Monroe County innkeeper’s tax revenues up again, to get routine review as part of regular CVC meeting

Meeting on Tuesday will be the board of the Monroe County convention and visitors commission (CVC), which is the group that oversees expenditures from the 5-percent charge on lodging in the county.

The CVC’s mission is to promote the development and growth of the convention and visitor industry. That means it is also a group that will play a crucial role in the future of the expanded Monroe Convention Center.

The new, expanded facility will be constructed to the east of the existing facility at the southwest intersection of 3rd Street and College Avenue.

Based on a recent estimated timeline, a newly constructed expansion to the convention center could be open for business by spring of 2027.

It is from the CVC’s budget that some convention center operations and maintenance, and Visit Bloomington are funded.

One of the points of interest expressed recently in a letter from the Bloomington city council to the Monroe County capital improvement board (CIB), which is overseeing the construction of the expansion, is related to an operations and maintenance plan for the new facility.

In broad strokes, the maintenance and operations plan for the new facility will rely at least in part on revenue from the innkeeper’s tax. A review of innkeeper’s tax revenues is a routine point of CVC meetings.

Tuesday’s meeting agenda is standard, with typical items, among them approval of the quarterly $159,000 debt payment on the renovations to the existing facility, which were completed by around 2012.

Once that debt is retired, in the first part of 2026, it will free up around $636,000 a year of innkeeper’s tax revenue, to invest in operations and maintenance for the newly expanded facility.

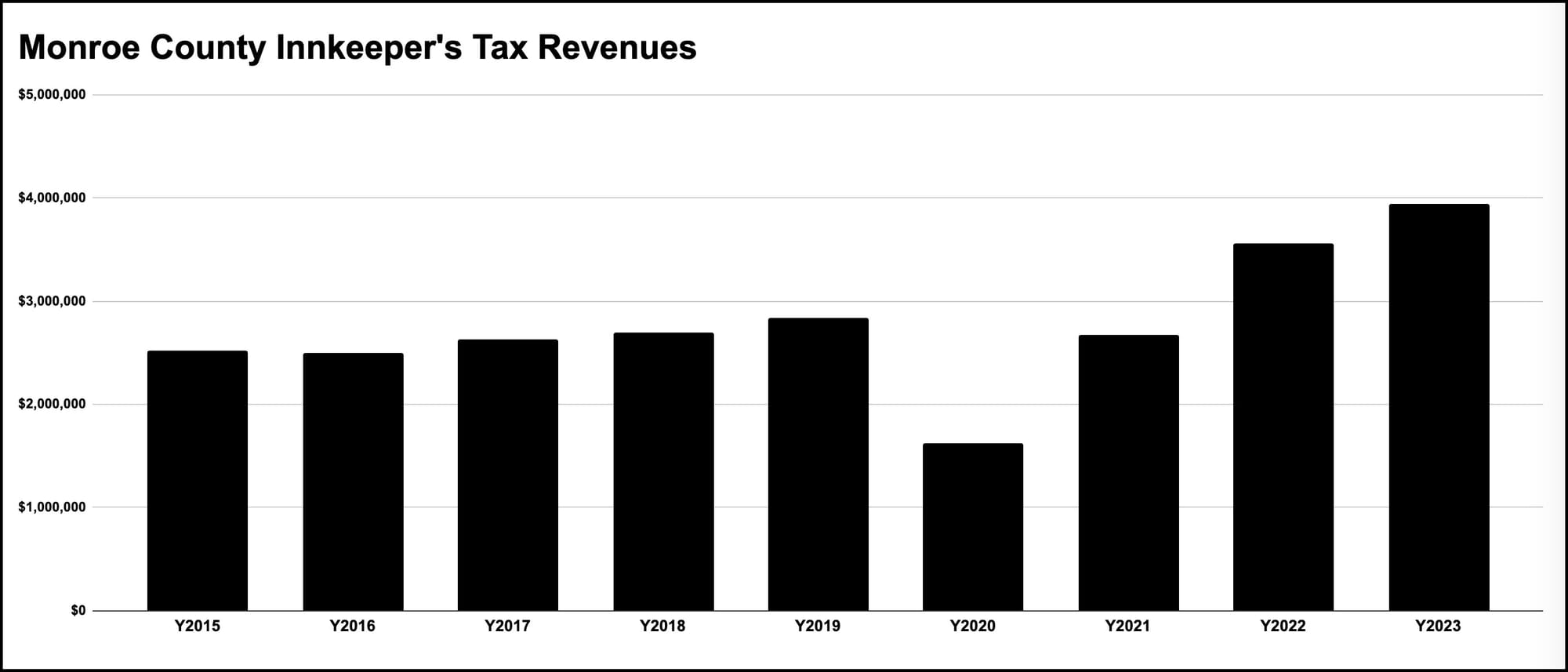

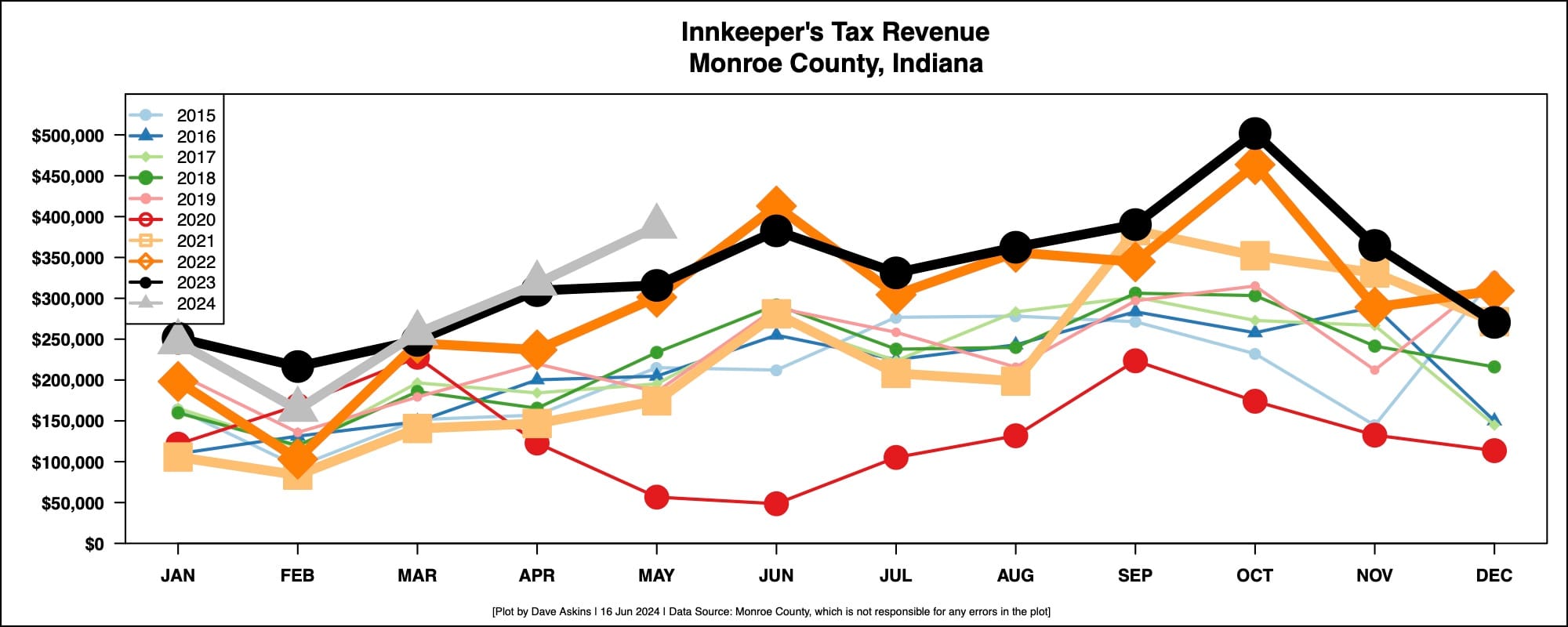

At the March CVC meeting, there was some discussion among members about the dip in February receipts of innkeeper’s tax, based on January business. January was down generally, just due to fewer events, said Mike Campbell, who chairs the CVC. Campbell serves on the CVC as associate director of Indiana Memorial Union.

Campbell said that February’s business was better, and he expected that would be reflected in the next revenue reports, which would include March receipts. Campbell was right about that, as the $318,134.51 in March revenues outpaced March revenues from 2023 by about 2.8 percent.

April business was expected to be significantly better than last April, due to visitors who came to watch the total solar eclipse on April 8 this year. That was proven out in the $387,835.12 worth of May receipts, which were nearly 23 percent better than May 2023.

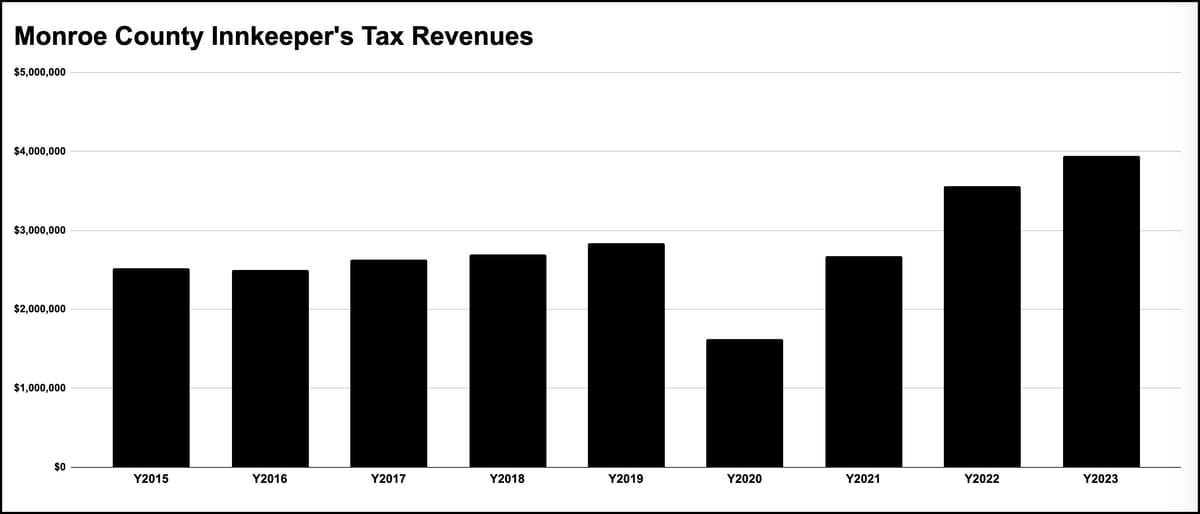

Through the first five months of the year, the innkeeper’s tax has generated $1,373,456. That’s about 2.4 percent more than in 2023.

The fraction of the innkeeper’s tax proceeds that comes from short-term rentals (like AirBnb or Vrbo) has remained around 20 percent of the total tax receipts through the first five months of this year.

In 2023, short term rentals account for $919,630.96 in revenue, or about 23 percent of the roughly $3.9 million of innkeeper’s tax that was generated overall.

Comments ()