Tax abatement for affordable housing project next to new park to be weighed by Bloomington city council

By December 2022, Bloomington is expecting to see completed construction of Retreat at the Switchyard, a new housing project with 48 apartments designated as affordable.

The project is a 64-unit, 5-story building with first-floor retail space at the 1.5- acre site of the former Night Moves building on South Walnut Street, next to the new Switchyard Park.

To help the project along, Bloomington’s city council will be considering a resolution at its regular meeting on Wednesday that will take the required steps to give the project a tax abatement.

The resolution would set up the relevant parcels as an economic revitalization area and would approve a 10-year abatement schedule that would waive a total of $154,370 in taxes.

The first year’s abatement would be 100 percent of the taxes owed. That percent would ratchet down over a decade, so that $175,690 in taxes will have been paid by the end of the abatement period.

Next steps, after Wednesday’s expected council action to adopt the resolution, include a public hearing that’s set for June 16. The June 16 hearing will be followed by a city council vote to confirm, amend, or rescind the resolution adopted on June 2.

Another step, before construction can start in August on Retreat at the Switchyard, is a site plan review by the city plan commission.

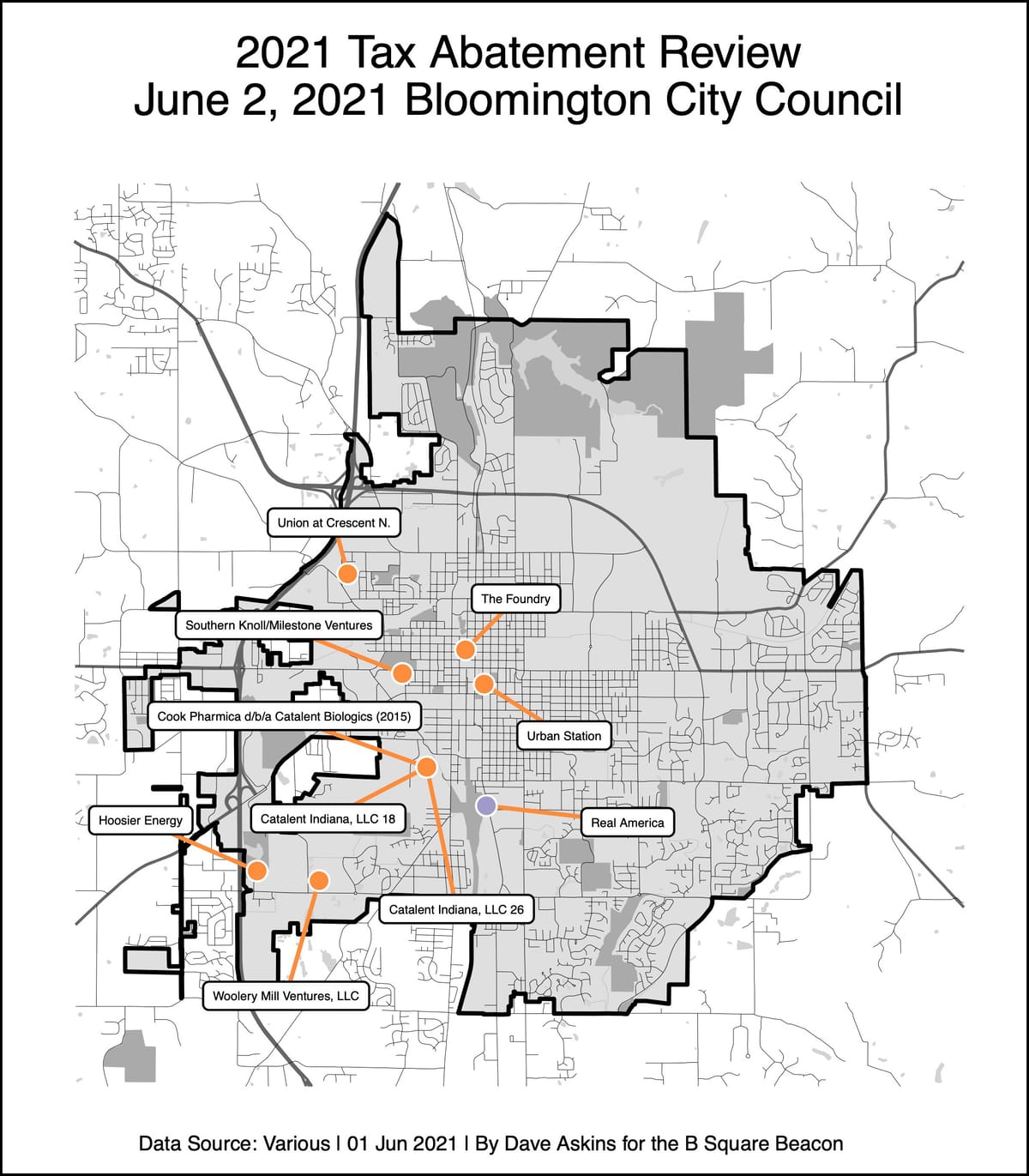

Also at Wednesday’s city council meeting, a report will be heard on compliance for eight other tax abatements previously granted by the city council.

Included in Wednesday’s meeting information packet is a memo from Bloomington’s assistant director of economic and sustainable development, Jane Kupersmith. The memo describes the impetus behind the request for a tax abatement from Real America, LLC for Retreat at the Switchyard.

According to Kupersmith’s memo, the deferred developer fee is estimated at $589,016. The 15-year cash flow without abatement is only $423,187, according to the memo. The abatement would increase the cash flow to $577,556, which is described by Real America as “within the margin of error to assume we will be able to repay the deferred developer fee within the 15 years that is required.”

Of the 64 apartments in Retreat at the Switchyard, 48 will be reserved for residents earning less than 80-percent of the area median income (AMI). That includes 12 apartments reserved for residents making less than 30-percent of AMI. The tie to tenants earning no more than 30-percent AMI translates into a monthly rent of $281 a month for a 1-bedroom apartment.

Real America’s request for a tax abatement is the first to be considered by Bloomington’s city council since it tweaked the criteria for tax abatements earlier this year, so that affordable housing is one of the highlighted criteria for eligibility.

In early March, the council revised the previous policy, which included a basic requirement that the project create full-time, permanent living-wage jobs.

In the revised policy, the basic requirement is creation of capital investment as an enhancement to the tax base.

Job creation is still a part of the mix for tax abatements. But it has the same status as two other criteria, listed under the basic requirement about creation of capital investment: significant increases to existing wages; and creation of affordable housing units.

The annual tax abatement report to the council—on compliance by previous tax abatement grantees with their proposals—will be based on a slide deck prepared by economic and sustainable development staff. Bloomington’s economic development commission will get the same annual report on June 9.

The annual report compares the estimated benefits for a tax abatement project with actual results. The summary slide indicates that across all tax abatement projects, a total of 337 new jobs were proposed to be created, and more than three times that number were actually created (1,126).

The big actual job gains overall—beyond the estimated benefits that were a part of the tax abatements—were due to tax abatements granted to Cook Pharmica (dba Catalent Biologics) and Catalent Indiana. A footnote on one of the slides indicates that the Catalent jobs numbers “were averaged in order to avoid duplicate reporting across abatements.”

The Urban Station project estimated that five jobs would be created, but has so far created four. Urban Station is in the fourth year of a 10-year abatement.

The Foundry was estimated to create 11 new jobs and has so far created five. The Foundry is in the second year of the real estate abatement. The personal property abatement, to which some of the expected employment gains are tied, has not yet started.

The Woolery Mill Ventures project was estimated to create 45 jobs and has not yet created any. The Woolery Mill is in the second year of a 10-year abatement.

In addition to the annual tax abatement report, the city council’s Wednesday agenda includes another report from the administration, which is labeled “Budget Report.”

The budget report is being given as an alternative to the council’s customary budget advance meeting. The late-April date that was initially scheduled for the city council’s budget advance was replaced with a briefing from Bloomington’s mayor, John Hamilton, on possible uses of American Rescue Plan Act (ARPA) money.

At the council’s regular session two weeks ago, the idea had been floated to reschedule the council’s budget advance for June 1. But at last week’s special meeting, council president Jim Sims said the function of the budget advance meeting would be folded into the budget report on June 2.

Comments ()