2023 budget notebook: Historic inflation, impact on pay get first look by Monroe County councilors

The past practice used by Monroe County to make a cost of living adjustment (COLA) for employees could lead to a historic fiscal impact on the 2023 budget.

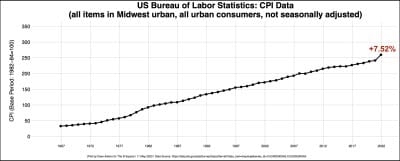

That’s because the county’s fiscal body—the seven-member county council—has typically tried to key its COLA to the percentage increase in the consumer price index (CPI) between the previous December and the December before that.

That number is already in the books: 7.5 percent. That’s the percentage increase in the US Bureau of Labor Statistics midwest urban CPI between December 2020 and December 2021.

And it’s the biggest December-to-December percentage increase in the CPI since 1979 to 1980, when inflation was at 12.2 percent.

The question of how to approach employee compensation for next year’s budget got some initial discussion at the county council’s Tuesday night meeting.

One way to approach a COLA is to define it in terms of a percentage of each employee’s existing compensation. Another way is to translate the CPI percentage into a flat rate increase to each employee’s hourly wage.

Council administrator Kim Shell reminded county councilors about their past practice, which had been to alternate years—in one year giving employees a percentage boost, and in the following year giving them a flat rate hourly increase. It hasn’t been a strict pattern.

In 2019, the Monroe County COLA was a percentage increase: 1.7 percent. In 2020, the Monroe County COLA was $0.35 an hour—which had been converted from 1.3 percent. In 2021 the Monroe County COLA was again a flat rate increase of $0.57, Shell said.

For 2022, the county implemented recommendations from Waggoner, Irwin, Scheele & Associates (WIS), a consultant hired to review county employee salaries.

Shell asked the county council on Tuesday night for some idea of how she should develop her initial budget proposal, given the 7.5 percent CPI increase. “I just need some guidance,” she told them.

Shell didn’t get direction in the form of a suggested COLA. Instead, councilors first wanted to understand what the fiscal impact would be on the budget as a whole.

Councilor Geoff McKim asked Shell to calculate the total fiscal impact for a 1-percent increase, and for a $1 flat-rate hourly increase.

McKim was not suggesting the COLA should be a 1-percent increase or a $1 flat-rate increase—it would just make for easy math, if councilors want to compare different scenarios. If the impact of a 1-percent increase were known, then councilors could calculate for themselves what the impact of a 3-percent increase would be—by multiplying it by 3.

Councilor Trent Deckard checked with Shell that such a preliminary calculation would be doable, which she confirmed it would be.

Council president Kate Wiltz wrapped up the topic by saying the council would take a look at Shell’s fiscal impact calculations at its next work session.

The county council’s next work session is scheduled for May 24 at 5:30 p.m.

Comments ()