Simtra gets initial OK for dual ‘augmented’ tax breaks at Bloomington manufacturing locations, contingent on creation of jobs

Simtra BioPharma has been given initial approval of tax abatements for two manufacturing locations where it is making investments totaling close to a half billion dollars. At its regular meeting on Tuesday, Monroe County’s council gave its approval. The county commissioners will vote on Thursday.

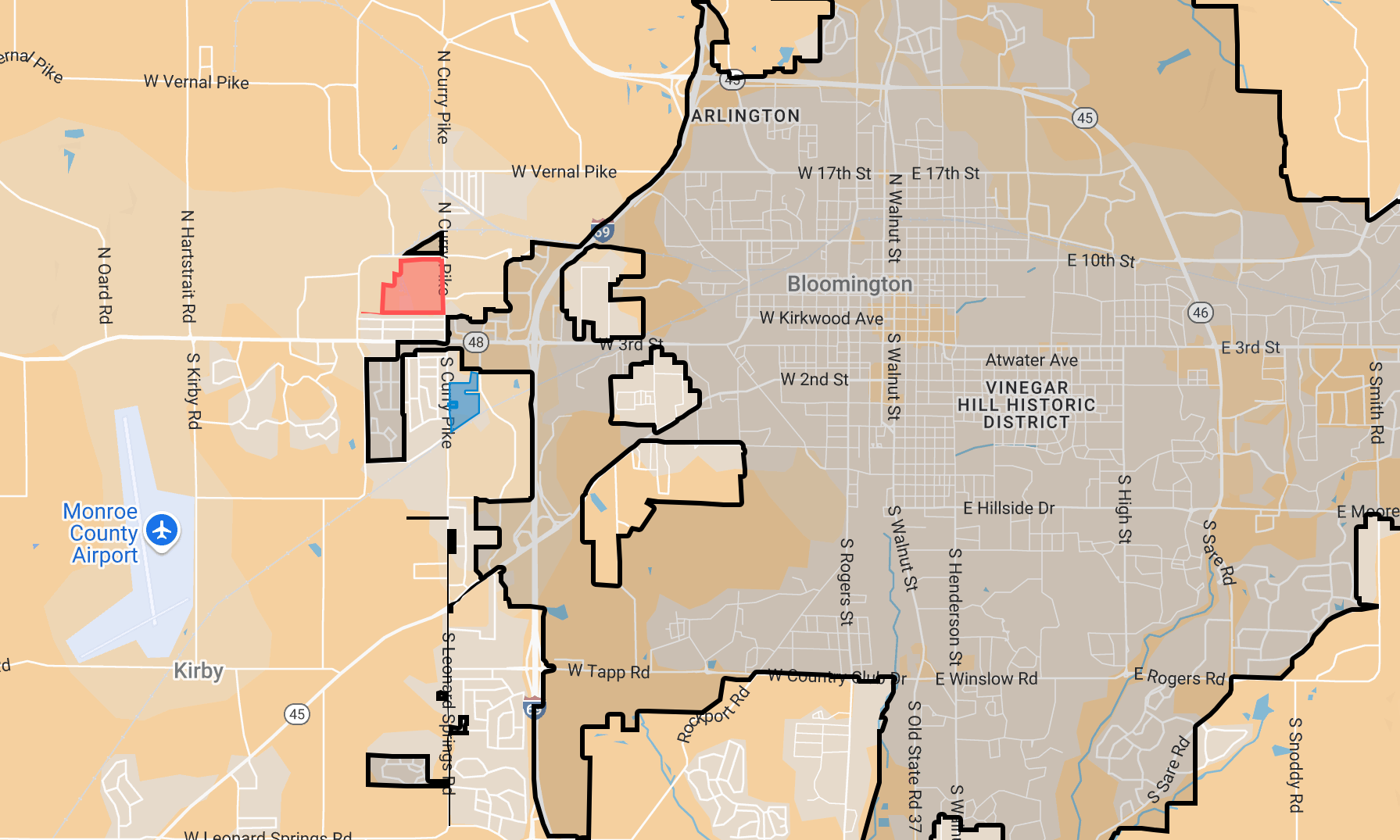

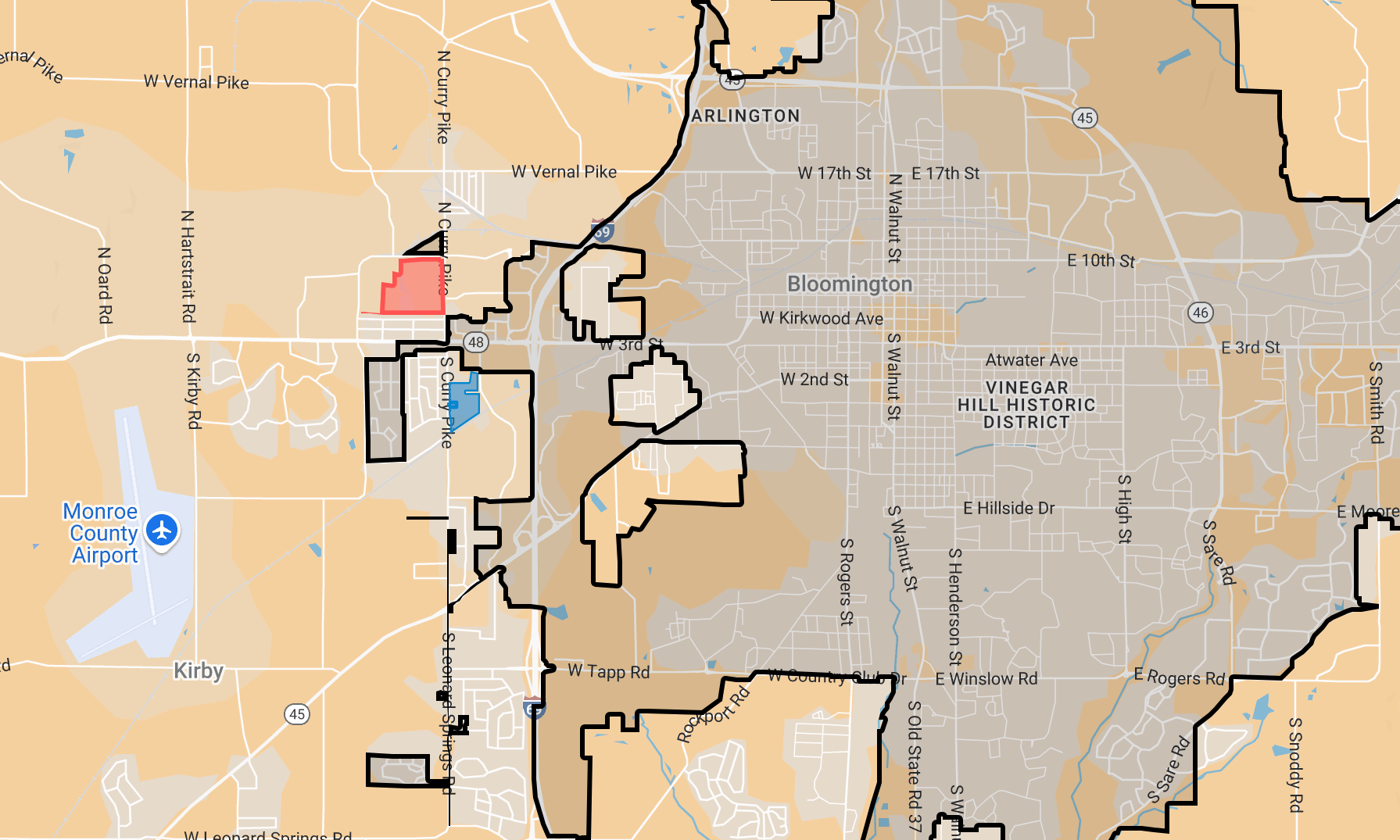

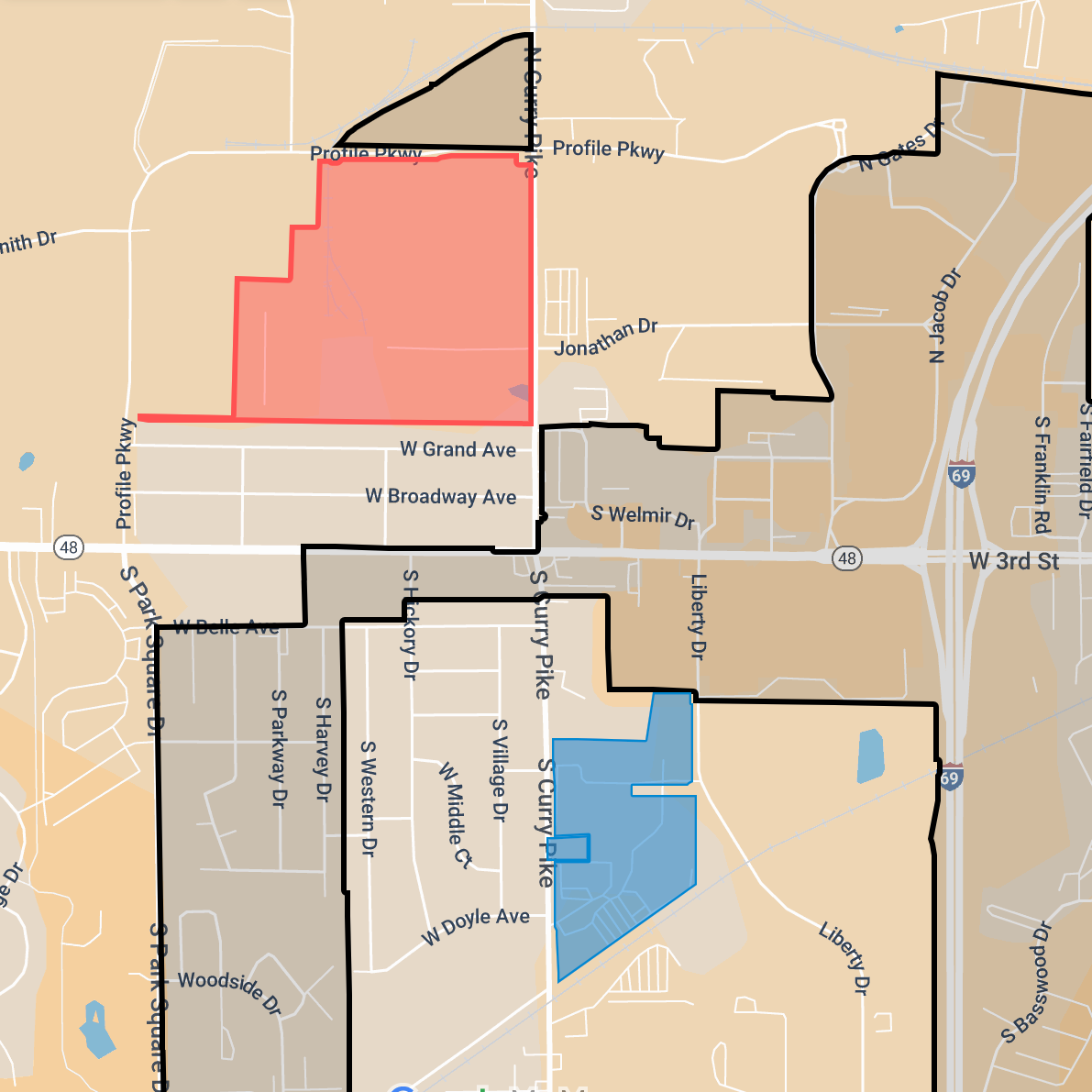

Maps by The B Square with parcel information from Monroe County. Shaded red is the parcel that was purchased from Cook by Simtra BioPharma Solutions. Shaded blue is Simtra's existing facility.

Simtra BioPharma has been given initial approval of tax abatements for two manufacturing locations just west of Bloomington, where the pharmaceutical firm is making investments totaling close to a half billion dollars. At its regular meeting on Tuesday (Aug. 26), Monroe County’s council gave unanimous approval to the abatements. The county commissioners will take a vote on Thursday.

One of the tax abatements is new—in connection with a $241-million capital investment at the long-vacant former GE site, which Simtra recently purchased from Cook Group for $45 million. The company plans to use the location for manufacturing lines that produce oncology-focused injectable drug products.

The other tax abatement is a revision to one that was awarded last year by the Monroe County council for a location on Curry Pike, the same road as the newly-purchased site, but south of 3rd Street. For that project, Simtra is investing $250 million.

Simtra currently has 1,259 full-time employees. Of those, 684 (about half) are Monroe County residents. Under the terms of the new tax abatement, Simtra has to bring its planned new “Project Park” facility at the former GE site online by the end of 2029. Adding a manufacturing line would entail adding 100 jobs at an average wage of $70,000.

The additional jobs drew comment from county council president Jennifer Crossley, who said, “I do appreciate the fact the jobs are coming in.” But she added that the county has a lack of affordable housing for such workers. She indicated that there are many people who are responsible for ensuring an adequate affordable housing supply, including county commissioners. (County commissioners have the final say over zoning regulations.) Crossley added, “I will watch on Thursday when this goes to the commissioners for final approval.”

Because the new tax abatement is located in a TIF (tax increment finance) district, it has to get approval from the board of county commissioners. It is supposed to appear on this Thursday’s meeting agenda for the commissioners.

The abatements approved by the county council on Tuesday have a scheme that is far more lucrative for the company than a standard abatement schedule. A standard abatement schedule typically starts at 100% in year one, then steps down by 10% each year until expiring after year 10. That’s the kind of abatement that was awarded in late February 2024 for the company’s “Project Greenlight Plus” at 927 S. Curry Pike, now under-construction.

But the approval given by the county council on Tuesday amends the earlier abatement to match the new one that it approved for the second site that Simtra recently purchased—“Project Park.”

Both abatements will now follow a schedule that starts at 100% in year one and continues at the 100% level for the next two years. In year four, the abatement is reduced to 90% where it remains until the end of the 10 years. The approach has been dubbed an “augmented abatement” by Monroe County and Simtra.

Estimating the dollar value of the tax abatement to Simtra

The $241 million that Simtra is putting into the new site breaks down like this: site purchase ($45 million); additional renovation ($16 million); machinery and equipment ($180 million). The machinery and equipment is taxed as “personal property.”

Using the Hoosier Energy online tax abatement calculator, under the scheme approved by the county council (3 years at 100% and 7 years at 90%) a 10-year abatement on $180 million of personal property can be estimated to have a dollar value of about $9.4 million.

The current assessed value of the land is ($5,370,000) and the existing buildings ($5,341,900) total about $10.7 million. The amount of the assessed value to be abated would be any increase in the assessed value due to Simtra’s investment—which could be estimated at around the $16 million that Simtra says it wants to put into the property. Based on the Hoosier Energy online calculator, the dollar value of the abatement of real property taxes would be around $2.37 million over the 10 years.

“Precedent-setting” fee payment

One feature of the tax abatement, which has not been seen before in Monroe County, is a requirement that Simtra pays Monroe County a fee of up to $40,000 that has to be passed through to the Bloomington Economic Development Corporation (BEDC). The provision of the memorandum of understanding (MOU) covering the fee notes that it relies on a provision of state law that allows such an arrangement. The wording of the MOU defines the fee amount as “the lesser of 5% of the amount of the abatement or $40,000 …”

The BEDC issued a news release on Tuesday about the abatement, quoting BEDC president Jennifer Pearl: “This project represents more than a facility expansion—it is an opportunity to redevelop an underutilized industrial site and transform it into a long-term asset for our community.”

At Tuesday’s meeting, councilor David Henry made a motion to strike the fee provision of the MOU, but his motion died for the lack of a second.

After the meeting, Henry told The B Square that he had nothing against the BEDC. Rather he had made the motion, because he felt that it warranted more discussion, given that the BEDC would be getting “a $40,000 annual passthrough without any oversight.” He added that while the county government does give money to organizations, those organizations typically present an annual report about what they have done with the money.

Councilor reaction

Henry’s concern about the lack of any conversation did not derail his enthusiasm for the abatement. He led off by saying, “This is exciting. I’m very much looking forward to supporting the overall abatement.”

Councilor Marty Hawk, representing the district where the project is located, emphasized the importance of job creation: “We’re really looking forward to seeing jobs created there. We need that. And this community supports jobs. And it’s very important to me that you’ve met your commitments in the past with the number of jobs you committed to.”

Councilor Peter Iversen highlighted the site’s potential, having toured it himself, and the significance of the company’s move into oncology: “This presentation doesn’t even do justice to the amount of space and just the potential this site has, to do a lot of what you all are planning on doing ... And I’m also really excited to hear the talk about branching out into the oncology sector.”

Councilor Trent Deckard reflected on the site’s history, saying that he liked the idea that the site was once a GE plant that the community had fought to convert to something else, especially when it is something that helps fight cancer.

Councilor Kate Wiltz said she’s excited to see Monroe County developing its biotechnology sector, saying that it’s what’s driving a lot of the county’s quality of life.

Comments ()