2023 budget notebook: Monroe County council recommends 5% pay raise for planning purposes

Monroe County employees could be looking at a 5-percent increase to their pay in 2023, while inflation is running a few points higher than that.

At their Tuesday night meeting, Monroe County councilors voted unanimously to recommend for current budget planning purposes that a 5-percent cost-of-living adjustment be made to county employee compensation.

That’s the amount that will be used by staff as they draft the 2023 county budget.

Tuesday’s vote to recommend a 5-percent increase came after county board of commissioners president Julie Thomas reported to the council that the commissioners support an increase that’s nearly double that amount—9.5 percent.

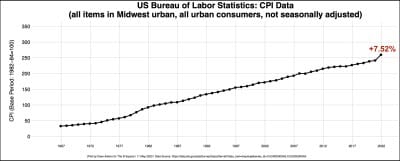

The figure supported by commissioners is based on comparing the June 2021 to June 2022 consumer price index (CPI), as calculated by the US Bureau of Labor Statistics for the midwest region.

It’s the county council’s typical approach to look at the December-to-December numbers for the previous year. Comparing December 2021 to December 2020, the current CPI shows a 7.5-percent increase.

Even though it is the county council that is the county’s fiscal body, which approves the budget, under state law [IC 36-2-5-4] county commissioners have to weigh before Aug. 20 on levels for the next year’s employee compensation.

In mid-May, the county council took a first look at the CPI numbers, and asked the council administrator, Kim Shell, to calculate the fiscal impact for increases in increments of 1-percent. On Tuesday, Shell broke down the budget impact of a 5-percent, 6-percent, and 7.5 percent increase.

| Scenario | 2022 | + 5% | + 6% | + 7.5% |

| Total Expenditure | $29,349,773 | $30,817,273 | $31,110,770 | $31,551,015 |

| Fiscal Impact | $0 | $1,467,500 | $1,760,997 | $2,201,242 |

Councilor Geoff McKim briefed his colleagues on the projected revenue increases for 2023 from local income tax, and property tax. McKim noted that the property tax levy will grow at 5 percent—that’s this year’s maximum levy growth quotient. McKim pegged the amount of additional revenue that might be available to the general fund from local income tax increases at about $1.7 million and from property taxes at about $800,000.

Councilor Peter Iversen offered some anecdotal evidence that a lot of entities around town are looking at trying to give their employees a 4- to 5-percent increase in cost of living. Iversen thinks the 5-percent figure is “square on the nose.”

McKim agreed with Iversen that 5-percent tracks with what nonprofits are trying to offer their employees. He also noted that the number the county council voted on that evening would serve just to develop the budget—the council would eventually have to vote on the whole budget package.

Even though the 5-percent figure could go up or down between now and the final vote, McKim said it would not be responsible to go too much lower than 5 percent.

Towards the end of Tuesday’s meeting, McKim also said he would be in favor this year of putting the compensation for county commissioners on par with other elected officials. That’s been a point of contention for commissioners, who asked last year that their pay be brought up to the same range as other electeds, like the assessor, recorder, and treasurer

Last year, that would have meant bumping the annual compensation for each of the three commissioners from $48,886 to $67,158, but that vote failed with no votes of support on the county council.

The county council’s calendar calls for the first session on the 2023 budget to be held on Sept. 7, with a vote to adopt it set for Oct. 18.

Comments ()