million that the district received in LIT revenue in 2024 through the current certified shares distribution, which is based on property tax footprint.

That leaves 0.15 points of "room" between 0.25% and the maximum of 0.40% for the fire protection LIT. Could that be used to fund a joint dispatch center? At Thursday's meeting of the county council's long term finance committee, county attorney Jeff Cockerill said he didn't think there is legal latitude to cover central dispatch from the new fire and EMS LIT category. That means Bloomington and Monroe County government will need to sort through how the joint dispatch center will be funded starting in 2028. A Bloomington resident could object to any city LIT revenue going towards the dispatch center, a countywide service, based on the idea that a city resident is already contributing to the county LIT revenue, as a resident of Monroe County.

Under the new LIT scheme established by SB 1, the challenge, at least initially, will likely be framed as finding a way to match current levels of funding to rates in the new scheme. For Monroe County government, to match just the LIT revenue that Monroe County currently receives, Greg Guerrettaz with Financial Solutions Group (FSG) said on Thursday that the rate would need to be about 1.0%—which would still give the county government 0.2 points to spare, up to the 1.2% maximum rate.

Comments ()