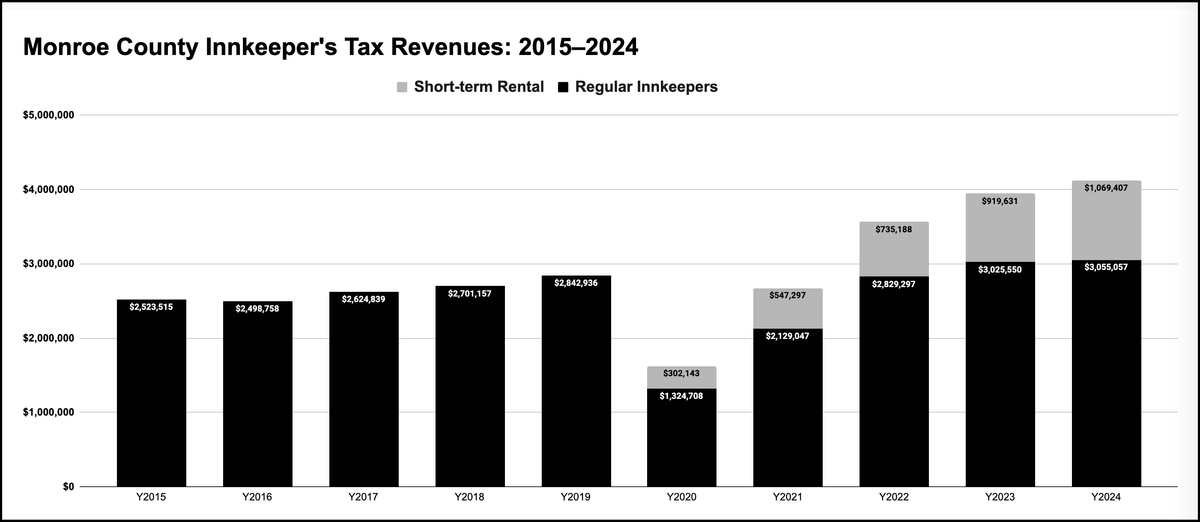

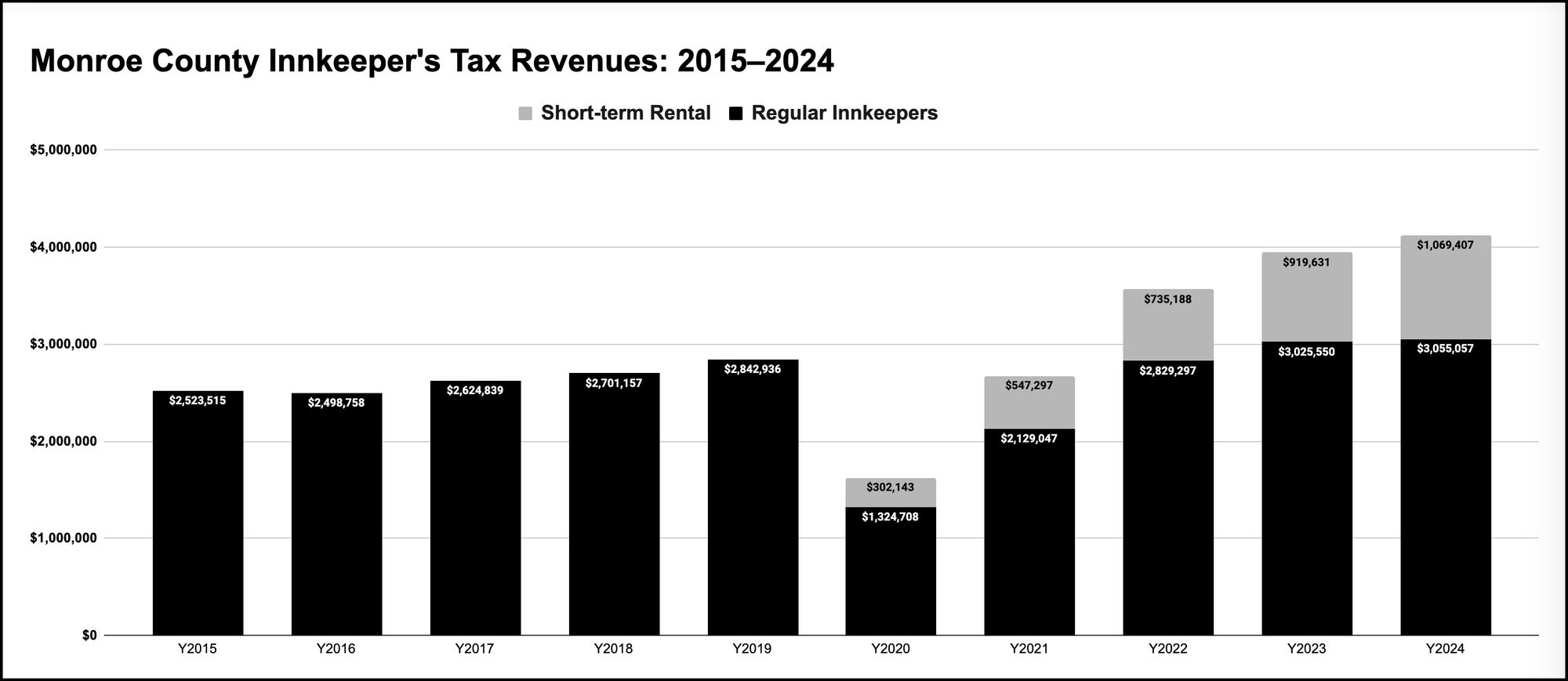

Short term rentals making up bigger share of Monroe County innkeeper's tax revenue

The continued stable performance of Monroe County’s overall lodging industry is becoming increasingly reliant on STRs (short term rentals).

That’s the picture that was already coming into focus in fall 2024, and was confirmed at Monday’s meeting of Monroe County’s convention and visitors commission (CVC).

Short term rentals (STRs) are the kind of accommodations provided by companies like Airbnb and Vrbo.

The state of the county’s lodging industry can be measured at least to some extent by revenues from the county’s 5% innkeeper’s tax, which is added to all the bills for hotels, motels, inns, and STRs.

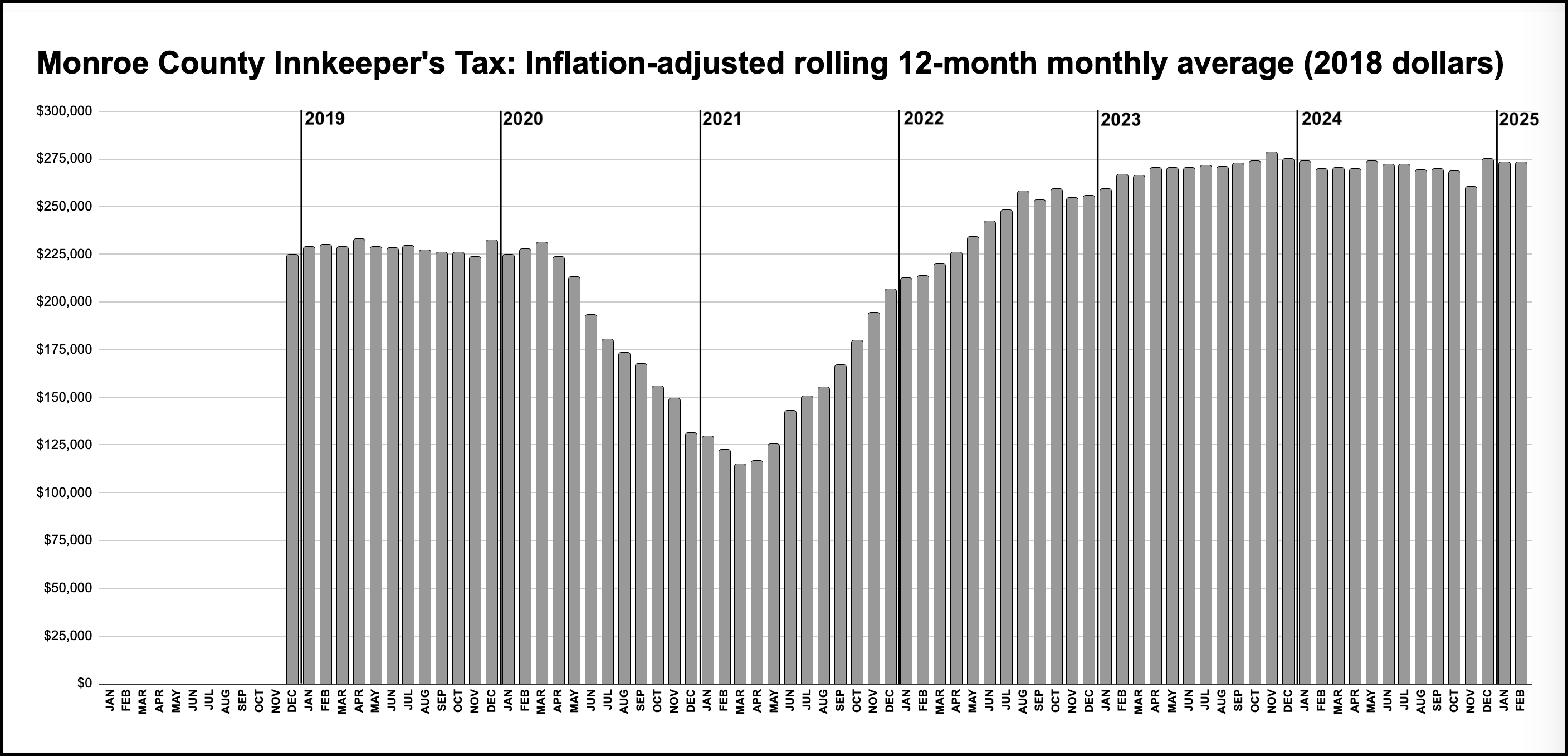

Based on 2018 dollars, the rolling 12-month monthly average revenue in 2019, the year before the pandemic, was stable at around $230,000 per month. After the pandemic, in 2018 inflation-adjusted dollars, the rolling 12-month monthly for 2023 had settled in at around $270,000 per month—$40,000 higher than pre-pandemic numbers. Monthly revenue continues to track at about that same level.

For the first two months of 2025, the overall figure for innkeeper’s tax revenue in Monroe County was $396,671—which is about 3% lower than the $410,063 that was collected in the first two months of 2024.

CVC chair Mike Campbell, who serves on the five-member group in his capacity as the director of Indiana University Hospitality, did not appear alarmed by the lower numbers so far this year. Campbell said, “We're running just a little bit behind where we were at this point last year, although very close, within just a couple of percentage points.” He noted that the raw dollar amount difference was just around $12,000.

The portion of innkeeper tax revenues that comes from STRs is growing.

The numbers for Monroe County from the Indiana Department of Revenue show an increase of about 1.2% for STR innkeeper’s tax collections (from $116,930 to $118,400) for January and February this year, compared to the first two months of 2024. That contrasts with the 3% overall drop.

For the first two months of the year, STRs made up almost 30% of all innkeeper’s tax revenue in Monroe County. It’s a fraction that continues to grow. In 2020, revenue from STRs made up about 18.6% of Monroe County’s innkeeper’s tax. By 2023, the fraction had climbed to about 23.3%. Last year it was 25.9%.

That fraction could go down in the next couple years, because the hotel inventory in Bloomington is expected to increase, due to at least three projects. The hotel under construction at the former Peoples Bank building on Kirkwood Avenue will offer 47 rooms. The Alluinn IU Trades District Hotel, with a land deal that is in the works, will offer 150 beds.

And the hotel that gets constructed to support the expansion of the Bloomington Convention Center is supposed to have at least 200 rooms.

The tentative date for the groundbreaking of convention center expansion was reported at Monday’s CVC meeting as June 1. That would put the hotel project behind the schedule of the convention center expansion.

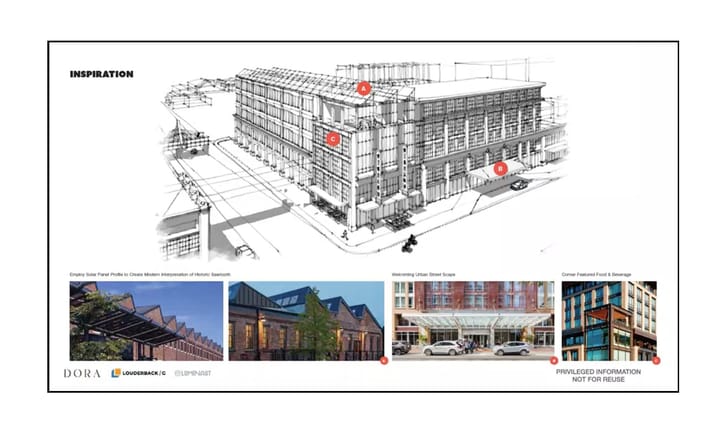

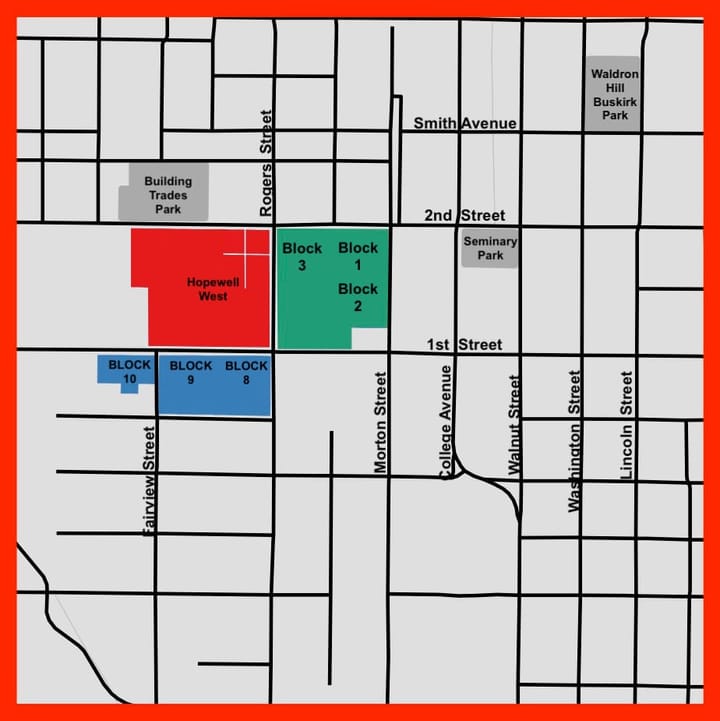

There has not been significant news on the convention center hotel front, since October 2024, when the Monroe County capital improvement board (CIB) named Dora Hospitality as its preferred developer. Dora is eyeing the former Bunger and Robertson property north of the existing convention center as a location for the hotel. But that’s a piece of real estate that is owned by the city’s redevelopment commission (RDC).

On the Wednesday (March 26) meeting agenda for the CIB is an update on the hotel situation from Bloomington’s economic and sustainable development director, Jane Kupersmith.

Comments ()