Vote postponed on $5M TIF set-aside for southwest Bloomington infrastructure planning

At its Monday meeting, the Bloomington Redevelopment Commission put off a vote on a resolution setting aside $5 million in TIF funds for public infrastructure planning in the city’s southwest quadrant. But the reason for the delay does not appear to be based on the merits of the policy choice.

Maps by The B S Square with information from the city of Bloomington.

At its regular Monday meeting, the Bloomington Redevelopment Commission put off a vote on a resolution setting aside $5 million in tax increment finance (TIF) funds for public infrastructure planning in the city’s southwest quadrant.

But the reason for the delay does not appear to be based on the merits of the policy choice. Instead, the pause before voting stems from the fact that RDC member Randy Cassady owns property in the southwest quadrant. The long and short of it is that Cassady recused himself from the vote, leaving just John West and Sue Sgambelluri present to vote on the five-member commission. Absent were Laurie McRobbie and Deborah Myerson.

Even though the tally would have likely been 2–1 on the vote to set aside $5 million, that would not have been enough to pass the resolution—because support from a majority of board members is required (at least three), in order for the RDC to take action on anything. So the vote was postponed until the RDC’s next meeting.

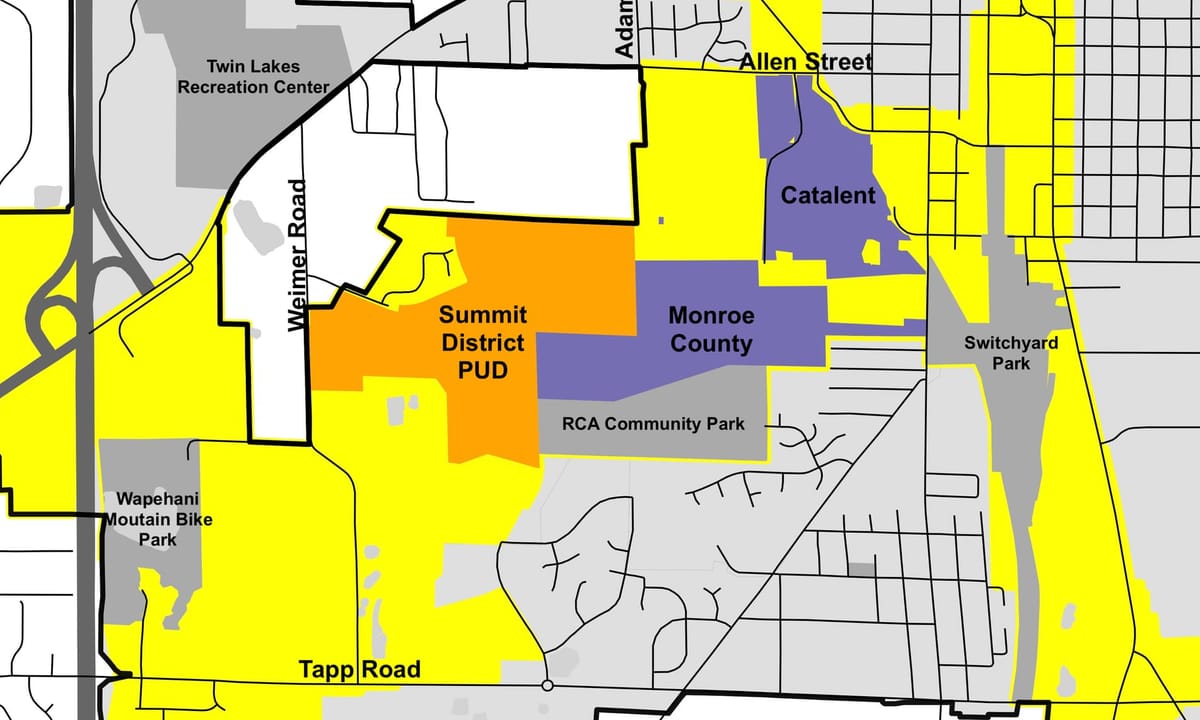

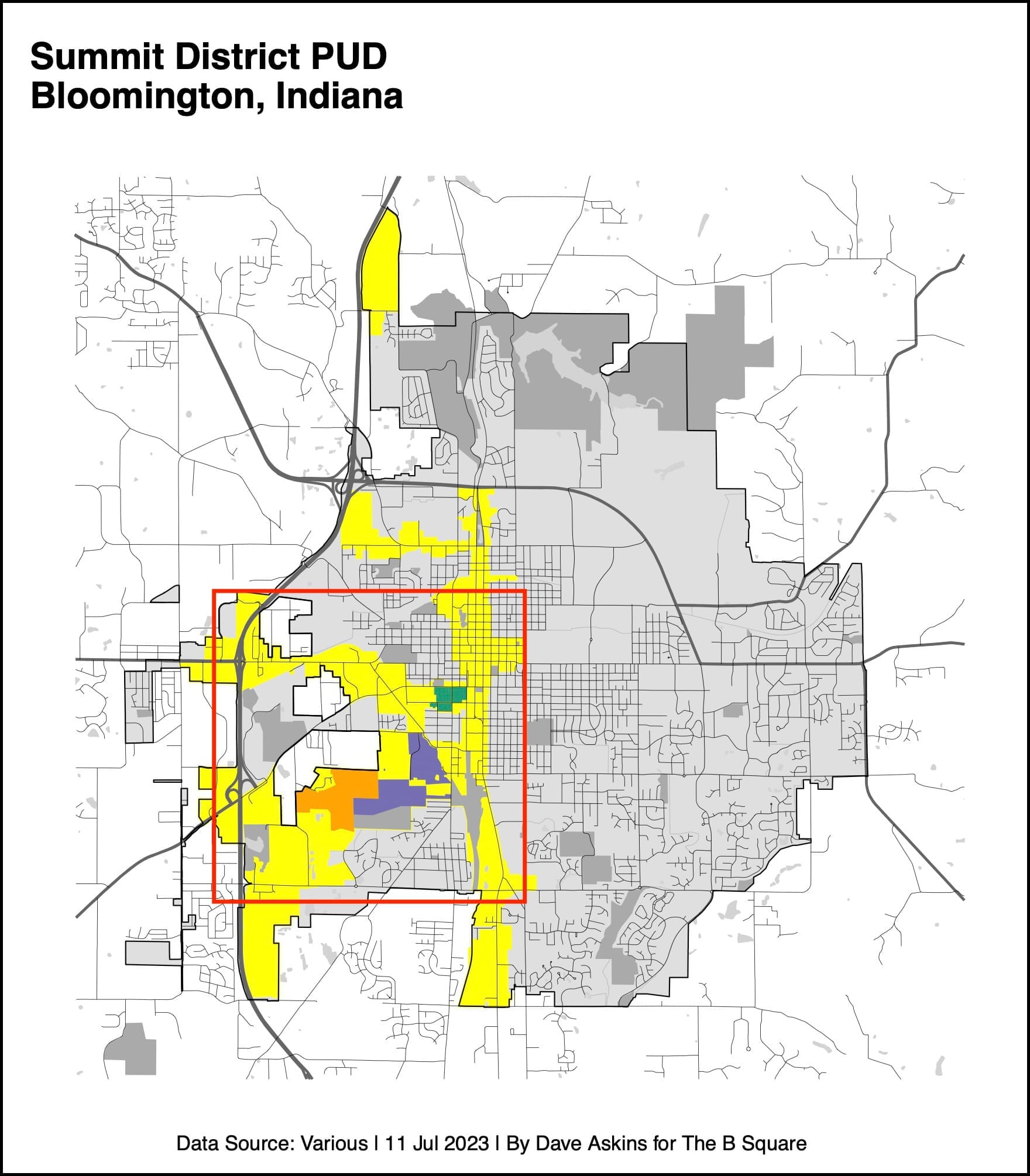

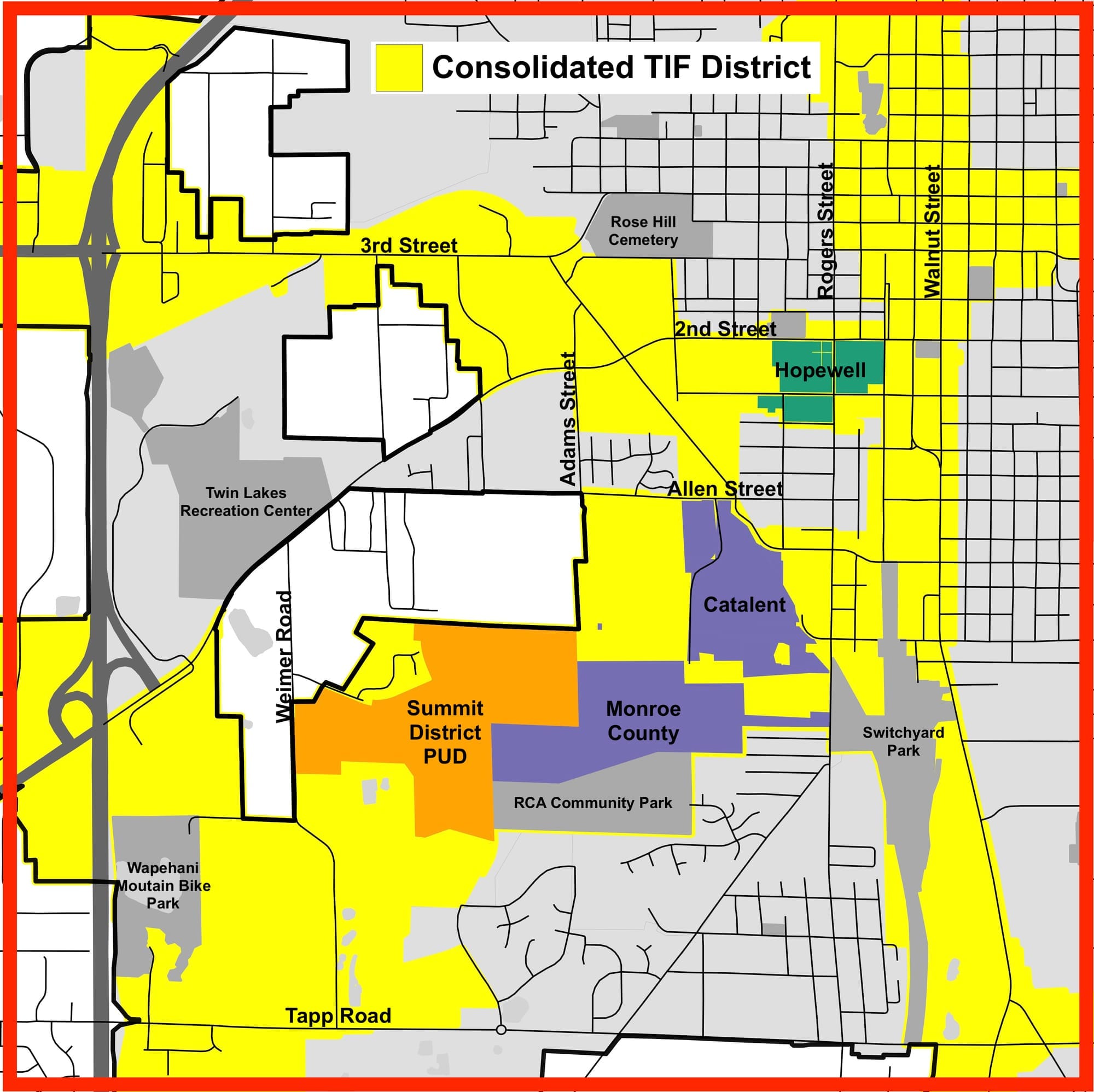

In the resolution, the “southwest quadrant” of Bloomington is defined as “the area bordered by Tapp Road to the south, Interstate 69 (previously known as State Road 37 to the west), 2nd Street/Bloomfield Road to the north, and Adams Street to the east ...” Inside the southwest quadrant, a good part of the area is a TIF (tax increment finance) district.

According to assistant city attorney Dana Kerr, one of the areas the resolution contemplates is the Summit District PUD, which was approved by the city council in May 2024. The other area targeted for development is property owned by Public Investment Corporation (PIC), north of Tapp Road, and east of the Wapehani Mountain Bike Park.

In the vicinity of the PIC property on either side, Cassady owns property. That’s the nature of the connection that led Cassady to sit out the vote. He put it like this at Monday’s meeting: “For me to vote on it would be wrong, because I'm in that quadrant.”

According to Kerr, the money could fund design work for a north-south road connection starting with Vanguard Parkway heading up through the PIC property, going across the Thomson PUD owned by Monroe County government, up to the Summit District PUD, connecting possibly to Adams Street.

A point of emphasis for city staff was the fact that the resolution would not approve or allocate funds to any specific contract. The idea of the resolution is not to allocate money towards a specific contract, but rather to establish that the RDC believes that infrastructure is important in the southwest quadrant of the city and that it’s willing to set aside $5 million for development.

RDC member John West was keen to get pinned down how the TIF (tax increment financing) would actually work in this case. TIF generally works by capturing the increase in property tax revenue generated by new development within a designated area and using that “increment” to repay the cost of public improvements in that same area.

Kerr described how the past consolidation of the city’s separate TIF districts meant that money from the consolidated TIF district could be used to fund the design work for this particular part of the TIF district in the southwest quadrant. When the infrastructure improvements spur development in the southwest quadrant that is sufficient to start generating an increment of property tax revenue, that revenue could be used to fund work in other areas of the consolidated TIF district that had not yet seen investment from developers, Kerr said.

In time for the next RDC meeting, it sounds like city staff could be providing commission members some additional history of individual TIF districts, before they were consolidated.

Based on DLGF (Department of Local Government Finance) records, the fund balance in the Bloomington's consolidated TIF fund at the end of 2024 was $17.2 million. Since 2016, DLGF records show an average of revenue to the TIF fund of $13.8 million per year, the most recent year (2024) bringing in $20.1 million.

Comments ()