Short term rentals boost innkeeper’s tax revenue, Bloomington mulls impact on housing supply

The impact of short-term rentals in Bloomington came up as a topic in two separate public meetings on Monday, and could factor into more conversations among public officials before the end of the year.

Short term rentals (STRs) are the kind of accommodations provided by companies like Airbnb and Vrbo.

At its regular noon meeting, Monroe County’s convention and visitors commission (CVC), reviewed revenues from the five-percent innkeeper’s tax that’s collected by all lodging establishments, including STRs.

Both the raw dollar amounts of STR innkeeper’s tax receipts, and the percentage of STR revenue as a fraction of the total, show an increasing trend.

Through July of this year, STRs account for 27 percent of the $2.13 million that has been collected from the innkeeper’s tax.

Later Monday evening, the topic of STRs came up at the “traveling town hall” at Binford Elementary School, which was hosted by Bloomington mayor Kerry Thomson, along with District 4 councilmember Dave Rollo.

Thomson reacted to Rollo’s inclination to regulate STRs by saying, “There’s probably a limited amount that we can do about controlling [STRs], but we can regulate some.”

Thomson noted that not all of the houses that are listed as STRs are used exclusively for that purpose—some are people’s homes that they rent out on a weekend to help them afford to live in Bloomington.

“I certainly don’t have an interest in limiting people’s ability to help themselves live in Bloomington,” Thomson said.

Regulating short term rentals?

In the last week of August, during departmental budget hearings, councilmember Dave Rollo had established his interest in regulating short term rentals (STRs), based on the idea that they erode housing supply.

At the August hearings, Rollo pointed out that the cities of Lafayette and West Lafayette recently both recently passed an ordinance to restrict STRs.

The wording of the ordinance approved by West Lafayette’s city council in early July refers to STRs as “transient guest houses.”

From the West Lafayette ordinance:

In the City of West Lafayette, transient guest houses are not permitted either by right or by special exception in the following single-family zones: R1, R1A, R1B and R1U.

Rollo asked HAND (housing and neighborhood development) director Anna Killion-Hanson at the Aug. 28 hearing: “How do we protect our housing stock?”

Rollo added to his question: “We could [restrict STRs], it seems to me, to relieve some housing pressure. What say you?”

Killion-Hanson replied: “I agree.” She added, “I actually believe that I’ll be back in front of you this fall, with something very similar.”

But based on a B Square interview with Bloomington mayor Kerry Thomson this week, what Killion-Hanson puts in front of the council will not likely be an ordinance that changes Bloomington’s unified development ordinance (UDO) along exactly the lines that West Lafayette did.

Thomson told The B Square: “The state legislature is going to prevent us from doing too much. We can ask [STRs] to register, and that’ll do something.”

Thomson said it’s not clear what the city can actually regulate when it comes to STRs, but said, “What we know we can do is get them to register.” She added that initial discussions have started, but she sees no reason not to require registration.

It’s not clear that such a registration requirement would have to be incorporated into the UDO. It might be possible for a requirement that STRs register with the city to be included in the city’s rental code, Thomson said.

[Updated 8:15 p.m. on Sept. 10, 2024. Killion-Hanson confirmed in an email that the HAND department has “requested airbnb legislation.” Her message continues: “Our legal team is thoroughly evaluating the airbnb legislation that West Lafayette passed. It is still not clear that the state will allow such an ordinance. That being said, we are looking at what we can and can’t do and hope to have something put together soon.”]

The figure that Killion-Hanson gave Rollo, of around 800 STRs in Bloomington, squares up roughly with the 859 that are indicated on AirDNA, which is a platform that provides data and analytics for short-term rental market.

According to Killion-Hanson, 80 percent of Bloomington’s STRs are whole houses. About the 800 STRs in Bloomington, Killion-Hanson said, “That’s a pretty significant number.”

STR impact on innkeeper’s tax receipts

The number of STRs in Bloomington gives a significant boost to innkeeper’s tax receipts, which are used to fund Monroe Convention Center operations.

That’s because STRs are also subject to the innkeeper’s tax. The innkeeper’s tax means that all lodging establishments in Monroe County are supposed to collect a surcharge of 5 percent.

Monroe County’s convention and visitor’s commission, which oversees expenditures of the innkeeper’s tax, includes the total receipts in its meeting information packets. The receipts from STRs are available from the Indiana Department of Revenue’s website.

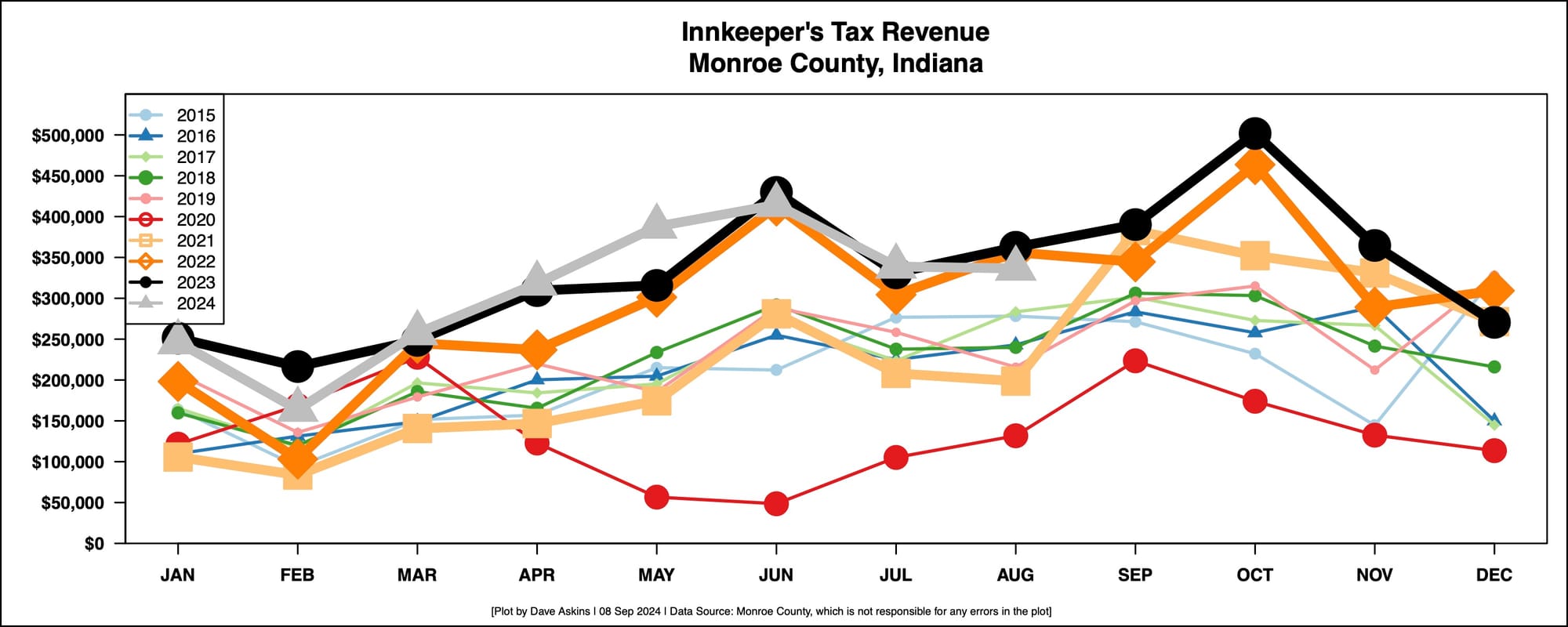

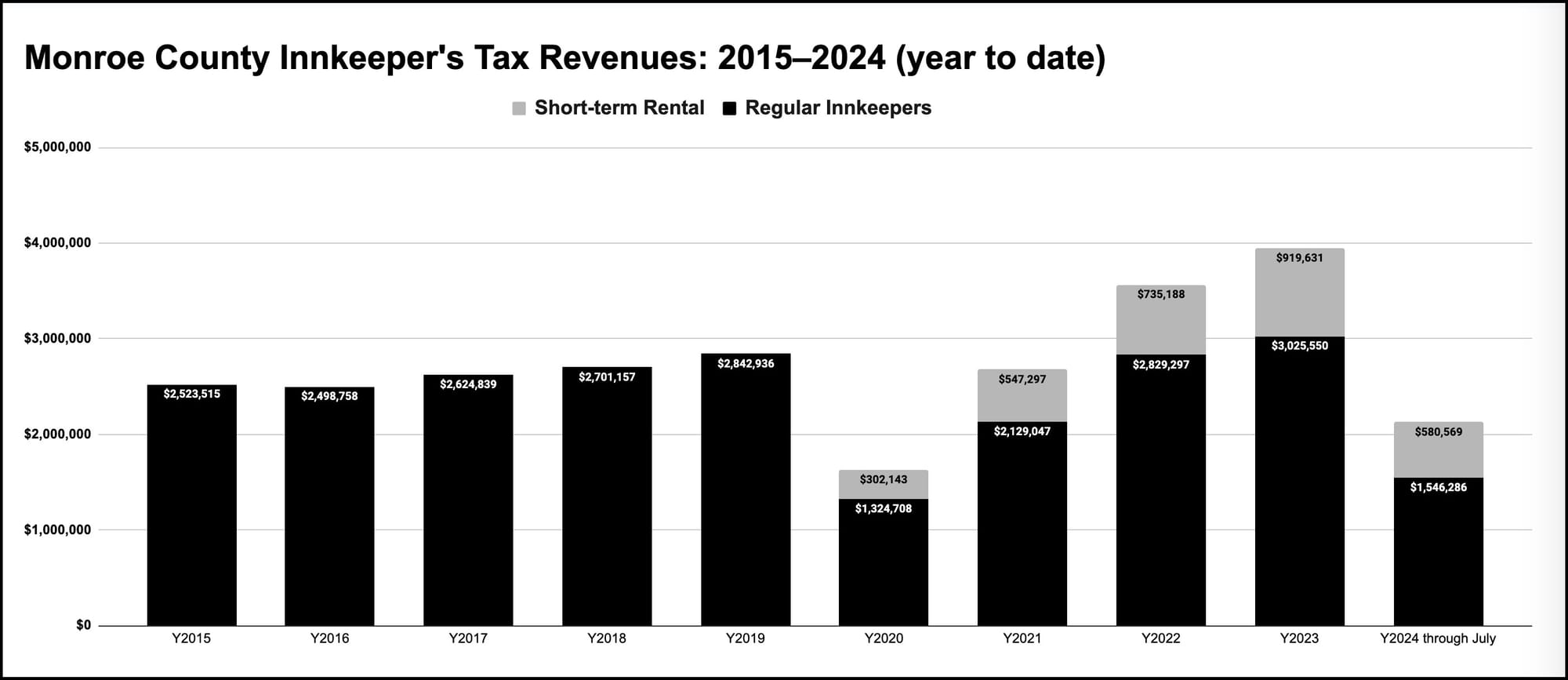

In 2023, just under $4 million worth of innkeeper’s tax was collected in Monroe County. Based on year-to-date revenue, 2024 looks on pace to hit about that same total. Coming out of the COVID-19 pandemic, revenue was significantly less than that—$1.6 million in 2020.

In 2020, STRs accounted for 18.5 percent of innkeeper’s tax revenues. That fraction has grown steadily each year. For 2024, through July, STRs account for about 27 percent of innkeeper’s tax revenues.

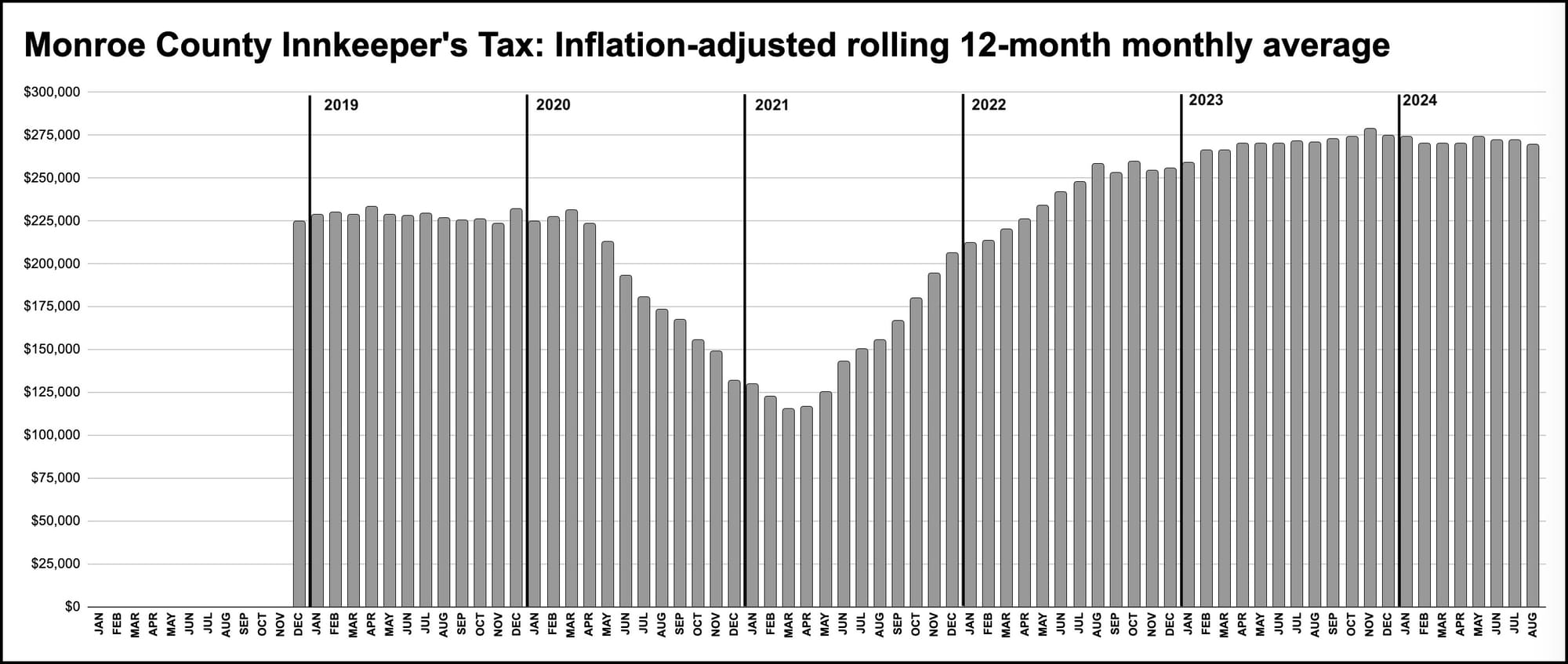

Based on 2018 dollars, the rolling 12-month monthly average revenue in 2019, the year before the pandemic, was stable at around $230,000 per month.

After the pandemic, in 2018 inflation-adjusted dollars, the rolling 12-month monthly for 2023 had settled in at around $270,000 per month—$40,000 higher than pre-pandemic numbers.

It looks like a big part of the post-pandemic rebound and increase in innkeeper’s tax revenue can be chalked up to revenues from STRs.

At Wednesday’s meeting of Monroe County’s convention and visitor’s commission, Mike McAfee, who’s executive director of Visit Bloomington pointed to other markets across the state where STRs are gaining market share. Specific examples from McAfee included South Bend and Hamilton County.

To illustrate how that’s impacting the local numbers, McAfee pointed to “room nights” in hotels as a metric. The last two years have set records for the number of hotel “room nights.” McAfee said—in 2023 there were a little over 680,000 hotel “room nights.”

But so far this year, McAfee reported, hotels are down about 25,000 “room nights” compared to last year. But STRs are up by about 30,000 “room nights.” The revenue from STRs has kept this year’s revenue numbers on pace with last year’s.

Comments ()