Thoughts turn to employee pay raises as 2025 budget season approaches for Monroe County, Bloomington

Next Monday, Aug. 26, marks the first day of class for Indiana University’s Bloomington campus.

It’s also the opening day of budget season for Bloomington’s city council. That’s when Bloomington mayor Kerry Thomson is expected to present her draft 2025 budget proposal to the council, which is the city’s fiscal body. Monday’s draft budget presentation starts at 5:30 p.m.

The rough equivalent for the start of Monroe County government’s budget season is a budget preview to be presented to the county council by its own administrator. The county’s budget preview is tentatively set for 5 p.m. on Thursday, Aug. 29.

As they watch the deliberations, among other questions, employees of both organizations will have their eye on this one: What kind of increase in compensation will they see next year?

According to Bloomington controller Jessica McClellan, last week city employees were given 3-percent as a working number for their annual raise—the so-called COLA (cost of living adjustment).

The number that county employees have heard is 5.2 percent—but that is less likely to be the final number for county workers than the one floated by the controller for city workers.

That’s because the 5.2-percent figure came from the three-member board of county commissioners, not the county council. The county commissioners are required under state statute to make a recommendation about salaries, which they also did this year.

But it’s not the county commissioners who have to make the numbers add up in the 2025 budget. It’s the county council itself that will build and adopt the budget. That’s a big difference between city and county governments.

The city council can cut the mayor’s budget or fail to adopt it, but it’s the mayor who decides what goes into it. The county council has full control of the county’s budget, from start to finish.

So the actual increase that county workers receive could come in lower than 5.2 percent, while it’s more likely, though not guaranteed, that city workers will actually see a 3-percent increase.

The budget picture for the county will come into better focus, at the tentatively scheduled budget preview on Aug. 29. That’s when the county council’s administrator, Kim Shell, is expected to have pulled together all the estimated revenue numbers, balanced against departmental budget requests, assuming no increase in compensation.

That presentation will give the county council an initial look at how much money might be available for increased employee compensation.

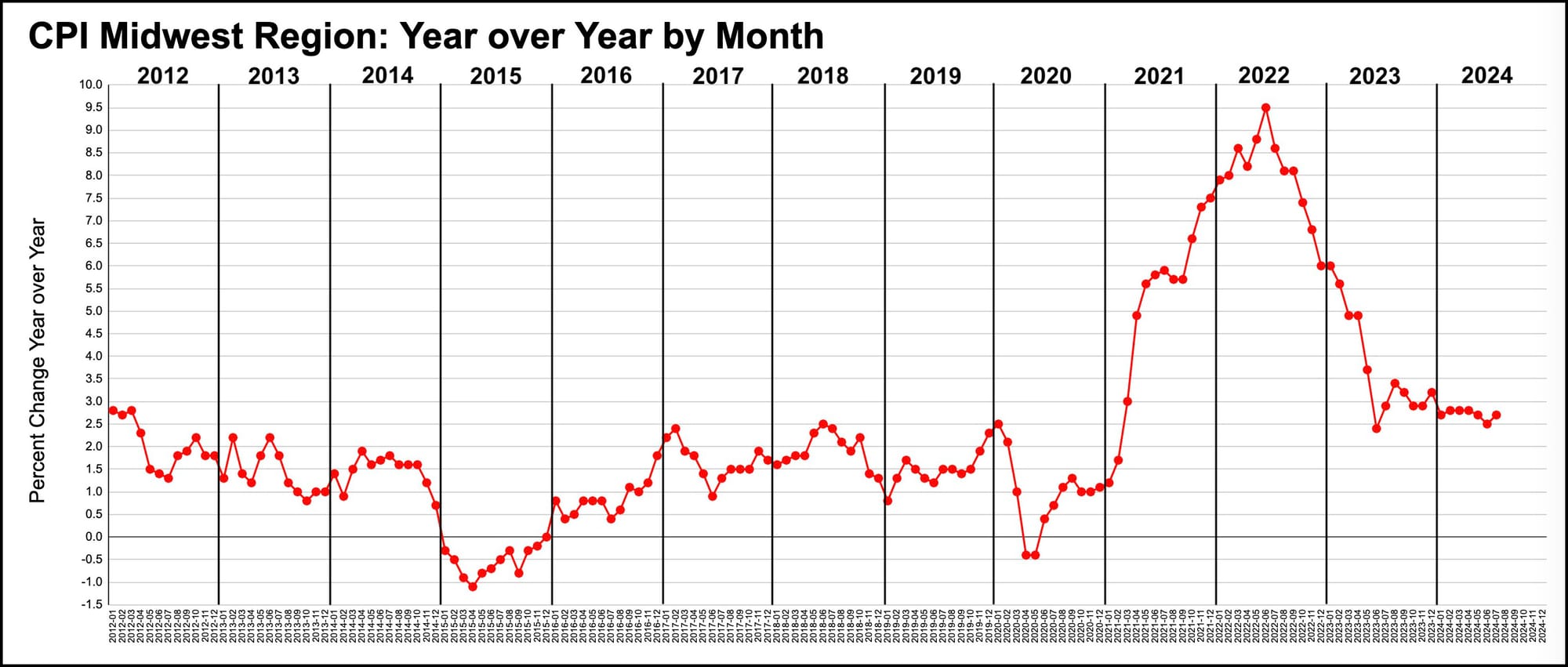

The benchmark used for employee compensation by the county government over the last few years has been the percentage change in the CPI (consumer price index), from December the previous year, to December the year before that. For this year’s budgeting process, that would mean comparing December 2023 to December 2022. That year-over-year difference is 3.2 percent.

County commissioners arrived at their 5.2-percent recommendation by looking at wage increases for county employees for the last four years: 2.3 percent (2021), 1.1 percent (2022), 5.0 percent (2023), and 8.5 percent (2024).

Commissioners compared county wage increases to the CPI increase over the same period, and concluded that there’s a gap, which could be filled with a 5.2-percent increase.

There’s a practical reality for city and county governments alike: The two biggest revenue streams that could be used to pay for increased compensation in 2025, will increase by 4 percent or less, compared to 2024.

One such revenue stream, which is the property tax levy, is limited for city and county government by the MLGQ (maximum levy growth quotient) for this year, which works out to 4.0 percent.

The other such revenue stream is local income tax (LIT). This year, the estimates from Indiana’s DLGF (Department of Local Government Finance) for 2025 LIT revenue to county government show a 3.4-percent increase compared to 2024 LIT revenue.

For city government, the 2025 LIT revenue shows a 3.8-percent increase compared to 2024 LIT revenue.

For both of those percentage calculations, The B Square looked at revenues in just the two categories of certified shares and economic development LIT.

The Aug. 26 start of the city’s budget process begins a four-day slog of departmental budget hearings, each starting at 5:30 p.m., which is an hour earlier than the council’s regular meeting time.

That is supposed to lead to a formal presentation of Thomson’s final budget on Sept. 25, with adoption possible on Oct. 9.

For the county council, the departmental budget hearings will start in September and unfold over six nights. The county council’s planned date for the 2025 budget adoption has been changed, from the one listed under the previous link, to Oct. 28.

Comments ()