Tax notebook: Monroe County units slated for extra $14.3M in local income tax revenue

It looks like the city of Bloomington, along with all the other governmental units in Monroe County, will see a significant extra infusion of revenue at the start of May.

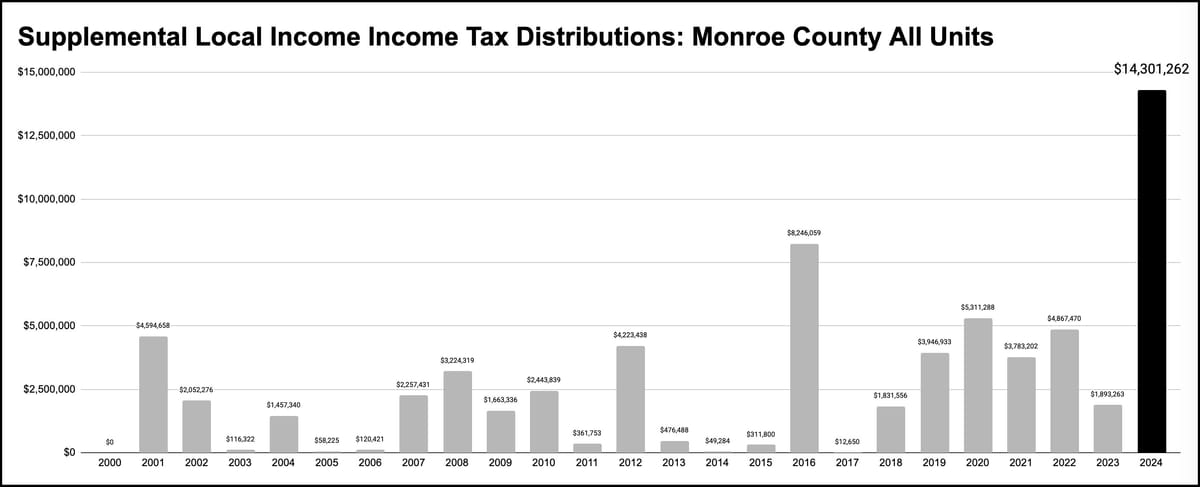

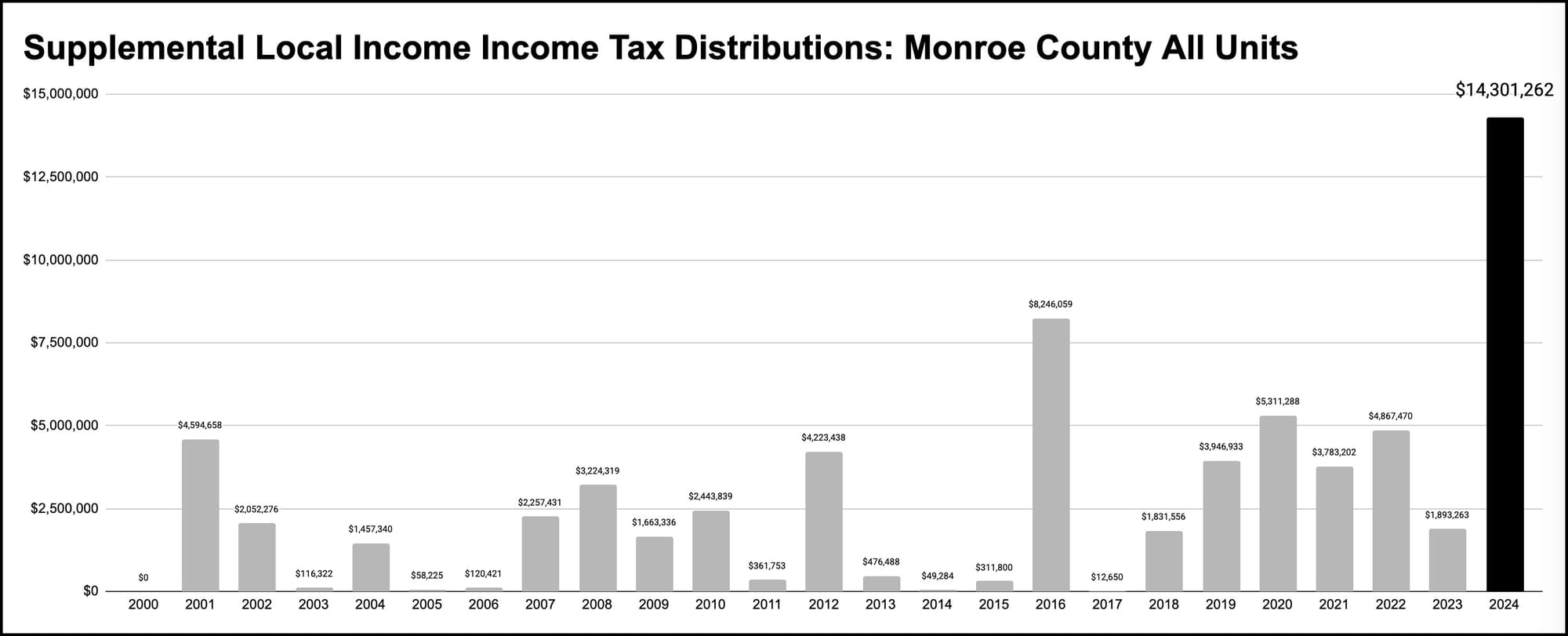

The total amount of additional revenue to be injected into local coffers, across all local government units in Monroe County, is about $14.3 million.

That’s based on calculations from Indiana’s State Budget Agency (SBA).

Local units include: Bloomington, Ellettsville, Monroe County government, Bloomington Transit, Monroe County Public Library, Monroe Fire Protection District, and all the townships.

The source of the revenue is the local income tax (LIT). Specifically it is a supplemental distribution from the SBA’s trust account for local income tax receipts. Monroe County residents pay local income tax at a rate of 2.0350 percent.

The supplemental distribution is not new. It is a routine calculation done every year, to ensure that the amount in the trust account does not get too big. The state legislature’s idea of what counts as “too big” has evolved to mean that the trust account balance for any county should be no bigger than 15 percent of the total certified distribution of income tax to the county in a given year.

For fiscal year 2024, the total amount of certified distribution to Monroe County units was $86,336,906. The amount in the SBA trust account for Monroe County was $27,251,798.

That was too much, because 15 percent of $86,336,906 is just $12,950,536.

To get the trust account balance down to the 15-percent level, the SBA is distributing the difference ($27,251,798 – $12,950,536) to Monroe County units. That’s where the $14.3 million figure comes from.

The $14.3 million sum is the biggest supplemental distribution ever for Monroe County—by a wide margin. The next-highest number of $8.2 million was recorded in 2016. Over the last half dozen years, the supplemental distribution for Monroe County has averaged about $3.6 million.

How much will each government unit get from the $14.3 million?

How that supplemental pie gets sliced is a function of the way that ordinary certified shares of LIT get distributed to the local units. It also includes the way that the new economic development local income tax (ED LIT) gets distributed.

The distribution of certified shares of LIT to each unit of government is based on a formula that includes the relative proportion of property taxes levied by that unit. ED LIT, in contrast, is distributed to just four units (Monroe County, Bloomington, Ellettsville, and Stinesville), based on the relative population of those four units.

To get an idea of how the extra money might work out for the city of Bloomington this year, last year’s supplemental distribution for Monroe County, in May 2023, was $1,629,772.

In May 2023, the city of Bloomington received $437,032 in supplemental certified shares. That amount did not include any supplemental distribution for the ED LIT category, but this year it should.

If the same simple percentage from 2023 (437,032/1,629,772) were applied to this year’s total, the city of Bloomington could see around $4 million or more in LIT revenue, beyond what was included in the 2024 budget. [Added May 15, 2024: Based on the figures released today, as supplemental distributions the city of Bloomington will receive about $3.7 million in the certified shares category and about $0.9 million in the public safety category.]

Bloomington’s approved 2024 budget shows $14,837,403 in revenue from regular LIT certified shares, which was the amount certified by the SBA to the city for budget planning purposes.

Bloomington’s approved 2024 budget shows $16,587,406 in revenue from the ED LIT, which was the amount certified by the SBA to the city for budget planning purposes.

Comments ()