Tax notebook: Indiana local government property tax revenues will grow at most by 4% for 2025

On Tuesday, Indiana’s state budget agency released its calculations for the maximum levy growth quotient (MLGQ) in calendar year 2025.

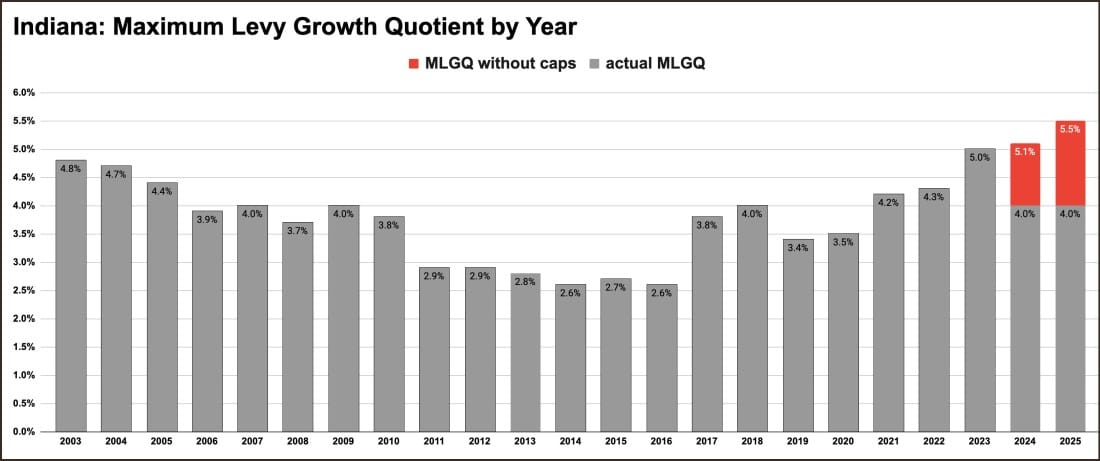

The MLGQ for 2025 is 4.0 percent.

That’s the maximum increase in the total revenues from property taxes that local government units can receive in 2025 compared to 2024.

The idea of the MLGQ is to limit increases in property taxes to what taxpayers can reasonably pay, based on increases in personal income and overall economic conditions, but at the same time ensuring a reliable level of tax revenue for local governments. The formula for the MLGQ is based on a six-year average of the state’s personal income growth.

In 2023, the legislature decided to impose a cap of 4 percent, for calendar years 2024 and 2025. The idea was to give a kind of tax relief for property owners who saw their post-pandemic assessed values go up—their taxes will still go up, but not by as much as without the 4-percent cap.

Tuesday’s announcement, that the MLGQ for 2025 would be right at the cap of 4 percent, was not a surprise. That’s how things turned out last year, too.

For the city of Bloomington’s general fund, that means the property tax levy for 2024 can’t be any more than $28,943,830 . That’s the result of adding 4 percent to this year’s levy, which came in at $27,830,606

The MLGQ would have been higher, by 1.5 percentage points, except for the 2023 legislation. The legislation, in the form of HB 1499, amended the state statute on the MLGQ calculation for calendar years 2024 and 2025, by putting a limit of 4 percent on the MLGQ.

If IC 6-1.1-18.5-2 had not been amended by HB 1499, the outcome of the MLGQ calculation for 2025 would have been 5.5 percent.

A 5.5-percent increase in Bloomington’s general fund levy would have amounted to $29,361,289. So the impact of HB 1499 on the city of Bloomington’s general fund for 2025 will be a loss of around $420,000.

Comments ()